- Strategy is the world’s largest corporate holder of Bitcoin

- Fresh purchases with the new capital will push the company’s total BTC holdings beyond 500,000 BTC.

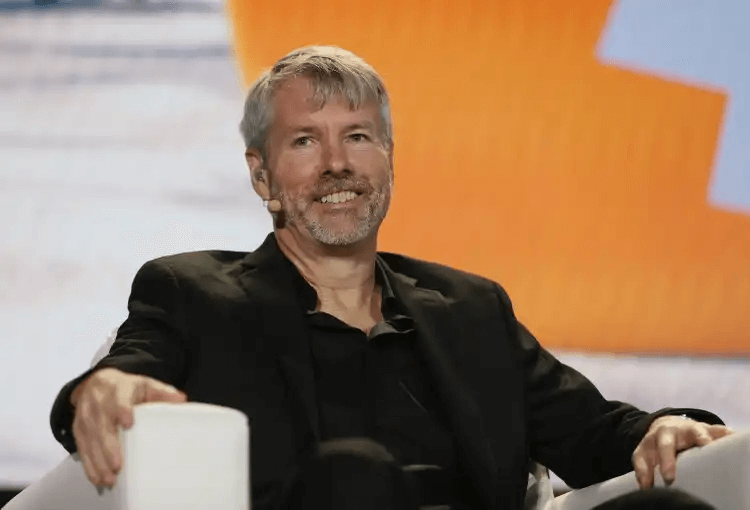

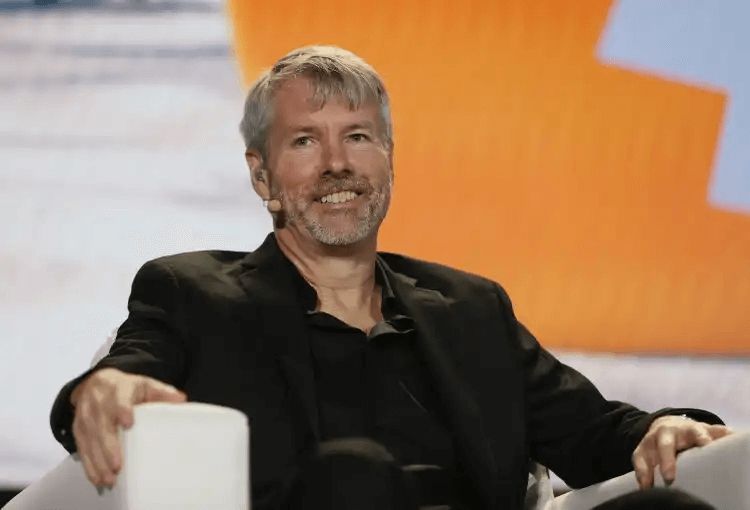

- Michael Saylor recently attended the White House Crypto Summit.

Strategy, formerly MicroStrategy, has announced plans to raise additional capital for general corporate operations, including the purchase of more Bitcoin (BTC).

In the announcement on Mar. 10, Strategy said it had plans to issue and sell shares of up to $21 billion in its at-the-market (ATM) program.

The offer will be for its 8.00% Series A Perpetual Preferred Stock (STRK), with proceeds expected to fund the company’s general corporate purposes. Most of this will go into more Bitcoin purchases as Strategy continues to accumulate BTC. Strategy will also utilize raised funds for working capital.

Strategy’s holdings just under 500k BTC

Michael Saylor’s artificial intelligence and business intelligence company – now the world’s largest corporate BTC company- first added BTC as a treasury asset in 2020. Since then, its been a prolific buyer of the benchmark digital asset.

With its last purchase in February 2025, Strategy pushed its haul to 499,096 BTC.

This is where it currently stands, with total holdings just below the landmark 500,000 bitcoin. So far, the company has spent $33.1 billion to buy Bitcoin. Per details, the company’s average purchase price was $66,357 per bitcoin.

News that Saylor was looking to buy more BTC slightly buoyed bulls during early trading on Mar. 10. Per market data, the top cryptocurrency’s price hovered around $83,252 at the time of writing.

While price was down 1.4% in the past 24 hours, the slight gains had seen BTC rebound from lows of $80,120. BTC nonetheless continues to struggle despite last week’s executive order on a Strategic Bitcoin Reserve and the first-ever White House crypto summit.