- Bitcoin fell to lows of $87,800 on Tuesday before bouncing to above $89,000.

- Losses for BTC came as gold hit new record high above $4,870.

- Galaxy Digital CEO Mike Novogratz says bulls need to take out bears around $100,000-$103,000.

Bitcoin dipped to around $87,800 on Tuesday, breaking lower as risk assets struggled.

However, amid waning investor confidence in the bellwether digital asset, gold has surged to new record highs.

Industry heavyweight Mike Novogratz says the flagship digital asset needs to reclaim the $100,000 mark to resume its uptrend.

Bitcoin price bounces off $87,800 low

Broader market uncertainty, including geopolitical tensions, has kept Bitcoin below the psychologically important $100,000 level.

In the latest session, the cryptocurrency slipped under $90,000, with data from CoinMarketCap showing intraday lows of $87,814 on major exchanges.

Bitcoin’s rally earlier this year was driven by strong institutional demand, but that momentum has eased in recent weeks.

In contrast, gold has climbed to fresh record highs above $4,870, reinforcing its role as a safe-haven asset amid heightened geopolitical risks and ongoing macroeconomic pressures.

Mike Novogratz, the outspoken CEO of Galaxy Digital Holdings, weighed in on Bitcoin’s current woes via a post on X.

Novogratz, a veteran Wall Street trader turned crypto evangelist, notes that Bitcoin could regain its upward momentum if bulls reclaim the $100,000-$103,000 level.

“The gold price is telling us we are losing reserve currency status at an accelerating rate. The long bond selling off is not a good sign either,” he posted on X. “BTC is disappointing as it is still being met with selling. I will reiterate it has to take out 100-103k to regain its upward trend. I think it will, in time.”

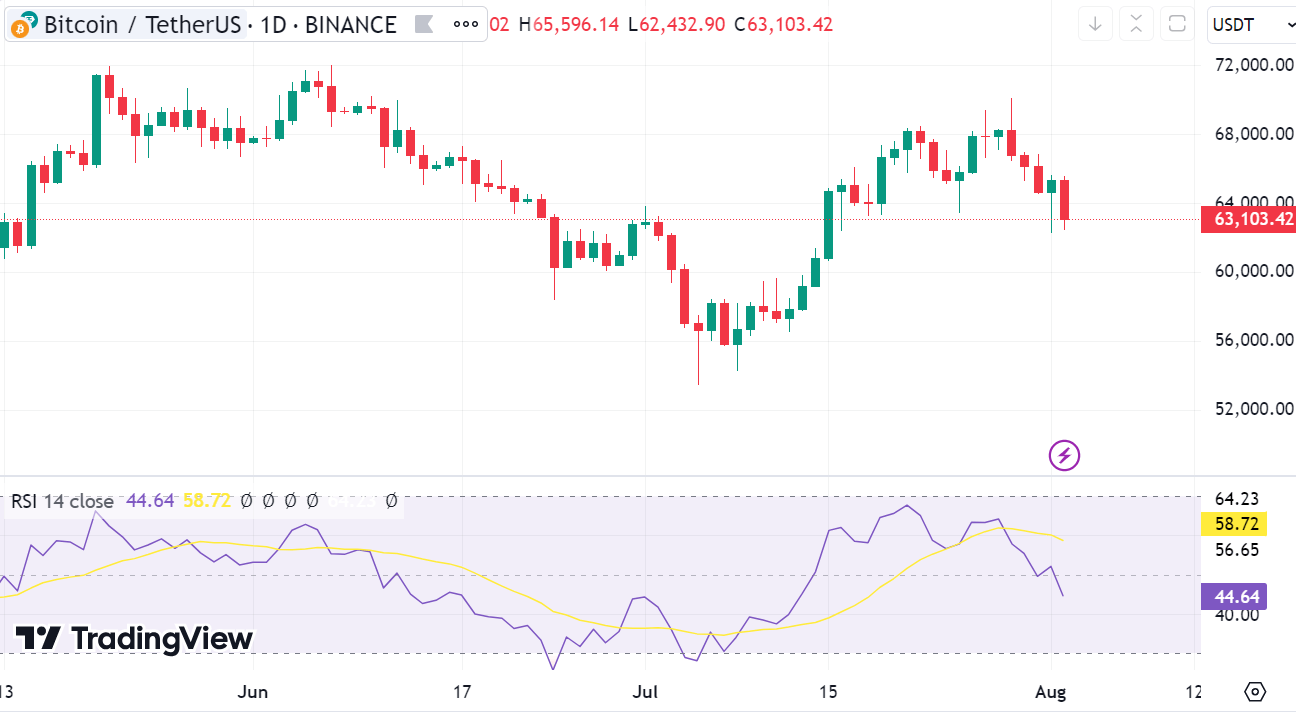

Bitcoin price technical outlook

From a technical perspective, the declines have pushed prices beneath the critical 61.8% Fibonacci retracement level calculated from its April low of $74,400 to October’s record peak of $126,198.

Bears have also breached the key support zone at the 50-day Exponential Moving Average (EMA) at $92,066 and a prior upper consolidation boundary near $90,000.

Other technical signals reinforcing the pessimistic outlook include the Relative Strength Index (RSI), which currently stands at 42.

Notably, the Moving Average Convergence Divergence (MACD) indicator has also flashed a bearish crossover, suggesting sellers are in control.

Volume profiles indicate thinning buying interest, which could exacerbate downside risks if headwinds persist.

A sustained close below $87,700 could accelerate the downturn toward the lower channel boundary at $85,450.

The demand reload zone aligns with the 78.6% Fibonacci retracement level.