- The DEX has signed a strategic collaboration with Ondo Finance.

- BNB Chain users can access over 100 tokenized US stocks and ETFs from today.

- PancakeSwap has offered zero trading fees for the first month.

PancakeSwap has teamed up with Ondo Finance to bring over 100 tokenized stocks and exchange-traded funds into the BNB Chain.

Starting today, users on the Binance platform can buy or sell digital representations of top US bonds, stocks, and ETFs, all pegged 1:1 to the underlying securities.

According to Ondo Finance CEO Nathan Allman:

Expanding Ondo Global Markets to BNB Chain allows us to bring tokenized US stocks and ETFs to millions of users across Asia, Latin America, and other geographies, in an environment that is fast, cost-efficient, and highly interoperable. This is a major step toward making US markets globally accessible through blockchain technology.

PancakeSwap is teaming up with @OndoFinance to bring 100+ tokenized real-world assets (RWAs) in stocks, bonds, and ETFs onchain to @BNBCHAIN.

You can now trade tokenized assets on PancakeSwap with zero fees for the first 30 days.https://t.co/EgOKhem4yT https://t.co/QwXvU3SALk pic.twitter.com/bbHBCY8rpq

— PancakeSwap (@PancakeSwap) October 29, 2025

PancakeSwap will waive trading fees for the first 30 days to celebrate Ondo Global Markets integration.

That gives the DeFi community a cost-free way to navigate tokenized traditional assets on the Binance ecosystem.

On-chain finance hits a key milestone

The alliance is part of Ondo’s mission to leverage blockchain technology to allow access to high-quality US monetary assets, including real estate and stocks.

Now, BNB Chain’s over 3.4 million daily users and the vast DeFi ecosystem can enjoy Ondo’s offerings.

Further, PancakeSwap promises user-friendliness, self-custody, and transparency.

The integration welcomes a new era for the Binance community, bridging decentralized finance with traditional markets.

BNB Chain’s thriving user base can now access high-net tokenized US securities.

The Chain’s Head of Business Development, Sarah Song, commented:

Real-world assets are one of the fastest-growing segments on BNB Chain, and having Ondo Finance join our ecosystem is another strong validation of that momentum. Together, we’re expanding access to high-quality financial assets and driving the next wave of adoption that connects traditional markets with blockchain technology.

Understanding PancakeSwap’s role

PancakeSwap is the leading DEX on BNB Chain. It will serve as the strategic launch partner supporting trading of the tokenized assets.

The decentralized exchange enables users to trade Ondo’s tokenized securities through a familiar interface, promising a remarkable experience for new and existing DeFi players.

Moreover, PancakeSwap announced a zero-fee campaign between October 29 and November 29.

Ondo will leverage PancakeSwap’s massive user base and liquidity pools to ensure streamlined market activity and price discovery for tokenization enthusiasts on the BNB Chain.

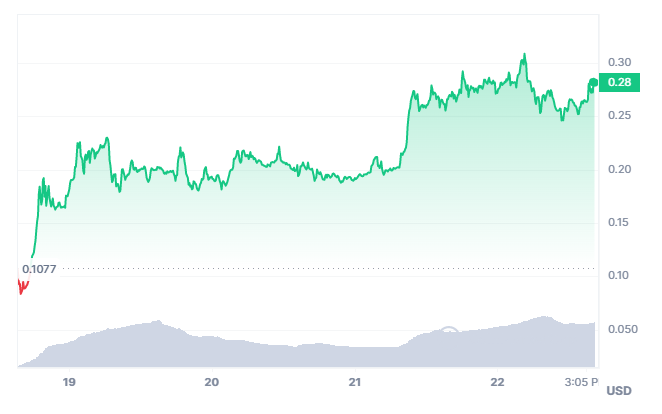

CAKE and ONDO price actions

The native tokens mirrored the broader market performance, exhibiting bearish biases on their daily timeframes.

CAKE lost nearly 5% in the past 24 hours to $2.55, whereas a 2% dip in that timeframe sees ONDO exchanging hands at $0.7364.

Bearish sentiments dominate the broader sector as the global cryptocurrency market cap plunged 1.5% the past day to $3.8 trillion.