- BTC rising 50% has produced a recovery in the crypto market

- AltSignals (ASI) is a highly promising new token launch

- ASI should outperform BTC percentage rise over the coming months and years

After some significant movements in the crypto markets, the Bitcoin price prediction forecasts further upside. However, experts suggest that AltSignals’ new token, ASI, should outperform the Bitcoin price prediction in percentage terms before the end of the year.

AltSignals is an industry-grade trading platform that is expanding its blockchain offering. Here’s why it could be the highest-performing project of its kind in 2023 and beyond.

AltSignals is launching during a widespread market recovery

The Bitcoin price prediction has flipped bullish after some promising price action at the beginning of 2023. BTC has risen over 50% from its recent lows and has been driving a recovery in the crypto market.

After many altcoins fell over 90%, the BTC recovery has produced widespread gains across the crypto market. This comes at a time when AltSignals, a highly successful crypto trading community, is launching its crypto presale event.

The ASI token has a high potential for future returns, especially as the crypto market recovers following a positive Bitcoin price prediction. A BTC recovery typically signals the beginning of bullish crypto market movements, and ASI is well-positioned to benefit over the coming months and years.

What is Bitcoin?

Bitcoin (BTC) is the first blockchain-based cryptocurrency. The Bitcoin blockchain uses a proof-of-work protocol to achieve consensus in a distributed computer network. This process is highly complex by design, and the economic costs of overriding the consensus mechanism make attacking the BTC network practically impossible.

Since it was first launched in 2009, BTC has become the largest cryptocurrency by market capitalization and has been adopted by governments and financial institutions worldwide. The rate of progress for the Bitcoin price prediction is a testament to its innate scarcity – there will only ever be 21 million BTC, which means that constantly rising demand is destined to push the price upwards.

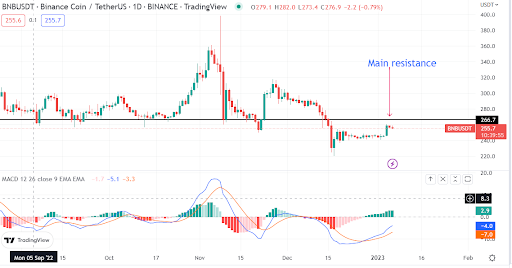

Bitcoin price prediction: Can BTC reach over $30,000 in 2023?

The Bitcoin price prediction for 2023 targets $30,000 as a key level. If BTC can break through resistance at $29,000, then it is likely to reach $30,000 and above before the end of the year.

What is AltSignals?

AltSignals is one of the largest crypto market trading communities in Web3. The platform has consistently provided profitable trading signals to its users since 2017 and has an impressive track record for success. For example, the Binance Futures Report for Feb 2023 has shown a win rate of 90%.

The project is now expanding its offering and will introduce several useful features to its community of crypto market traders. The ASI token, which is being released at $0.012 during the presale, is integral to this development.

How will the ecosystem utilize ASI?

The ASI token will give holders exclusive access to premium trading signals in the crypto market using ActualizeAI. ActualizeAI is a groundbreaking AI-powered development tool that combines several leading technologies with crypto market data. After analyzing a wide variety of different indicators, ActualizeAI will generate profitable trading signals on a consistent basis.

ASI can be used to access the AI Members Club. This premium offering will grant early participation in AltSignals’ new trading tools. With massive profits already being made through AltSignals’ AI tools, this feature can give traders a real edge in the crypto markets.

By holding the ASI token and joining the AI Members Club, users can gain access to exclusive investment opportunities and much more. Members can even help the AltSignals development team improve their tools by participating in early tests and sharing feedback with the team.

Could ASI reach $1 in 2023?

The ASI token represents a strong existing project that is now branching out further. AltSignals has a large existing user base and extensive token utility, making it a prime investment opportunity over the coming years.

The AltSignals crypto presale will raise the price of ASI from $0.012 to $0.02274 before the token goes live on exchanges. At this point, the price of ASI could go parabolic, especially if the AI development coincides with rising prices across the crypto market.

Experts are forecasting a $1 price level for the ASI token before the end of 2023 – a 45x price rise from the end of the presale. As a reputable community-driven project that will in the future utilize advanced AI tools, AltSignals certainly has massive potential.

AltSignals vs. Bitcoin price prediction: Why buy ASI?

While Bitcoin is expected to kickstart a recovery for the crypto markets, it is unlikely to outperform AltSignals in 2023 and beyond if a bull market begins. Early investors in the ASI crypto presale can expect significant returns over the coming years, as the project combines several ground-breaking technologies to deliver a comprehensive user trading experience.

AltSignals has the potential to become an industry-leading AI trading project on the blockchain. However, a limited number of ASI tokens are being released during the presale event, and it is first come, first served. The ASI token could be the best buy of 2023 as investors prepare for the next bull run in the crypto market.

You can participate in the AltSignals presale here.

Share this article

Categories

Tags