Key takeaways

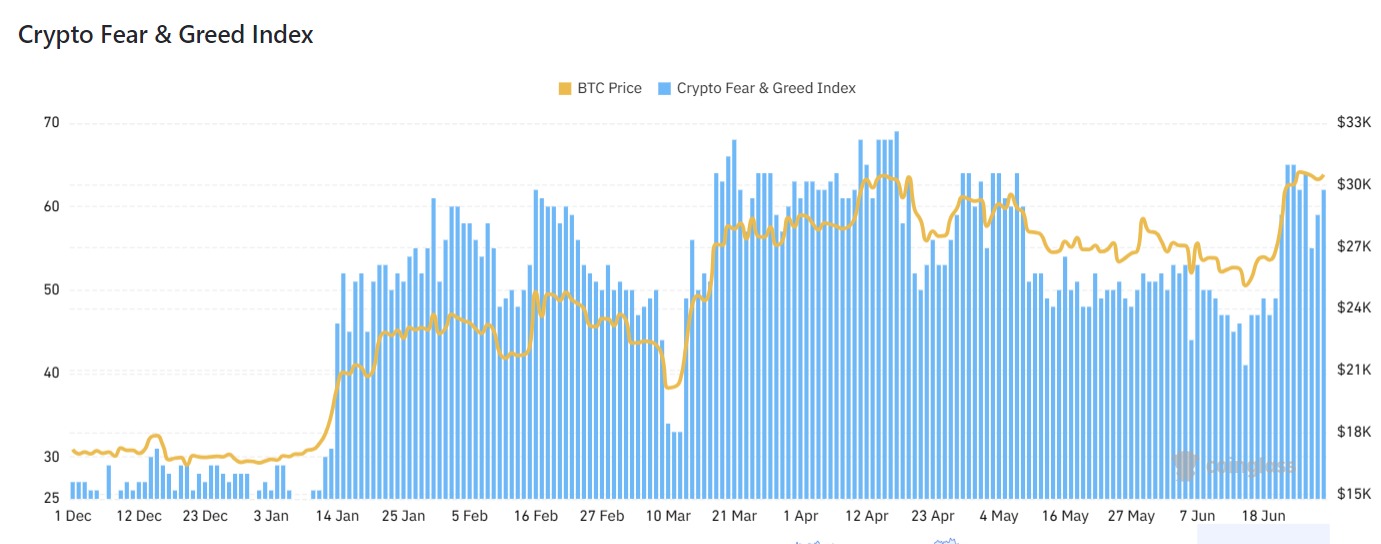

Bitcoin has been underperforming in recent weeks, down from the $31k level it achieved last month. The world’s leading cryptocurrency by market cap is struggling around the $29k region, and market experts believe it could dip lower in the near term.

Shiba Memu has continued to set new records with its presale despite the bearish market conditions.

BItcoin Stays Around $29k

The cryptocurrency market has been bearish since the start of the month. The prices of most cryptocurrencies are trading in the red zone despite the positive performance recorded earlier this week.

Bitcoin has lost more than 1% of its value so far this week and is now trading at $29,119 per coin. Ether, Dogecoin, Solana, XRP, and other leading cryptocurrencies are all down by more than 2% so far this week.

Despite the bearish trend, Shiba Memu’s presale continues to set new records. The team has raised more than $1.5 million so far, with more than 52 million tokens sold.

What is Shiba Memu?

Shiba Memu is an exciting project in the cryptocurrency space that seeks to combine the powers of blockchain technology and artificial intelligence. With the rise of AI, their applications have become vast globally.

Shiba Memu is a project that wants to leverage AI and blockchain to make it easier for people and organisations to create content and roll out marketing campaigns.

In their whitepaper, the team explained that Shiba Memu could handle the task of numerous marketing agencies. As an AI tool, Shiba Memu is always active and will work 24/7 to find the best work going on in creative advertising, consuming it and generating better content marketing.

The idea to launch as a meme token has to do with the recent popularity of meme projects in the cryptocurrency space. Within the space of two years, the market cap of meme coins grew from practically $0 to $20 billion in 2022.

However, what makes Shiba Memu different from other meme token projects is that it has an excellent use case. Shiba Memu can be regarded as a self-sufficient marketing tool powered by AI technology.

Shiba Memu can be able to create marketing strategies, roll out PR schedules, and promote campaigns on relevant forums and social media platforms. At the moment, Shiba Memu is available on the Ethereum and BNBChain blockchains.

Shiba Memu’s presale hits $1.5M

Shiba Memu’s presale has been going on excellently despite the bearish trend in the market. The presale has been around for roughly a month now, and the team has raised $1.5 million so far.

The Shiba Memu project has sold over 52 million SHMU tokens to raise $1.5 million. The team intends to use the funds to develop some of its products and services.

According to their whitepaper, most of the funds generated in the presale would be directed towards developing the Shiba Memu AI technology. By leveraging AI technology, Shiba Memu can provide exciting marketing services to its users.

The Shiba Memu platform would also have a robotastic dashboard, allowing users to interact with the AI, provide feedback, make suggestions, and ask questions.

Click here to find out more about Shiba Memu’s presale event.

Shiba Memu price prediction

Predicting Shiba Memu’s price would be impossible at the moment since the SHMU token is still in its presale stage. At the moment, 1 SHMU = 0.017650 USDT.

According to the team, SHMU’s price increases every day at 6 pm GMT. In a few hours, the token will go for 0.017875 USDT.

SHMU began trading at $0.011125 when the presale began and will trade at $0.0244 when the presale ends. The SHMU token can be purchased using Ethereum, USDT, BNB and BUSD

Should you buy Shiba Memu today?

Shiba Memu could be an excellent project for investors to get into. The fact that it is still in its early stage means that it could generate impressive ROI for investors in the medium to long term.

As a project, Shiba Memu is combining AI and blockchain technology, making it an interesting meme token. With the right level of adoption, SHMU’s price could rally over the next few months and years.

In addition to that, a Bull Run by the broader crypto market could see SHMU’s price also rally higher. So far, Bitcoin and other major cryptocurrencies are up by over 40% year-to-date.

A combination of excellent adoption and a Bull Run by the broader crypto market could make SHMU one of the best performers in the market over the coming months.