- Strategy bought 4,225 Bitcoin for $472 million, bringing its total holdings to $73 billion.

- The company raised funds through preferred shares and plans to report a multi-billion-dollar profit next month.

- Strategy’s stock is up over 3,300% since 2020 as Bitcoin strategy drives its $121 billion market cap.

Michael Saylor’s Bitcoin-focused company, Strategy (formerly MicroStrategy Inc.), has further expanded its already massive cryptocurrency holdings with a recent purchase of 4,225 Bitcoin tokens.

According to a regulatory filing with the U.S. Securities and Exchange Commission (SEC) on Monday, the company spent $472 million during the seven days ending July 13, acquiring the tokens at an average price of $111,827 each.

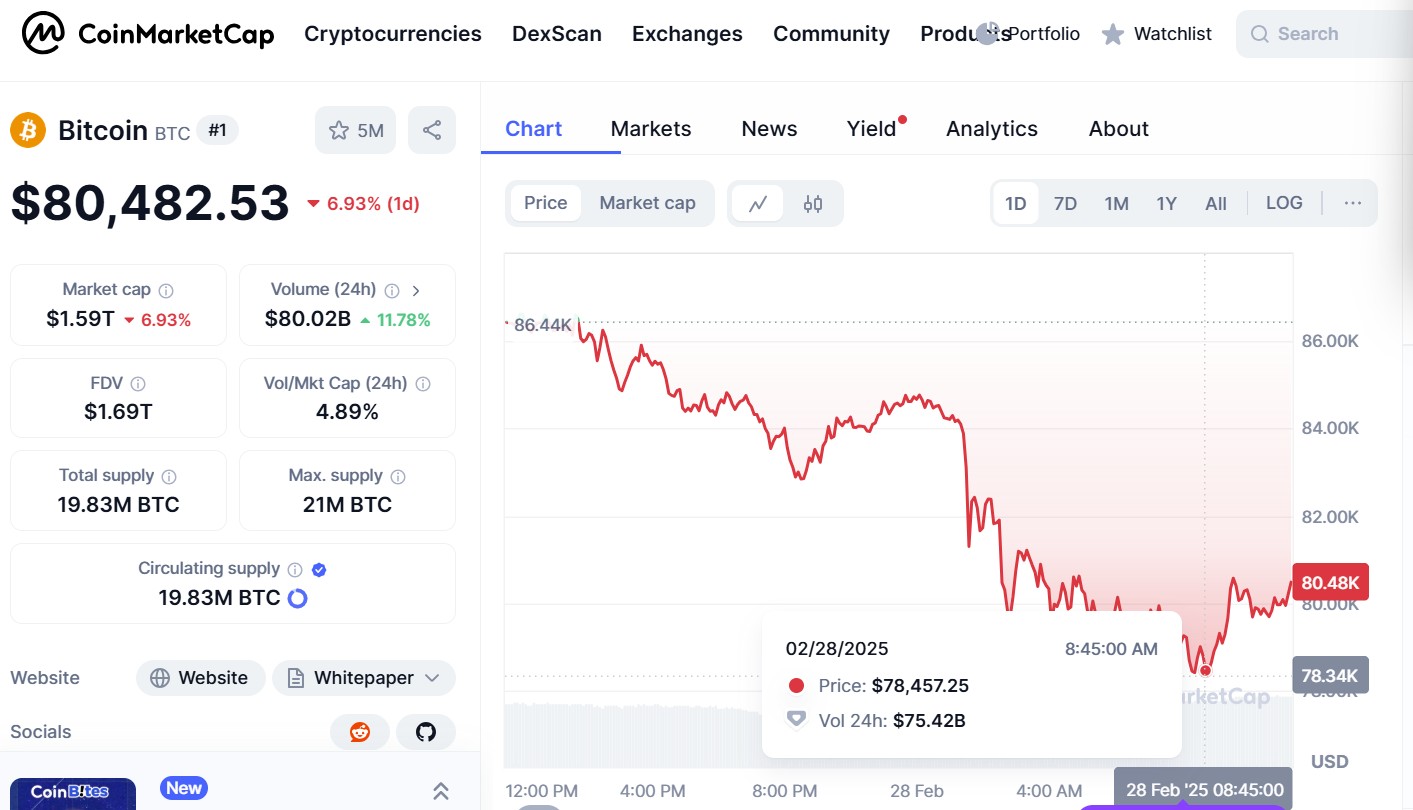

This purchase comes as Bitcoin trades near all-time highs, recently hitting $123,000 before slightly retreating to $120,483 as of writing this.

With this latest acquisition, Strategy now holds Bitcoin valued at approximately $73 billion, representing about 2.8% of the total 21 million Bitcoin that will ever exist.

The company remains the largest corporate holder of Bitcoin globally.

The purchase was funded through proceeds from the sale of preferred shares via Strategy’s at-the-market (ATM) program.

The firm raised the full $472 million last week through three offerings of these stock-like products, which are tradable indefinitely and offer dividend payouts.

The use of preferred equity instead of common stock marks a strategic shift in how Strategy finances its growing Bitcoin portfolio.

Strategy eyes profit amid accounting changes and crypto surge

Strategy is poised to report a multi-billion-dollar profit in its upcoming earnings release, benefiting from both the strong rebound in Bitcoin prices and changes to accounting standards that now more accurately reflect the value of its digital asset holdings.

The company has spent $7.24 billion on Bitcoin in the current quarter across 13 separate transactions, according to Bloomberg.

This aggressive accumulation aligns with the Strategy’s long-standing approach of using Bitcoin as a hedge against inflation, a strategy first initiated in mid-2020.

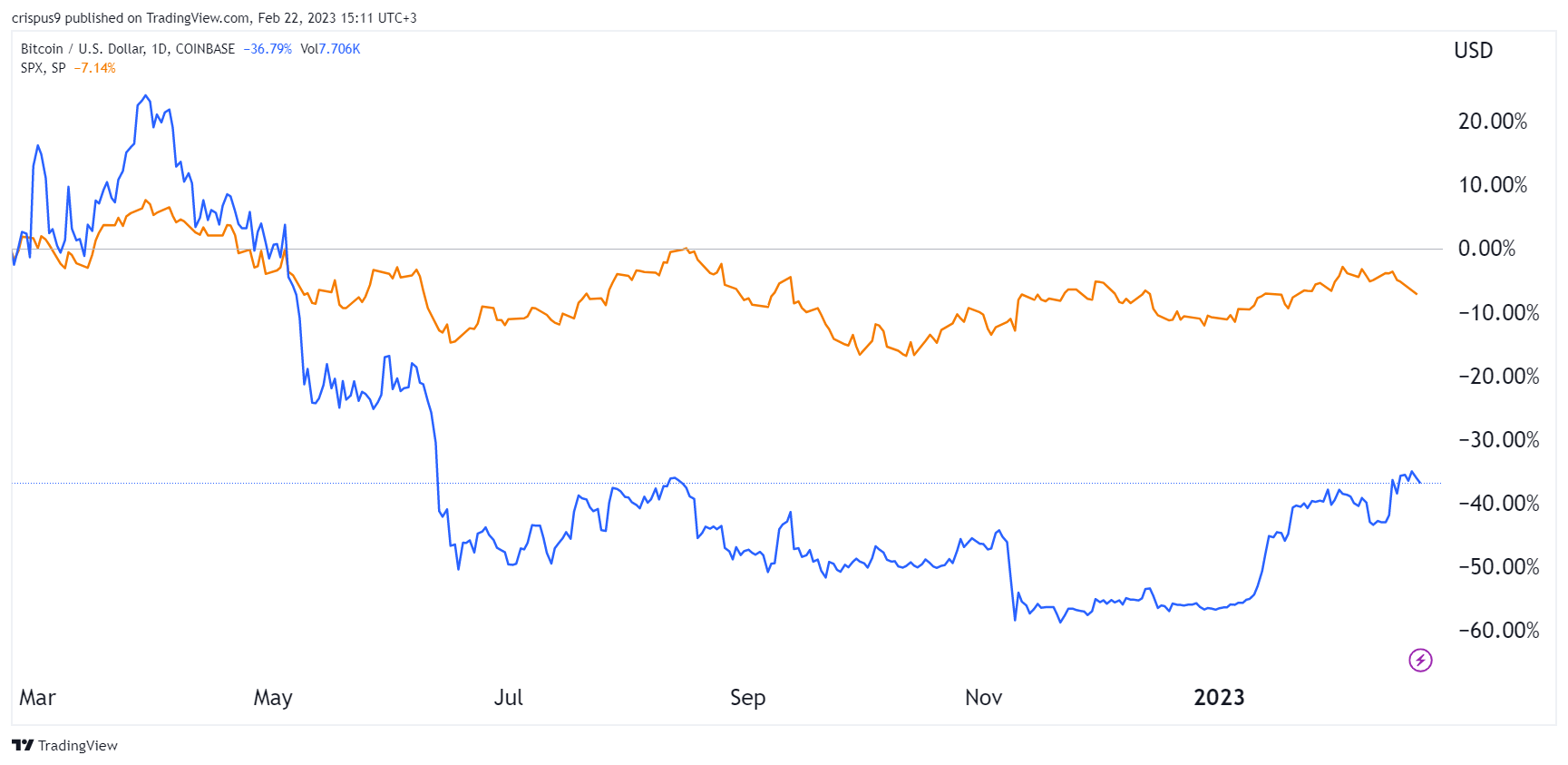

Since then, the company’s stock has surged over 3,300%, significantly outperforming traditional equity benchmarks.

During the same period, Bitcoin has risen by more than 1,000%, while the S&P 500 has gained approximately 115%.

The potential for substantial quarterly earnings also reflects the increasing institutional acceptance of Bitcoin as a store of value.

For Strategy, this bolsters its positioning as both a technology company and a de facto Bitcoin investment vehicle.

Market cap climbs as Bitcoin strategy evolves

Strategy’s market capitalization now exceeds $121 billion, a figure largely driven by investor enthusiasm over its bold Bitcoin-centric approach.

The company’s commitment to consistently increasing its exposure to the cryptocurrency market has transformed its profile on Wall Street and among digital asset advocates.

The firm’s decision to rely more heavily on preferred share offerings suggests a deliberate shift to reduce dilution for common shareholders while continuing to pursue large-scale Bitcoin acquisitions.

The nature of these instruments—tradable forever and dividend-paying—may also appeal to a broader base of investors looking for exposure to crypto-linked equities with income potential.

With Bitcoin prices hovering near record highs and regulatory scrutiny of digital assets ongoing, Strategy’s actions will continue to be closely watched by both crypto investors and traditional market participants.

As the company prepares to release its quarterly results next month, all eyes will be on whether its aggressive bet continues to pay off.