-

Bloomberg report projects bullish Bitcoin in 2023

-

Analysts bank on recession dynamics and central banks’ actions as bull triggers

-

BTC trades on a short-term recovery, with $19,000 in sight

Investors may hold their breath, hoping that 2023 will turn out to be a good year for crypto and stocks alike. But even with these hoped-for expectations, market analysts have warned that 2023 could be the year of a global recession. With the economic depression, notable recoveries may be hard to come by. But Blomberg analysts think a recession would be a bullish trigger for Bitcoin price (BTC/USD). How?

In its cryptocurrency outlook, analysts say Bitcoin will come out ahead in a potential economic shutdown in 2023. Even so, the prediction is not outright. According to the report, Bitcoin could slide to $12,000 or even $10,000. From there, it will stage a strong comeback.

Additionally, the Bloomberg report highlights policy easing in 2023 as a key bullish trigger for Bitcoin and cryptocurrencies. The analysts say central banks could be forced to ease policy on the back of deflationary outcomes. If this happens, the use case of Bitcoin as a digital version of gold will strengthen. The analysts point out that Bitcoin will start performing like the US long-dated treasury bonds and metal. The scenario will be bullish for the digital asset.

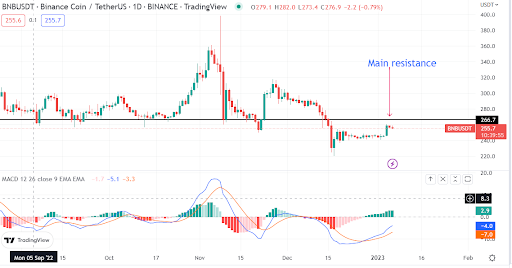

Bitcoin price movement as moving averages join the support

Technically, BTC is mildly bullish and trades along a short-term ascending trendline. The price has, for the first time since November, moved above the 50-day moving average. A potential 20-day MA crossover of the 50-day MA could heighten the recoveries. The RSI reading has safely surpassed the midpoint reading of 50, indicating that buyers are in control.

What is the likely target for BTC?

With the upside, Bitcoin now trades below an overhead and crucial resistance at $19,000. Should the current upside continue, the level is the target zone for buyers. Accelerated recoveries will depend on the prevailing crypto sentiment.

Where to buy BTC

eToro

eToro offers a wide range of cryptos, such as Bitcoin, XRP and others, alongside crypto/fiat and crypto/crypto pairs. eToro users can connect with, learn from, and copy or get copied by other users.

Binance

Binance is one of the largest cryptocurrency exchanges in the world. It is better suited to more experienced investors and it offers a large number of cryptocurrencies to choose from, at over 600.

Binance is also known for having low trading fees and a multiple of trading options that its users can benefit from, such as; peer-to-peer trading, margin trading and spot trading.