- Bitcoin currently trades in a tight range near $90K amid a 3-day streak of ETF outflows.

- The current market consolidation mirrors pre‑2025 surge patterns with low volatility.

- The key levels to watch include the support at $90K, the immediate resistance at $95K, and $100k in case of a breakout.

Bitcoin (BTC) price has remained stuck in a narrow trading range around $90,000.

The cryptocurrency is showing signs of consolidation after a volatile start to 2026.

Bitcoin ETF flows and macroeconomic uncertainties are playing a key role in the price movement.

Bitcoin ETF outflows weigh on BTC price

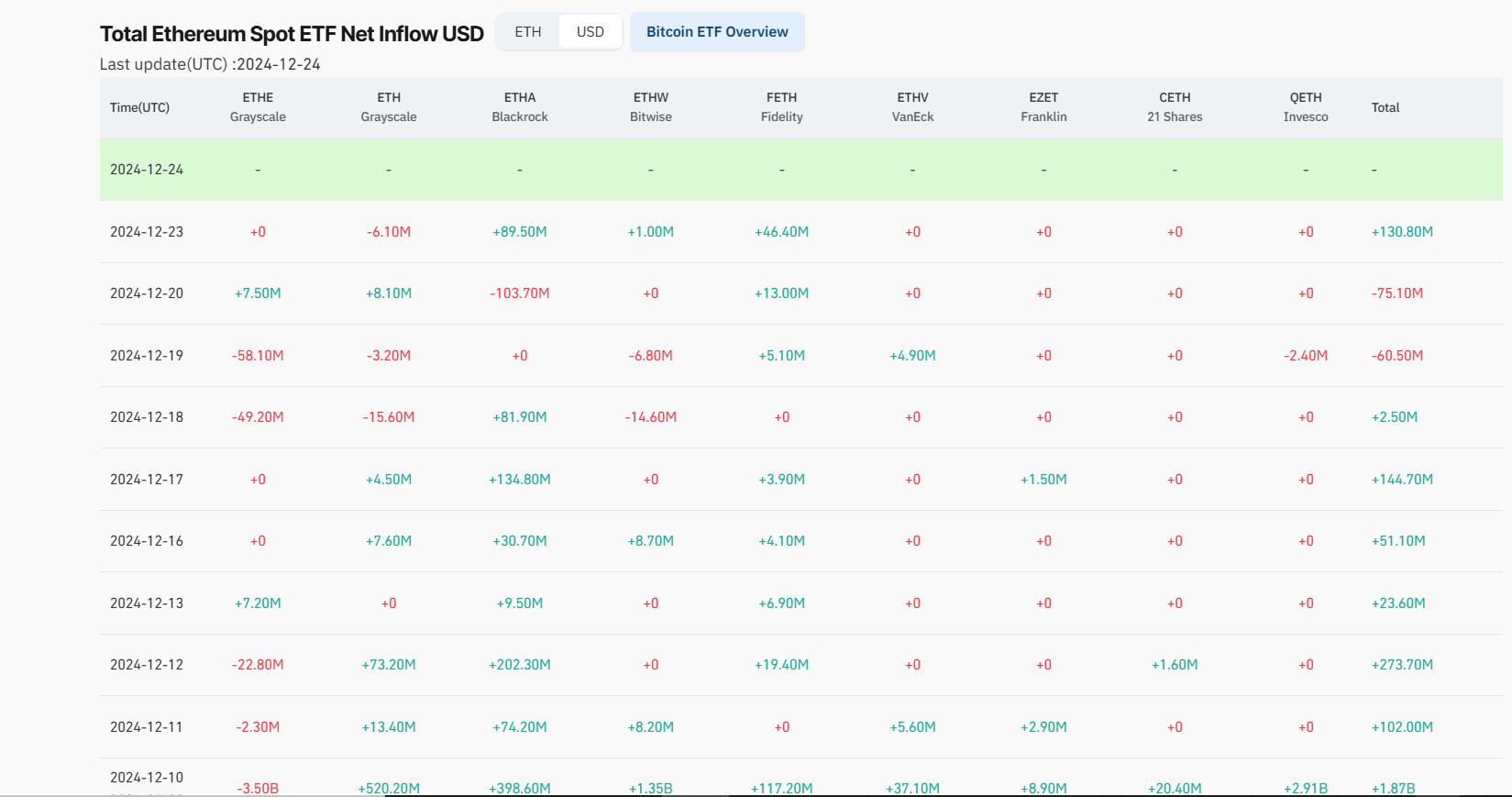

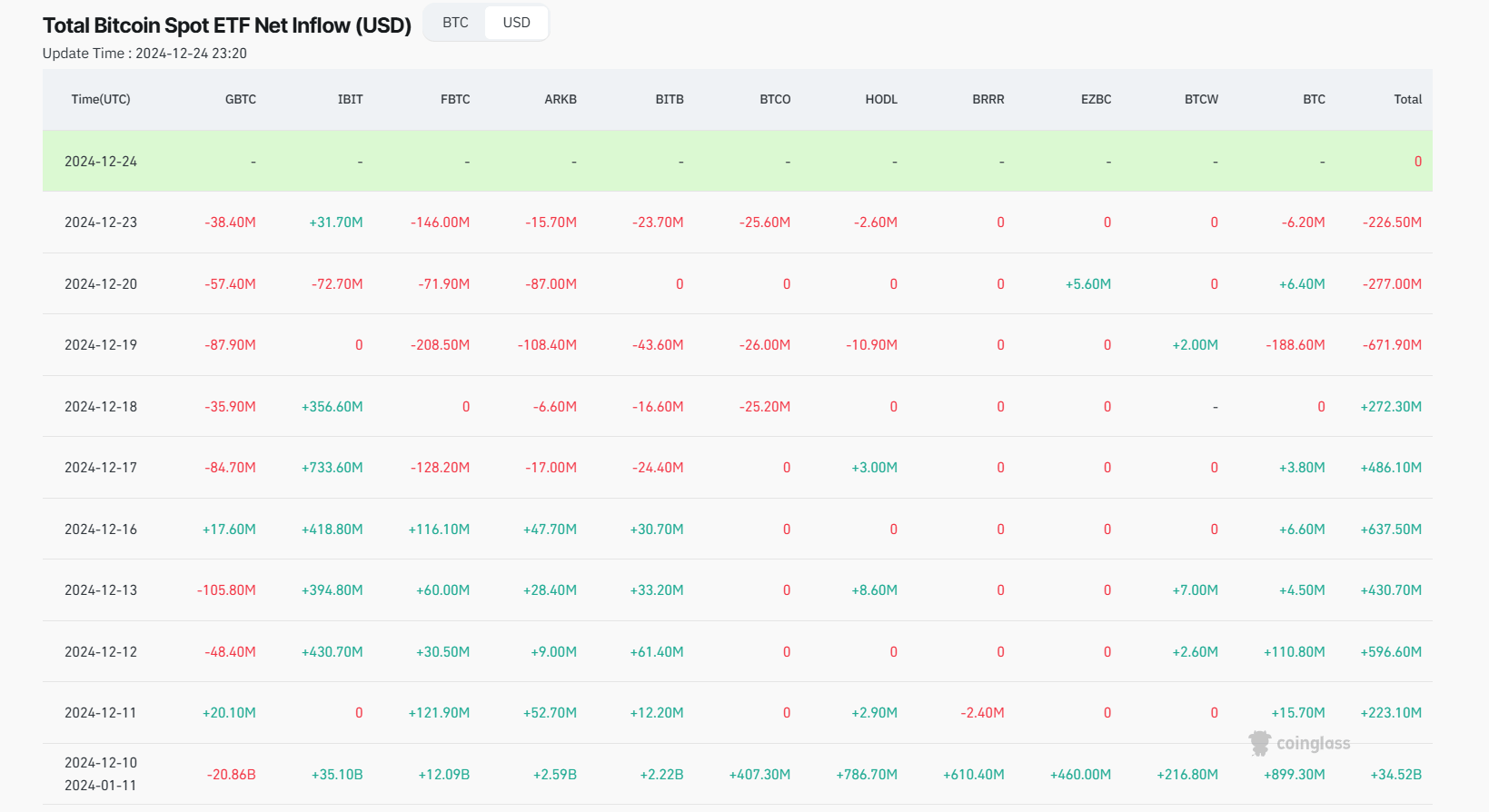

In early January, Bitcoin spot ETFs initially attracted strong inflows, signalling renewed institutional interest.

However, a three-day streak of outflows totalling over $1 billion has nearly erased those gains.

This shift indicates waning conviction among institutional investors.

The outflows have contributed to Bitcoin’s inability to break above $95,000.

Traders are cautious as geopolitical tensions between the USA, Latin American countries and Iran, and broader risk-off sentiment, weigh on the market.

ETF redemption patterns are currently a major driver of near-term price behaviour.

These flows may represent tactical rotation rather than long-term liquidation.

Investors could be reallocating capital to other assets while maintaining exposure to Bitcoin.

Nonetheless, the short-term pressure has kept BTC trading in a tight range between roughly $88,000 and $95,000.

Echoes of pre‑2025 rally patterns

Bitcoin’s current sideways trading resembles the consolidation phase before its 2025 rally.

In the months leading up to the surge, BTC spent nearly 50 days in a narrow range, a phenomenon called time-based capitulation.

This period allowed weak hands to exit and set the stage for a powerful upward move.

The current market consolidation mirrors that pattern, suggesting the market may be quietly building momentum.

Unlike traditional capitulation, this phase does not involve panic selling or sharp drops.

Instead, low volatility and a steady range characterise this pre-rally accumulation period.

Some analysts see this as a signal that Bitcoin could be preparing for a significant breakout.

The ETF outflows and geopolitical pressures may simply be temporary obstacles.

If history repeats, a sustained push above resistance could trigger renewed bullish momentum.

The key Bitcoin price levels to watch

One of the key price levels to watch out for is the key support that remains near $90,000.

A break below this support could open the door to further declines toward $86,000–$88,000.

However, a sustained move above $95,000 would signal renewed institutional buying and potential acceleration.

If Bitcoin overcomes $100,000, the market could revisit mid‑2025 highs and even target $110,000 in the medium term.

Moving forward, traders and investors should monitor both technical levels and macro catalysts to gauge the timing and scale of the next potential surge.