- Memecoin’s cultural value clashes with Memeinator’s AI-driven strategy for meme supremacy.

- Short-term dips forecasted for MEME, but long-term outlook signals growth potential.

- Memeinator’s MMTR token enters the meme coin race, battling for the top spot.

In the ever-evolving world of cryptocurrency, two contenders are vying for the coveted title of the top meme coin—Memecoin (MEME) and Memeinator (MMTR).

Recent developments and price movements have set the stage for intense competition, with each project bringing its unique approach to the forefront. Let’s delve into the latest updates on Memecoin, explore its price predictions, and uncover the exciting details of Memeinator’s MMTR token presale.

Memecoin’s price movements: riding the waves

Memecoin (MEME) has boldly declared its lack of intrinsic value or financial promises, relying instead on the cultural phenomenon surrounding memes. Developed within the Memeland ecosystem by 9GAG, MEME stands out as a unique player in the cryptocurrency landscape.

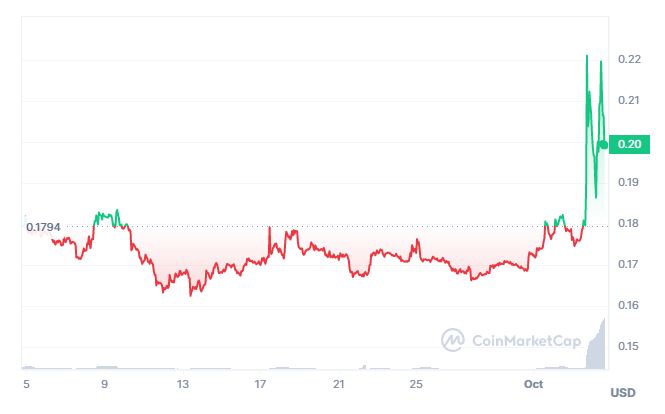

Recent days have seen MEME navigating the crypto seas with both bullish and bearish winds. Opening at $0.02705, bears initially had the upper hand, but bulls staged a comeback around $0.02100, stabilizing the market. The price found crucial support at $0.025, propelling MEME to a daily high of $0.02968.

Memecoin (MEME) price chart

Memecoin (MEME) price chart

MEME’s value, though unconventional, is culturally driven, reflecting the community’s interest and the significance of memes. Collections like “You the real MVP,” “The Potatoz,” and “The Captainz” serve as digital collectibles, contributing to the governance of the Memeland DAO.

Memecoin price prediction: short-term and long-term forecasts

In the short term, market analysts predict a slight dip in MEME’s value. However, despite the current bearish sentiment, the Fear & Greed Index registers 71 (Greed), indicating a dynamic market.

For the long term, analysts foresee memecoin (MEME) oscillating between a yearly low of $0.024312 and a high of $0.038052. DigitalCoinPrice anticipates volatility, with potential highs in the coming years, projecting a surge to $0.092991 in 2026 and $0.051937 in 2027.

Memeinator and the MMTR token presale

In the competitive arena of meme coins, another coin, Memeinator, is also making headlines. According to the coin’s website, its mission is clear: to capture and destroy the weakest memes.

Powered by cutting-edge AI tech, Memeinator is on a relentless journey, eliminating unworthy projects and setting its sights on the top meme coin spot.

The Memeinator (MMTR) token, is currently in its presale stage. The presale allocates 62.5% to the community, 15% for marketing and CEX listings, and additional percentages for development, liquidity provision, and a competition pool. The presale is in its twelfth stage and the MMTR is currently going for $0.0186 and is expected to rise to $0.0197 in the next stage.

The project’s roadmap outlines phases like setting coordinates, unleashing the Memeinator, search and destroy, and ultimately achieving meme domination.

The unfolding meme coins battle

Both Memecoin and Memeinator are actively competing for the throne of the hottest meme coin. While Memecoin relies on its cultural significance and community-driven value, Memeinator brings forth its AI-powered Memeinator game and Memescanner, aiming for meme domination and eliminating threatening memes.

Memecoin’s cultural approach and Memeinator’s tech-fueled strategy showcase the diverse paths projects can take in this unique corner of the cryptocurrency market.