- Trustless BTCVaults aim to use Bitcoin as on-chain collateral without wrappers or custodians.

- Babylon’s staking previously reached over $2 billion in total value locked.

- An integration with Aave V4 is expected to bring native Bitcoin collateral to DeFi by April 2026.

Babylon is moving to widen Bitcoin’s role in on-chain finance, following fresh backing from venture capital firm a16z Crypto.

The investment supports Babylon’s transition from a single-purpose staking platform toward a broader financial infrastructure built directly on Bitcoin.

Rather than focusing only on yield, the project is positioning BTC as usable collateral across lending and other decentralised applications, without relying on wrapped tokens or custodial bridges.

The shift reflects a growing push across crypto markets to unlock capital efficiency from Bitcoin’s large but largely inactive supply, while keeping security anchored to the Bitcoin network itself.

a16z crypto investment

On Dec. 7, a16z Crypto disclosed a $15 million investment in Babylon, made through the purchase of Babylon’s native BABY tokens.

Babylon was originally developed as a Bitcoin staking protocol that allows BTC holders to earn yield without transferring assets off the Bitcoin network.

The firm said the investment reflects confidence in Babylon’s approach to extending Bitcoin’s functionality beyond staking, while preserving Bitcoin’s core security assumptions.

a16z positioned the project as a potential neutral alternative to wrapped BTC models, which currently dominate decentralised finance but introduce reliance on issuers, custodians, or multi-signature structures.

Trustless BTCVaults explained

Babylon is now expanding into lending infrastructure through what it calls Trustless BTCVaults.

These vaults are designed to allow Bitcoin to act as verifiable on-chain collateral without bridges, wrappers, or custodians.

The architecture relies on cryptographic tools such as witness encryption and garbled circuits to enable conditional execution tied directly to Bitcoin transactions.

The aim is to let Bitcoin interact with decentralised applications while remaining native to its own network.

According to a16z, this design could reduce counterparty and settlement risks that arise when BTC is represented on other blockchains via synthetic tokens.

Babylon’s approach targets the large pool of Bitcoin capital that currently sits idle, estimated at more than $1.4 trillion, by making it usable in lending, credit, and other capital-efficient use cases.

Founders and technical roots

Babylon was founded by David Tse and Fisher Yu.

Tse is a professor at Stanford University and is known for his academic work in information theory and blockchain research.

a16z highlighted Tse’s long-standing role in mentoring crypto founders and researchers as part of its rationale for backing the project.

The firm framed the investment as support for technically driven infrastructure that could reshape how Bitcoin integrates with decentralised finance, rather than incremental improvements to existing staking models.

From staking to DeFi integration

Babylon’s staking protocol has previously drawn significant demand.

Earlier staking caps recorded more than $2 billion in total value locked, with participation from institutional custodians such as BitGo and exchange partners including Kraken.

More recently, development has shifted toward BTCVaults and native Bitcoin lending.

In early December 2025, Babylon and Aave announced that native Bitcoin would be used as collateral on Aave V4.

The proposed integration includes Aave’s first Bitcoin-backed “Spoke”, enabling borrowing and lending against BTC without converting it into ERC-20 tokens.

The launch is expected around April 2026.

If successful, it could open new decentralised finance markets built directly on Bitcoin’s base layer, with potential extensions into perpetual futures, stablecoins, and other financial primitives.

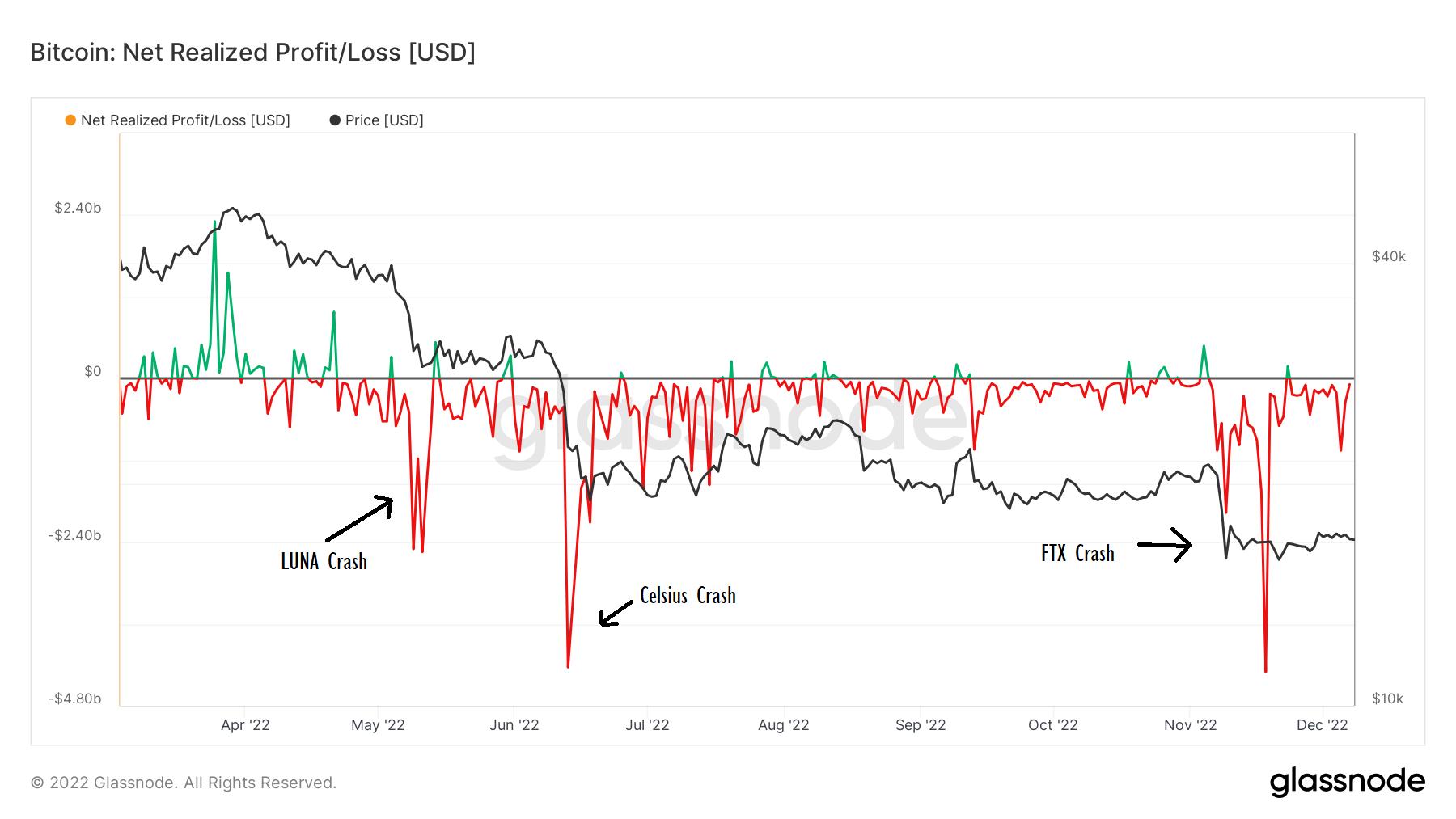

FTX was a central part of the ecosystem, and its bankruptcy understandably rocked the market. As I wrote recently, this contagion

FTX was a central part of the ecosystem, and its bankruptcy understandably rocked the market. As I wrote recently, this contagion