- Bitcoin is fighting to close October in positive territory, a key historical signal.

- The month has been highly volatile, with a 13% correction at one point.

- A series of technical indicators are now pointing to a bullish short-term structure.

It has been an up-and-down and often frustrating month for Bitcoin traders, a period of wild price swings that has put the seasonal promise of an “Uptober” rally to a severe test.

Now, with just a few days left in the month, a tense battle is underway as the bulls fight to keep the world’s leading cryptocurrency in positive territory, a goal that could have significant implications for the rest of the year.

Historically, October has been a powerful launchpad for Bitcoin, delivering average gains of more than 20%. But this year has been a different story.

After spiking above $123,000 early in the month, the market was hit by a brutal 13% correction that saw prices plummet to $107,000.

Since then, the bulls have been in a grinding, hard-fought recovery, with the price currently hovering around $115,000, a meager 1.14% gain for the month.

A powerful macro tailwind provides support

This fragile recovery is being supported by a powerful macroeconomic tailwind.

Traditional markets are firing on all cylinders, with the S&P 500 hitting fresh record highs as investors confidently price in a quarter-point interest rate cut from the Federal Reserve this week.

This dovish monetary policy, combined with an easing of US-China trade tensions, has propelled a “risk-on” sentiment that typically benefits assets like crypto.

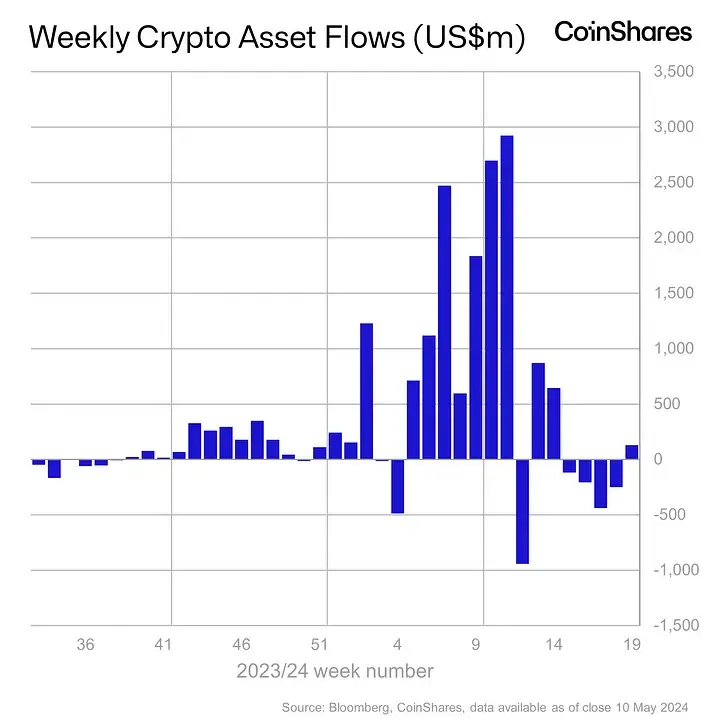

Adding another layer of support is a renewed wave of institutional interest.

Spot Bitcoin ETFs have now recorded their third consecutive day of inflows, a clear signal of conviction from the market’s larger and more influential players.

The view from the charts: a bullish structure takes shape

A deep dive into the technical charts reveals a bullish short-term structure that suggests the path of least resistance is now to the upside.

The Average Directional Index (ADX), a key measure of trend strength, is sitting at a strong 32.14, a reading that suggests the current upward momentum is likely to persist.

At the same time, the Squeeze Momentum Indicator is flashing a “bullish Impulse,” a high-probability signal that directional movement to the upside is just beginning.

The Ichimoku Cloud analysis also shows Bitcoin trading above the clouds, another classic indicator of trend continuation.

The final hurdle: a pivotal Fed decision

While the technical and macro pictures are aligning in favour of the bulls, a major and binary risk event looms on the horizon: the Federal Reserve’s policy announcement on Wednesday.

While the market is pricing in a 25-basis-point cut, any hawkish language about the future path of interest rates could easily trigger a wave of short-term volatility.

The key for the bulls will be whether Bitcoin can maintain its critical support above the $114,000 level through any Fed-related turbulence.

If it can, then this “Uptober,” while not as explosive as many had hoped, may still end in the green, setting the stage for a potentially powerful final two months of the year.