- Story (IP) price fell sharply to hit lows of $7.13 on Friday, extending losses amid profit taking.

- IP drops as selling pressure wipes out millions in positions across the market.

- Analysts say Story’s strong traction as a real-world assets platform could help IP price bounce.

Story (IP), the token of the Story Protocol, has experienced a sharp correction in the past 24 hours.

Amid a more than 25% dip, the IP token has erased most of the gains seen as bulls pushed to a new all-time high early this week.

The losses have come amid heightened selling pressure as profit taking across the market hits major coins.

IP price nosedives amid profit taking

Story is the intellectual property blockchain targeted for a AI-native infrastructure for the $80 trillion IP asset class.

The protocol’s IP token, which powers the blockchain designed to tokenize and manage intellectual property assets ranging from AI models to creative works, plummeted 25% in the last 24 hours.

Losses saw price plummet to lows of $7.13, extending the dramatic drop that has followed IP’s surge to the all-time high of $14.89.

This means Story’s price has dropped more than 51% since its peak on Sept. 22.

Enthusiasm over the Story Protocol’s innovative approach to programmable IP licensing and its integration with decentralized applications drove bulls to dominance.

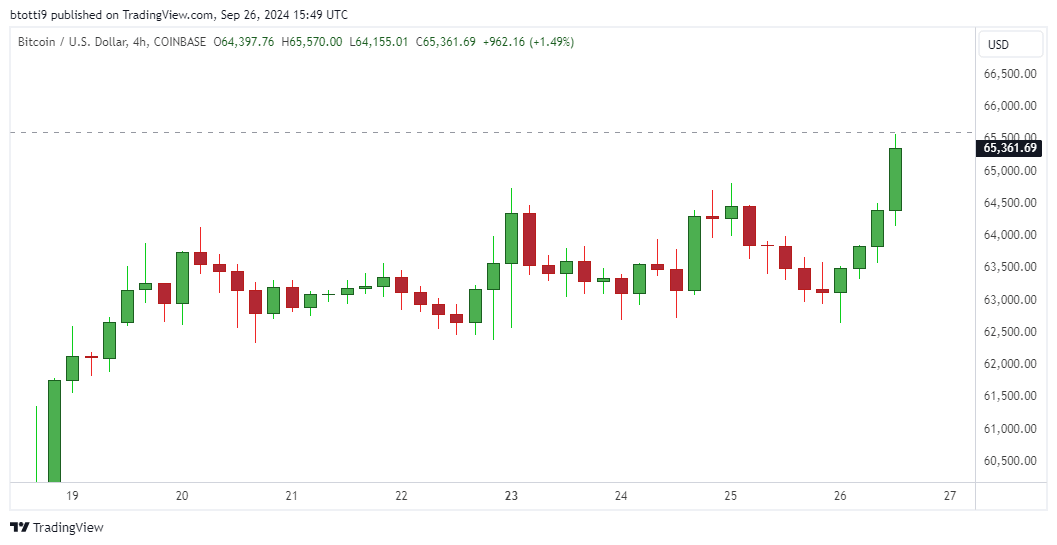

But with Bitcoin selling off and major altcoins following suit, IP has pared most of the upside.

Per data from CoinMarket, trading volume has increased 41% to over $361 million in the past day to suggest a rush of sell orders.

The nosedive has intensified the profit taking the IP-focused blockchain solutions platform could yet witness fresh downside pain.

Currently, Story trades near $7.20, with bears shaving off about 30% of IP value in the past week.

Story Protocol, while innovative in its RWA approach, faces many of the headwinds that impact most cryptocurrencies, including a broader downturn of risk assets.

Why are analysts bullish on Story (IP)?

Despite the turmoil, some observers point to underlying strengths. Story Protocol’s recent tokenization of high-profile IP demonstrates real-world utility.

Key partnerships and integrations signal this strong traction and in institutional interest amid AI and blockchain adoption growth, add to this bullish perspective.

This is so as RWA takes shape, and the platform’s focus on the multi-trillion-dollar IP market gives it an edge.

“At its core, Story is the only blockchain purpose-built to make IP programmable, traceable, and monetizable in real-time, at global scale.

Conventional blockchains can represent static ownership but cannot embed dynamic, programmable license terms,” the Story team noted following mainnet launch.

Crypto analysts have also pointed to Grayscale’s launch of the Story Trust as a potential catalyst for IP. Hype are ETFs and institutional demand could be key.

Holding above $6.00 and successful bounce to $10 will buoy IP bulls. However, a dip below this key demand reload zone could allow sellers to target the $3.20 area.