- Over $4.3 billion in Bitcoin and Ethereum options will expire today, December 12.

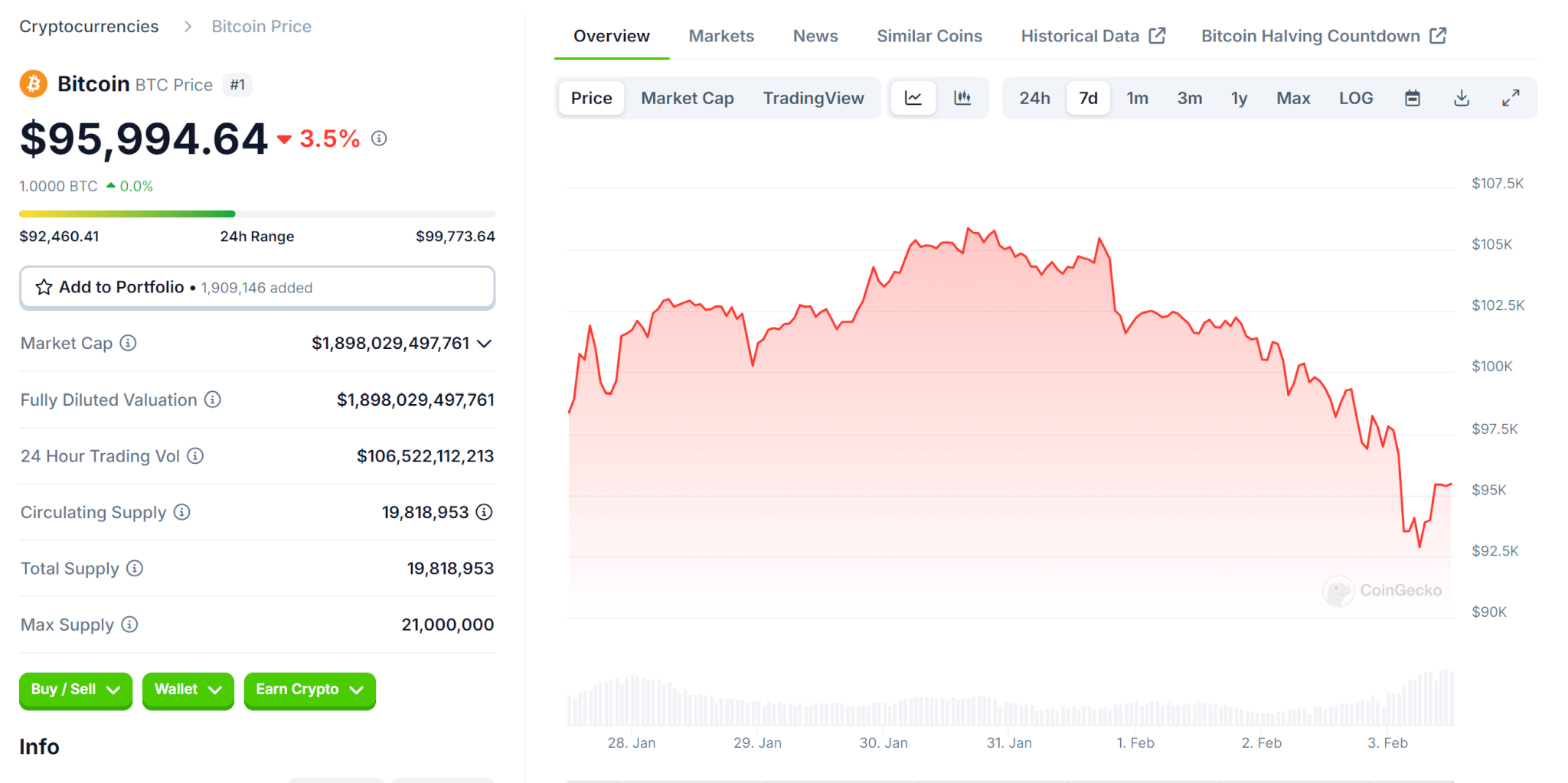

- BTC trades above $92,300, with a maximum pain level at around $90,000.

- Data shows balanced calls and puts, signaling a cautious stance among traders.

Cryptocurrencies remained elevated on Friday as Bitcoin recovered from post-FOMC retracements.

While most tokens trade below their key resistance zones, today’s gains brightened the mood across majors as uncertainty dominates even after the highly anticipated December 10 rate cut.

Amidst the optimism, the primary story remained the over $4.3 billion in Bitcoin and Ethereum options expiring today, on December 12.

With BTC price pinned above $92,300, analysts believe the event could shape the broader market’s trajectory as we close 2025.

Markets steady amid balanced expiry

Deribit revealed a curiously balanced options board, with 18,974 call contracts and 20,852 put contracts, for a combined open interest of 39,826.

Most importantly, a 1.10 put-call ratio confirms balance, with neither side dominating the market.

Clearly, there are no aggressive actions or euphoric calls that generally herald parabolic moves.

Rather, traders have positioned themselves to keep price fluctuations predictable and tight.

And that seems to work, as Bitcoin and Ethereum traded calmly as billions in notional value near a deadline.

Deribit analysts stated:

BTC positioning is tightly centered around the $90K level. Call and put interest sit in near balance, suggesting traders expect a contained expiry after the recent range-bound tape.

$90,000 as the magnet

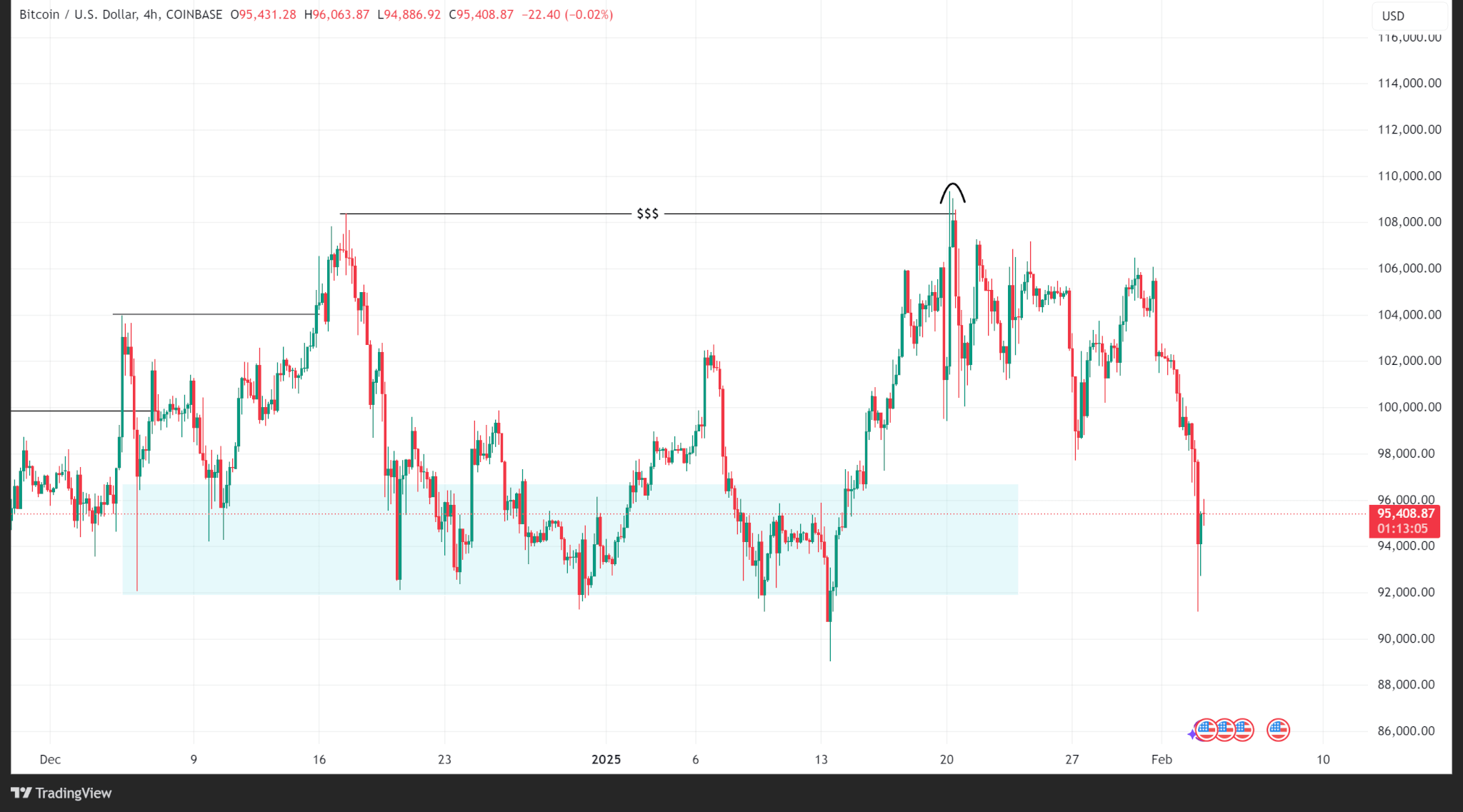

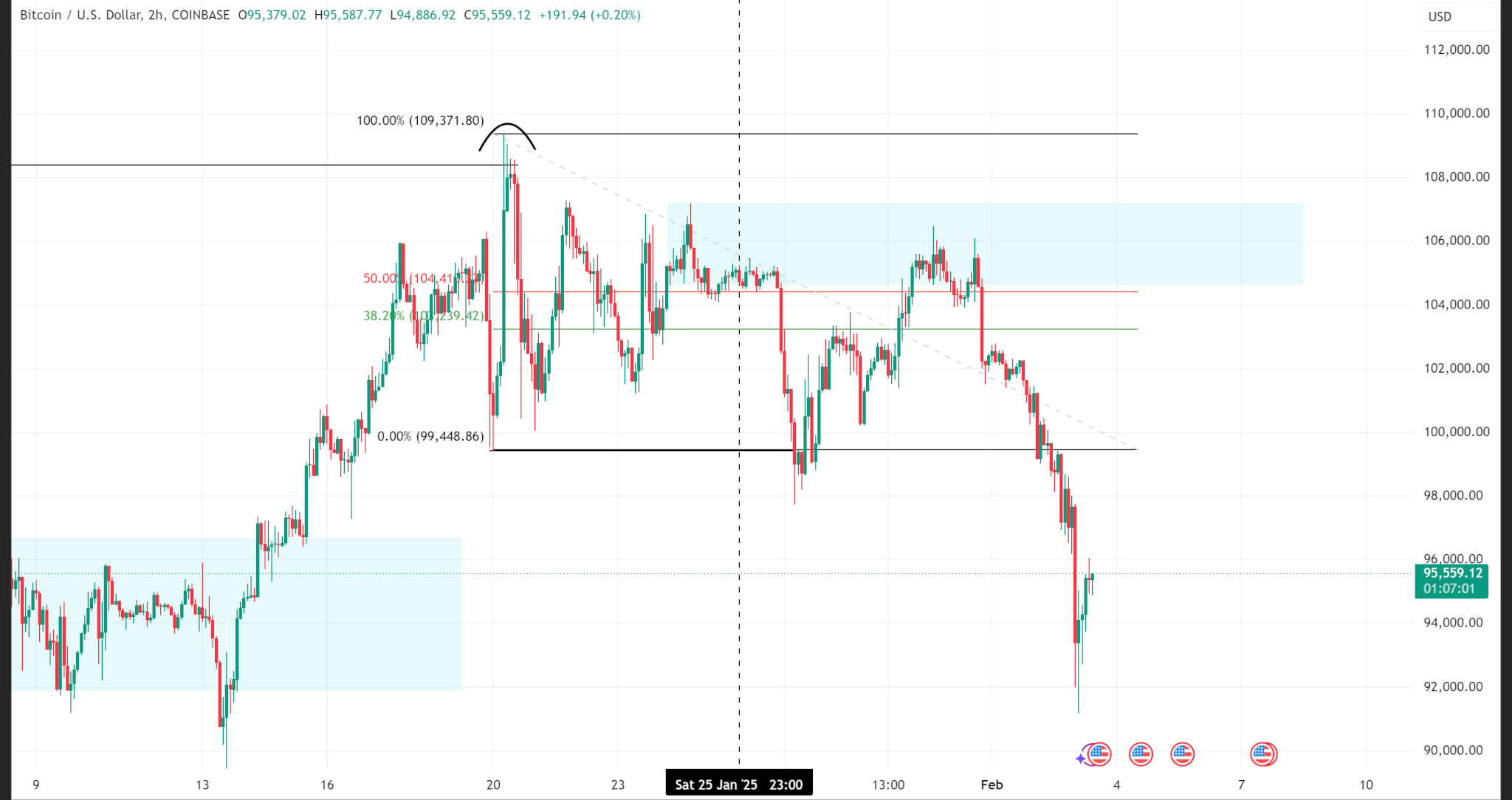

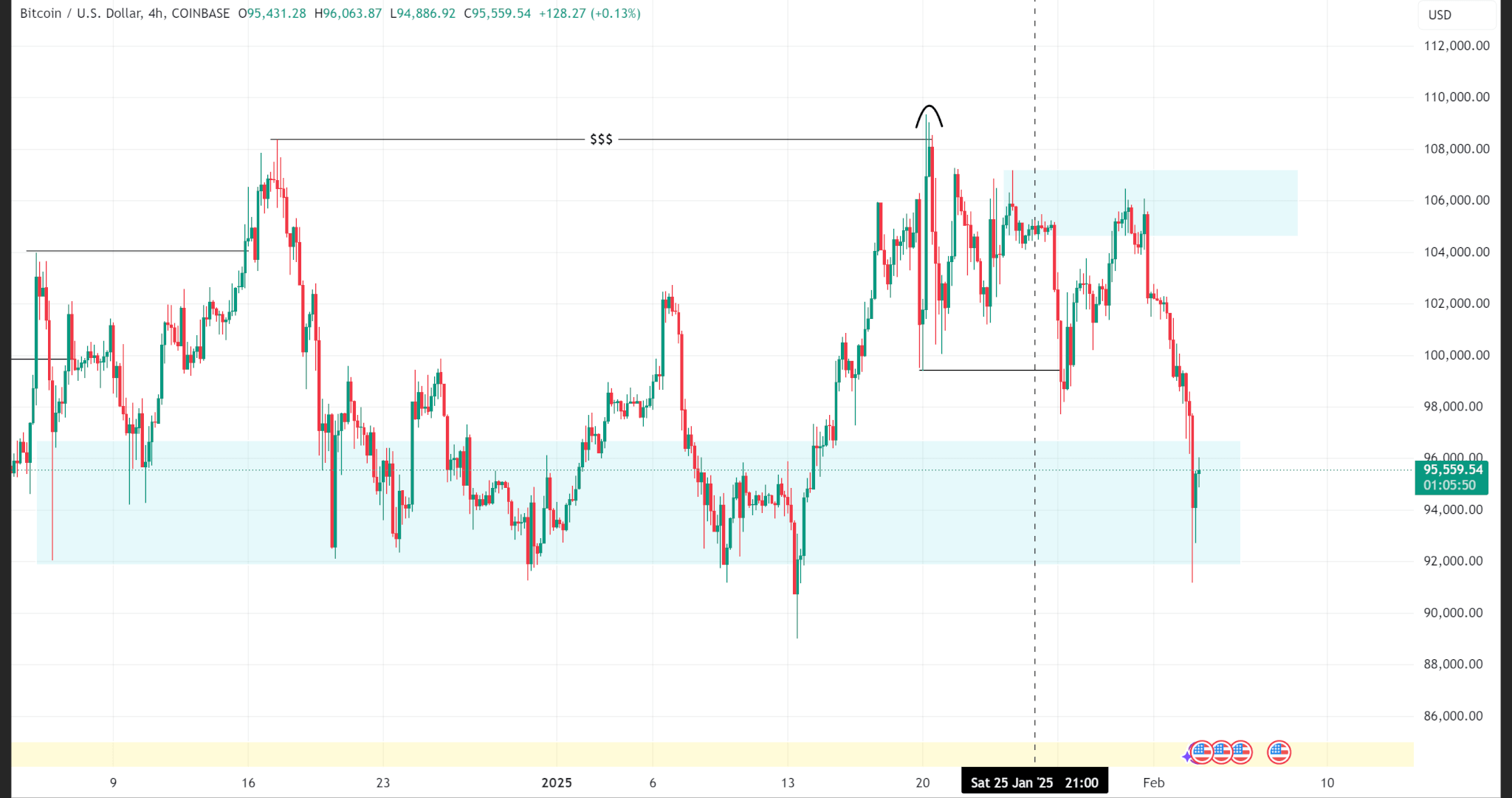

The crypto community’s attention remained on the max pain region of $90,000 – where options bulls stand to suffer.

Generally, whales or market movers drive prices toward max pain.

Meanwhile, Derbit’s chart shows puts stacked massively between $75,000 and $85,000, with call interest heavy at $95,000 – $100,000.

Thus, Bitcoin is hovering at the most balanced region of around $90,000 – $92,000.

That indicates a calm market with no dramatic moves.

On the other hand, Ethereum is trading at $3,250, above its $3,100 max pain level, with open interest of 237,879 comprising 130,579 put contracts and 107,282 call contracts.

That leads to a 1.22 put-call ratio and approximately $770 notional value.

Indeed, Bitcoin is displaying restraint despite the massive notion value (nearly $3.7 billion is linked to BTC options only).

There’s no such thing as sudden liquidations, panicked shakeouts, or forced price gains.

That level of calmness during high-stakes events like options expiry seems rare, leaving most market players alert.

A market that ignores imminent pressure often waits for the next catalyst.

What’s next?

Options expiry weighs on crypto prices, and digital tokens often set clear directions after the event.

The options will expire at 8 pm UTC, and traders will closely watch post-performance.

Clearing $93,000 – $94,000 can trigger near-term recovery, with fresh calls toward the $100,000 psychological mark.

However, losing $90,000 could mean a continued near-term struggle for Bitcoin.

Meanwhile, traders and investors will watch signs of thin liquidity amid holiday sessions, which often intensifies moves, and year-end institutional repositioning through key indicators like ETFs.