- XRP trades above $2.00 and could eye a decisive break above $2.30.

- An uptick to $2.50 could confirm bullish continuation.

- However, a drop below $2.00 may signal deeper corrections.

The price of XRP is holding near $2 as top cryptocurrencies trade at key support levels.

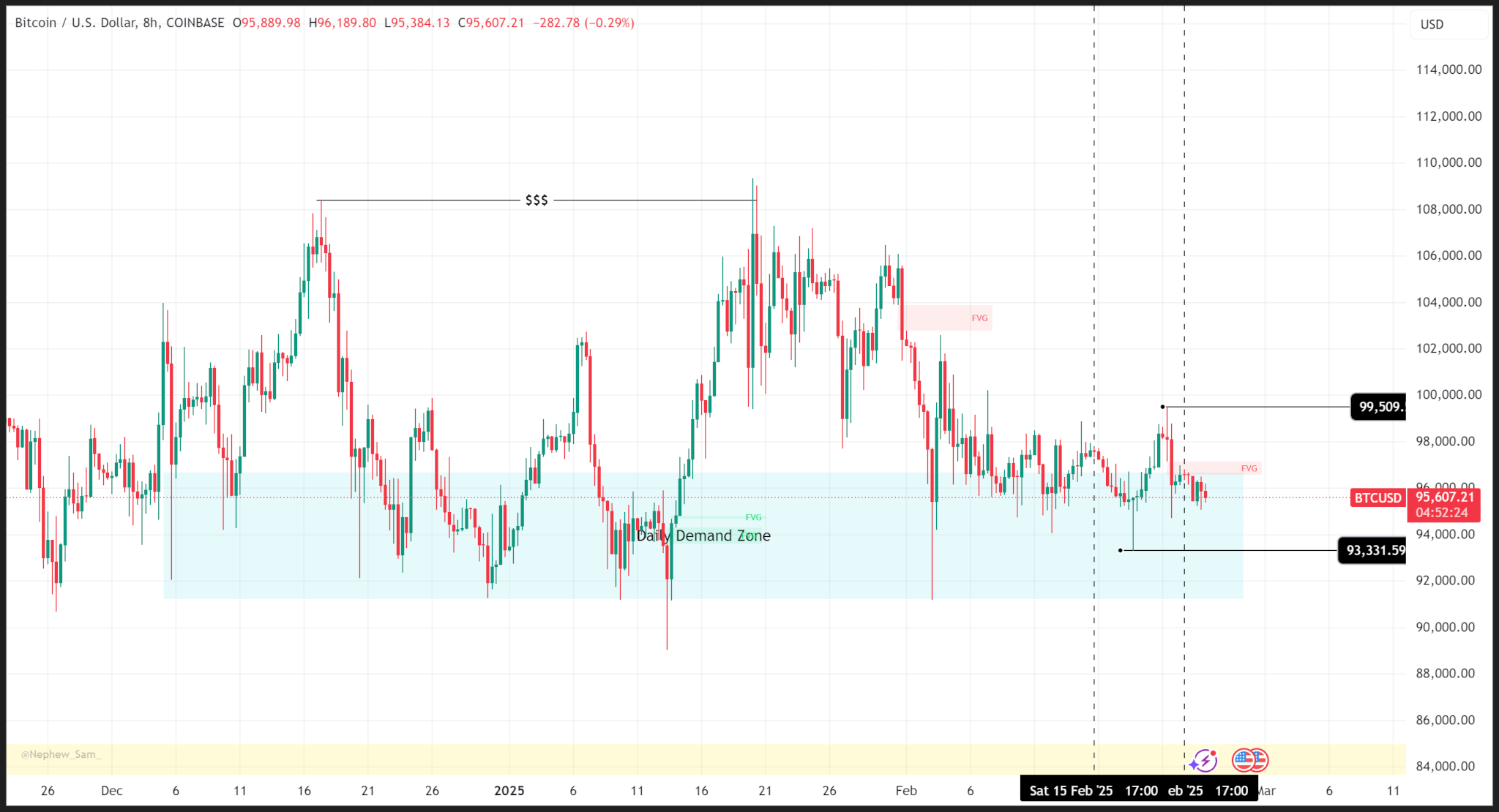

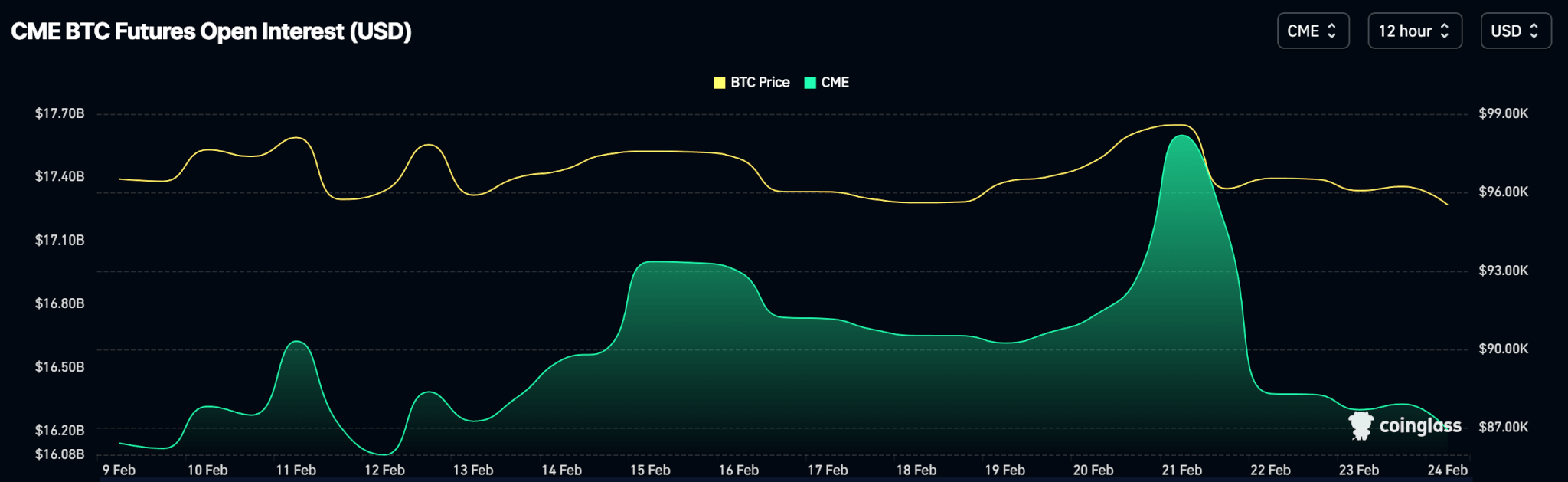

Most altcoins mirror Bitcoin’s trajectory, which saw a sharp decline over the weekend, largely attributed to heightened geopolitical tensions stemming from US military strikes on Iran.

Despite its downturn to lows of $1.94, XRP demonstrates resilience.

Bitcoin has also bounced above $100k, with bullish sentiment among investors signalling strength despite the volatile broader market.

XRP price above $2 as volume spikes

XRP has shown notable strength, rebounding from a weekly low near $1.94 as trading volume surged by over $3 billion in the past 24 hours.

This spike in volume, coupled with the price holding above the critical $2.00 psychological support level, indicates robust buying interest.

According to market analysts, increased trading volume during a price recovery often reflects renewed investor confidence and potential for sustained upward momentum.

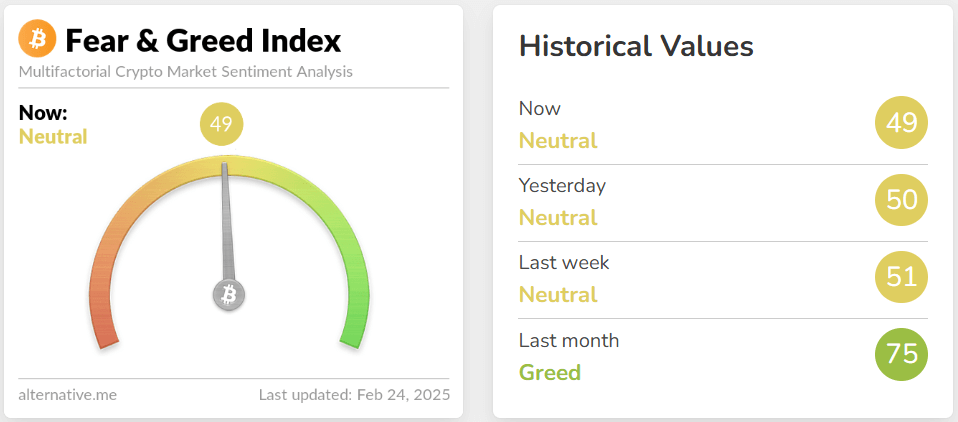

The broader cryptocurrency market has faced downward pressure due to US strikes on Iran, which intensified fears of a wider conflict.

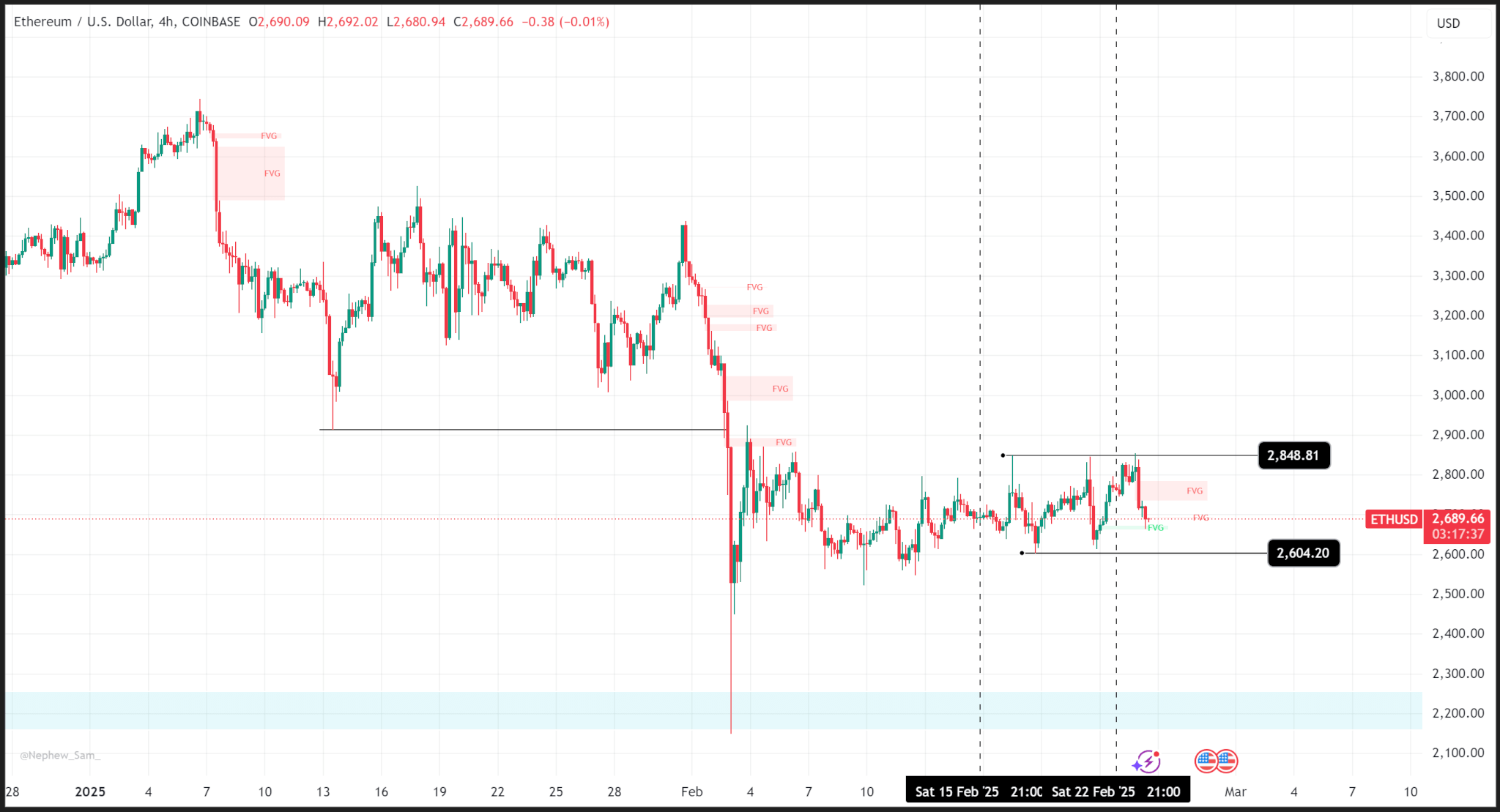

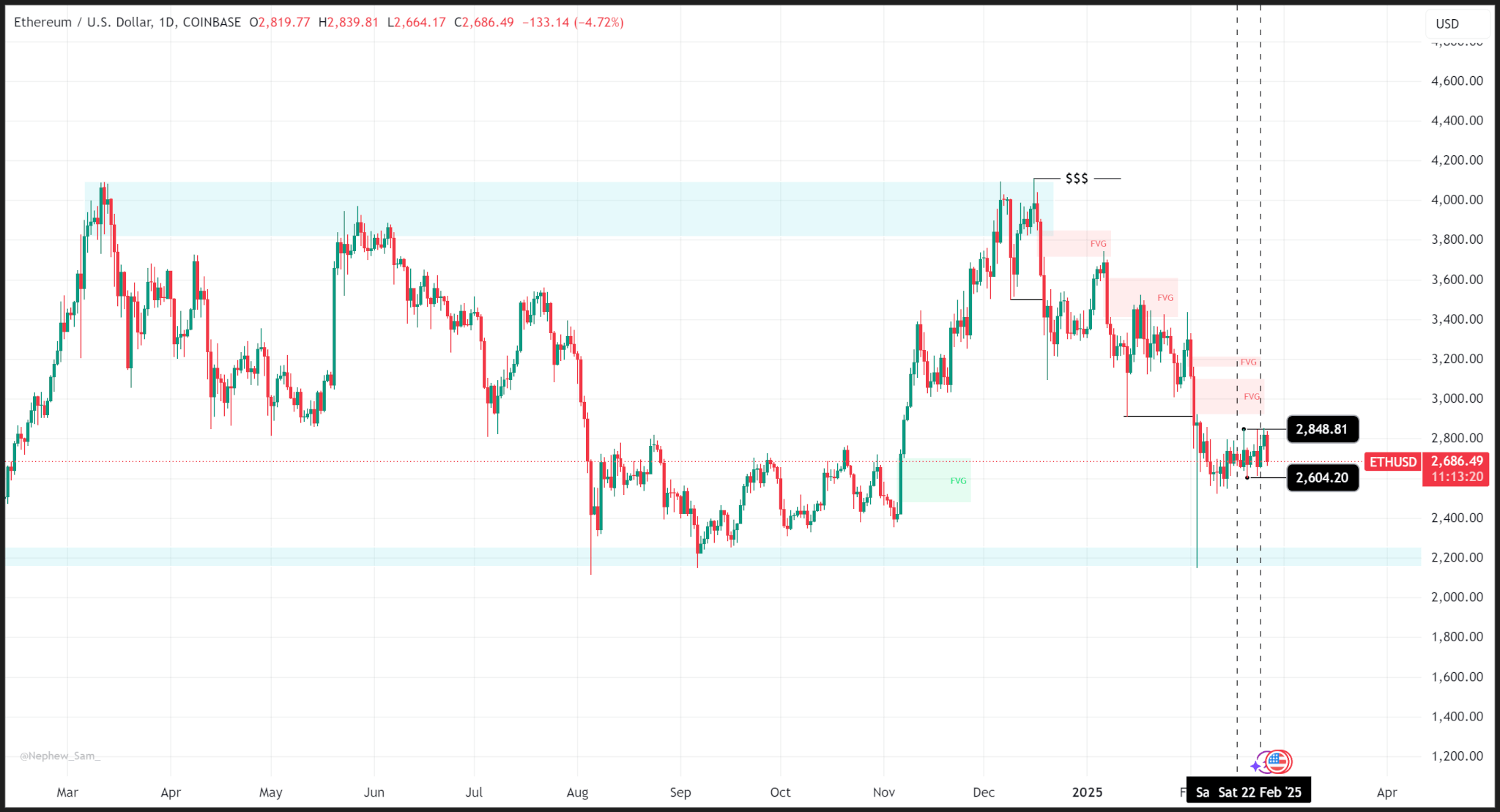

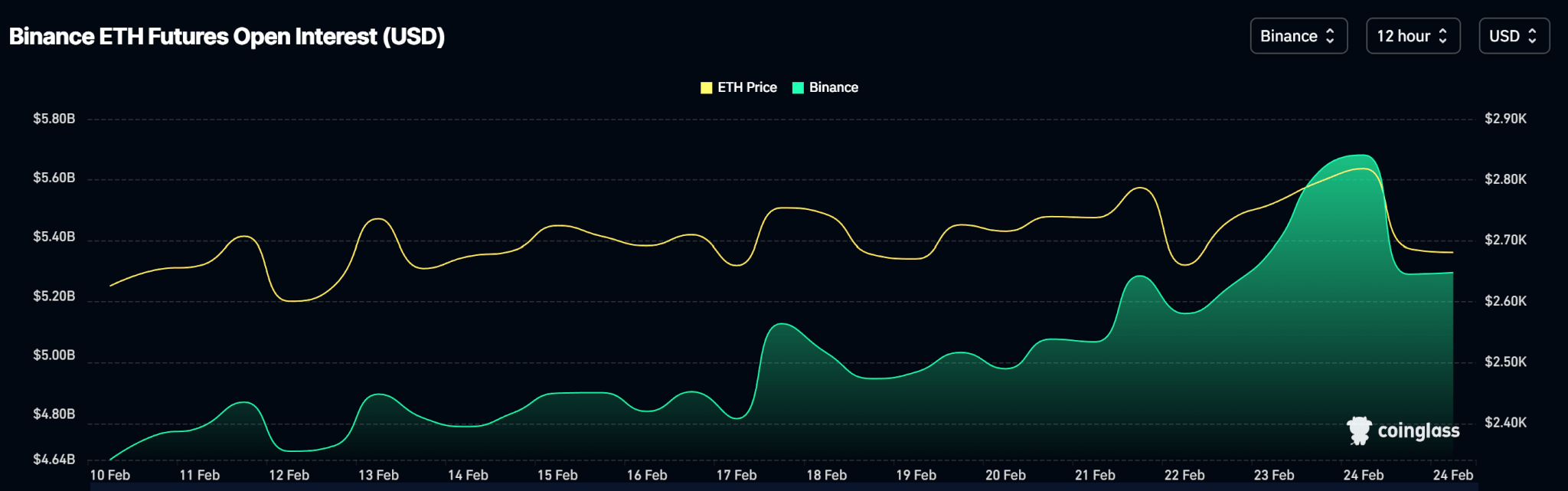

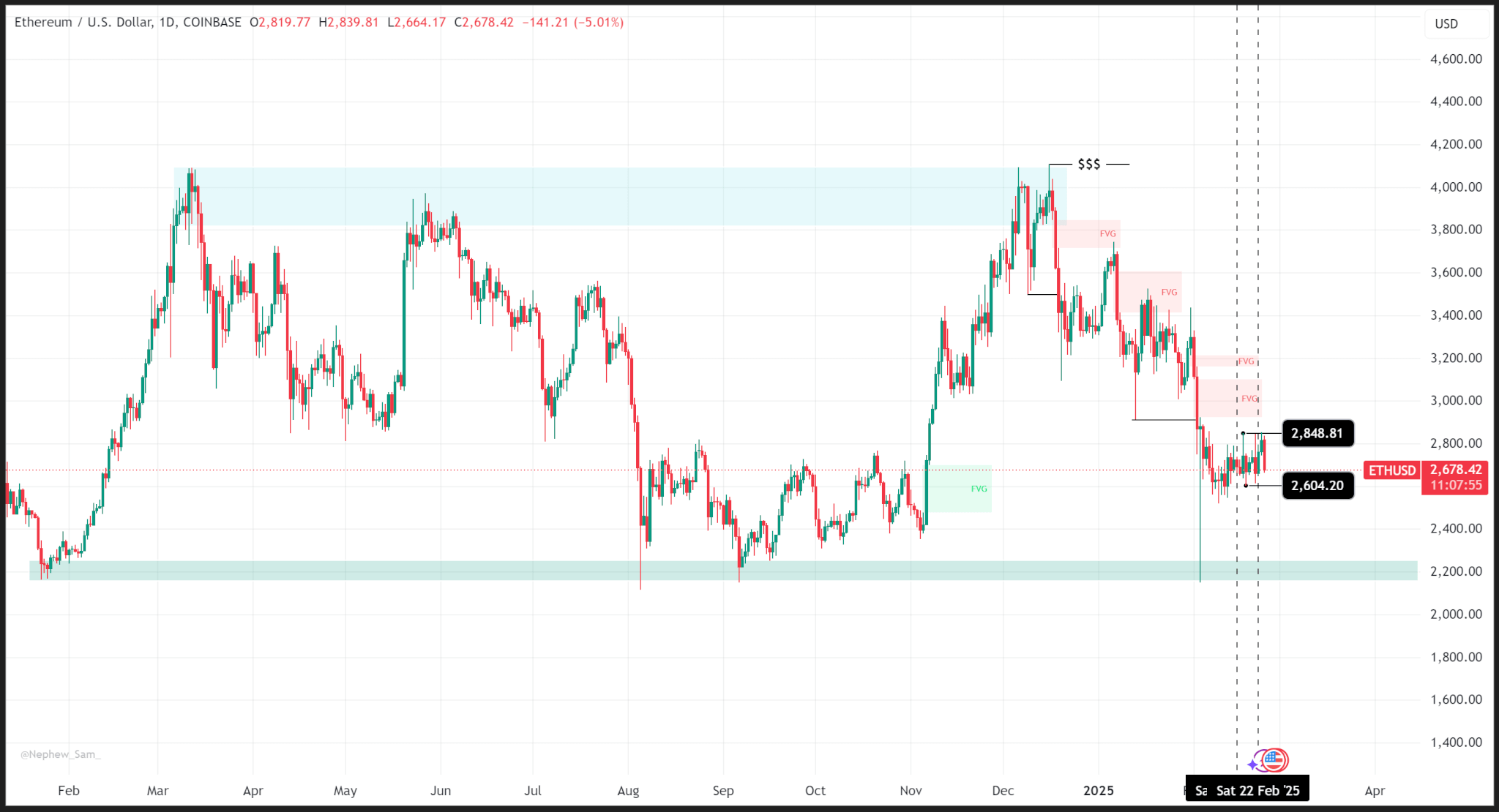

Bitcoin and Ethereum have also corrected, with Bitcoin trading just above $101k.

Despite this, stock futures indicate investors are shrugging off the weekend’s sell-off, and oil prices have stabilized after a brief spike, suggesting markets are adapting to the geopolitical unrest.

A crypto market bounce is possible if risk-on sentiment returns, but an escalation in the Middle East could trigger further declines.

Ripple price prediction

A bounce for cryptocurrencies comes as data from asset manager CoinShares shows digital asset investment products saw a 10th consecutive week of inflows for the week ending June 20.

As per details shared on June 23, the crypto sector attracted $1.24 billion in exchange-traded funds last week, with Bitcoin leading with $1.1 billion for a second straight week of inflows.

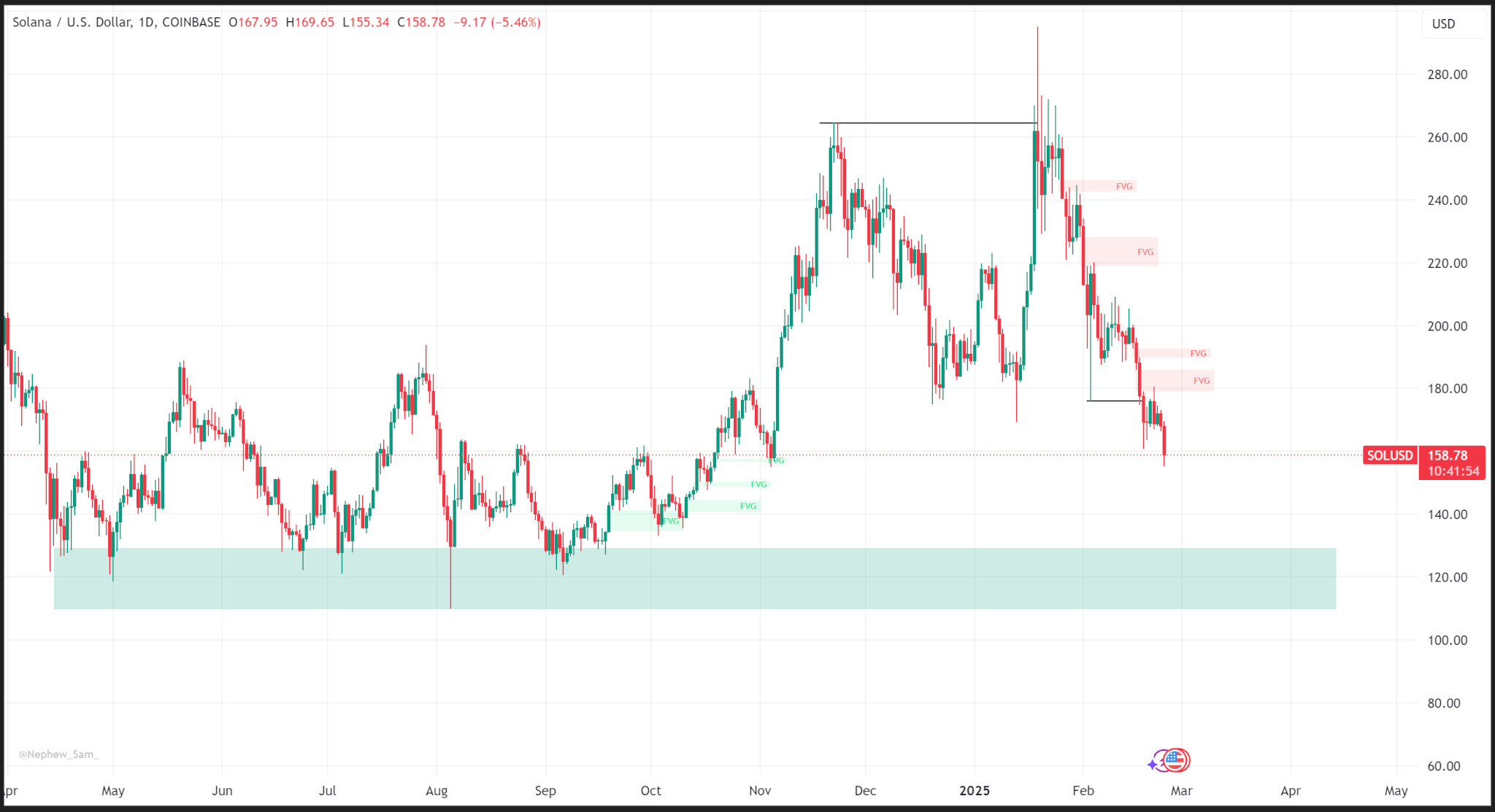

Meanwhile, Ethereum hit a 9th consecutive week of inflows with $124 million. Solana attracted $2.78 million and XRP $2.69 million.

Analysts are cautiously optimistic about XRP’s future. Short-term forecasts suggest a potential breakout above $2.50 could push prices toward $3.00.

The bounce to $2.00 suggests that bulls are defending this key level, positioning XRP for a possible short-term rally.

Despite the RSI and MACD on the weekly chart, long-term projections are more ambitious.

A break above the 20-week exponential moving average (EMA) will reinforce this outlook.

Notable predictions for XRP include a potential rocket past $10, driven by increased institutional adoption and regulatory clarity.

However, failure to hold above $2.00 could see prices retest April’s low of $1.60.