- Sushi price is near the key support level of $0.50 while Memeinator is set to jump to $0.0118.

- But what’s the price prediction for SUSHI and MMTR?

- What makes Memeinator stand out among meme coins?

Sushi is a top DeFi protocol, whose governance token SUSHI reached a high of $23.38 in May 2021. Memeinator on the other hand is a new meme cryptocurrency that recently launched its presale. The project’s approach in the quest to disrupt the meme world is attracting enthusiasts, with over $680k raised just days after it went live.

But what’s the outlook for these two projects? Let’s dive in for more.

What is Memeinator?

Memeinator is the “Terminator” of the crypto meme world. It comes with a mission – marshalled from the future of memesphere to bring order and clarity to the market by taking down weak meme tokens. To achieve this mission, the Memeinator has tapped into artificial intelligence to create a Memescanner that will identify and bring into view worthless memes for judgement. A target of $1 billion market cap means many will fall.

This is expected to start after the final presale stage, with the roadmap including the launch of the Meme Warfare game. Expanding on meme utility in this way adds to the unique value proposition of Memeinator that has the crypto community excited and looking to make an early kill via the presale.

Other than the game, other enticing aspects of the Memeinator that add to MMTR’s utility is the support for staking and NFTs. There’s more in an advertised $250k Virgin Galactic trip to space, more of which can be gleaned from the presale page and via the project’s social media channels.

What is Sushi?

SushiSwap is a community-driven DeFi protocol that offers opportunities such as yield farming, staking and liquidity providing. It’s an automated market maker (AMM) powered by smart contracts.

The project was announced in September of 2020, with the native governance token SUSHI giving holders the right to vote on ecosystem initiatives. Holders also earn from the fees collected.

Sushi price prediction

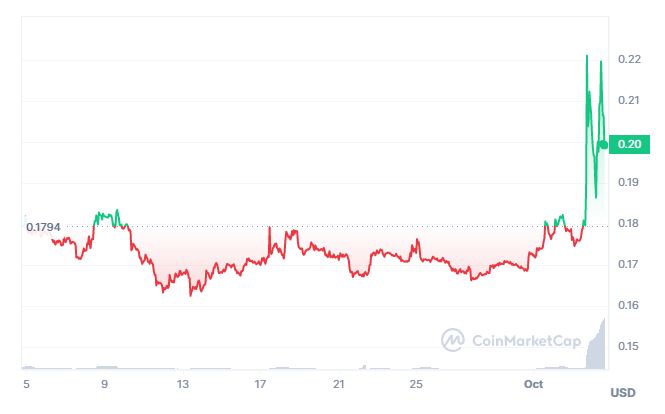

SUSHI traded to lows of $0.47 in 2020 before skyrocketing during the last bull market to break above $23 in May 2021. However, it’s edged lower amid the crypto winter and has lost 97% of that value given the current price. Negative sentiment remains, but if bulls hold the long-term support zone at $0.50, a rebound to $1 might signal fresh momentum.

With several innovative products, SushiSwap has become one of the key DeFi platforms in the market. As part of the latest development plans, the Sushi team has organised an AMA on X. The event is scheduled for October 16 at 10 pm UTC and will feature Origin DeFi, Boba Network, PopcornDAO, and others in a discussion centred on continued building even as the bear market drags.

Memeinator price prediction

Memeinator will be in presale for 29 stages, a period that will see the price of MMTR rise to $0.049. Currently, the token sale is at $0.0112 with the presale at stage three. Over $687k has been raised so far and with the price set to jump to $0.0118 at the next stage, gem hunters might yet get this at what looks like a mighty bargain. If the token launches as expected during the next bull market, it could target $1 in 2024.

Why Memeinator?

While Sushi remains one of the altcoins to watch in the market, the potential for far more gains starting from the presale suggests Memeinator could be a stand out buy between these two.

The Memeinator is quickly progressing through its initial development phase, with a strong community set to grow with the launch of MMTR across the market in phase two of the project. That will also include partnerships, staking and NFTs launch, with weaker meme tokens annihilated as MMTR targets the $1 billion market cap. The roadmap lists this as phase three of the project.

Learn more here.