- CME group says demand from clients has increased amid the heightened market volatility.

- The marketplace plans to expand expiries for its standard and micro-sized BTC and Ether options contracts.

- Approval would see the derivatives platform make the changes on 22 May, 2023.

Derivatives marketplace CME Group is seeking to expand its options expiries for Bitcoin and Ethereum, according to an announcement published today, 17 April 2023.

The platform, which says the plans are subject to regulatory approval, indicates that the plan is to have its suite of crypto options for BTC and ETH contracts expiries be available every business week day – Monday to Friday.

Currently, expiries for micro-sized options on the two crypto futures are available on Monday, Wednesday and Friday. The CME also offers monthly and quarterly expiries for BTC and ETH options on its futures contracts.

If approved, the company will look to have the new expiries available beginning 22 May.

Client demand for BTC and ETH products

Giovanni Vicioso, CME Group Global Head of Cryptocurrency Products said the goal is to have market participants access options contracts that offer “greater precision and versatility” for managing short-term Bitcoin and Ethereum price risk.

“Against a backdrop of heightened market volatility in the digital asset sector, we continue to see clients turn to a trusted, regulated venue like CME Group for reliable and efficient cryptocurrency risk management products,” Vicioso added.

CME Group has seen an increase in demand for Bitcoin and Ethereum futures and options. The top two assets by market cap are also the two best cryptocurrencies for crypto derivatives trading.

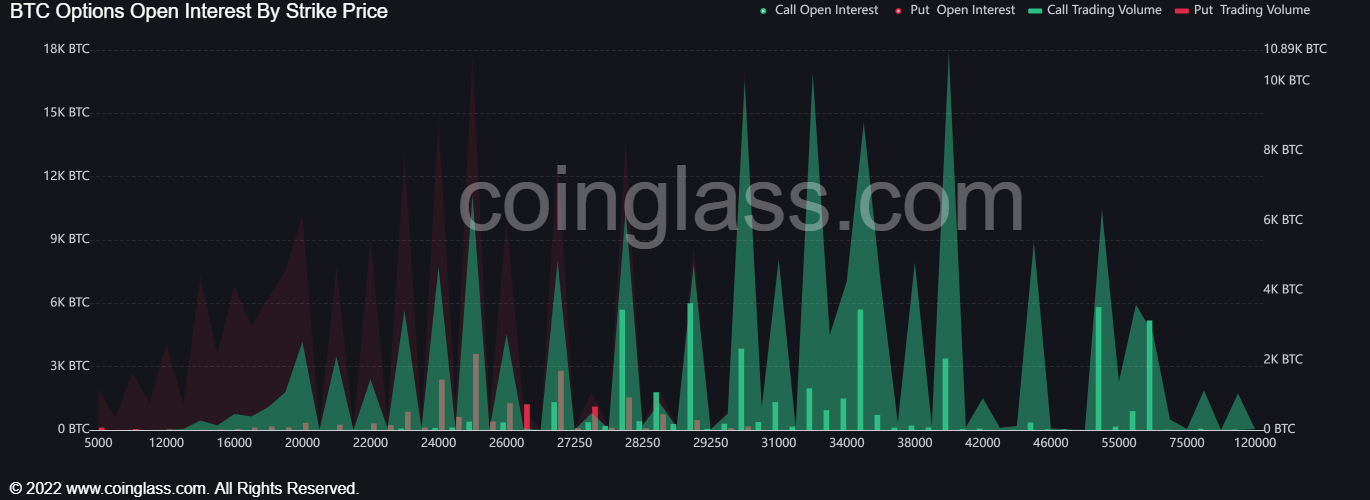

The bitcoin’s numbers in Q1, 2023 for CME achieved a notional of over $3 billion, a record in terms of daily average. The marketplace also saw a record BTC options contracts of 2,357 traded on 22 March 22. Open interest rose to an all-time high of 14,700 contracts on 31 March and could soar further amid a long-term bullish Bitcoin price prediction, particularly going into the next halving.

The all-time high for Ether options contracts was 311 on 22 February, while OI hit a record 1,800 contracts on 24 March.