- Michigan’s HB 4510 allows pension funds to invest in crypto ETFs.

- HB 4512 enables Bitcoin mining at abandoned oil or gas wells.

- HB 4513 offers income tax breaks to miners in remediation schemes.

State and federal lawmakers are charting a new course for cryptocurrency in the United States.

In Michigan, a legislative package of four crypto-focused bills is moving forward, combining pension fund exposure, environmental cleanups, and digital asset rights.

At the same time, lawmakers in Washington have reintroduced a bill to clarify the regulatory obligations of blockchain developers and non-custodial providers.

These coordinated efforts aim to balance innovation with accountability, as regulators seek to provide legal clarity without stifling decentralised finance.

The push reflects a growing political will to define crypto’s role within the broader financial and technological landscape.

Michigan bill allows crypto in pension funds

One of the most significant pieces of Michigan’s legislation is House Bill 4510, which would permit state-managed retirement systems to invest in cryptocurrencies through regulated financial products, such as exchange-traded funds (ETFs).

These investment vehicles must meet market capitalisation thresholds and be overseen by relevant financial authorities, offering a relatively conservative pathway for exposure to assets like Bitcoin.

The proposal comes amid rising institutional interest in crypto and growing demand for diversified, inflation-resistant portfolios.

If passed, the bill would position Michigan among a small group of US states, enabling public pension managers to hold crypto-linked assets under regulatory safeguards.

Mining linked to abandoned wells and tax breaks

In a bid to align crypto with environmental responsibility, Michigan’s HB 4512 and HB 4513 introduce an energy reuse programme targeting abandoned oil and gas wells.

Under the plan, Bitcoin miners would be allowed to power operations using these dormant energy sites, provided they remediate environmental damage.

Ownership transfers, well site assessments, and environmental progress tracking would be mandated under the bill, ensuring accountability.

In return, miners participating in the scheme would qualify for income tax deductions under HB 4513.

The measures are designed to attract miners with incentives while tackling legacy pollution problems.

The bills reference Bitcoin explicitly and focus on “orphan well programmes” as a potential win-win for the energy and crypto sectors.

State protection against CBDCs and digital discrimination

Another critical element of Michigan’s proposal is House Bill 4511.

This bill would prohibit state and local authorities from creating restrictions, licensing rules, or special taxes targeting digital assets solely based on their digital form.

It also bans any state agency from endorsing or promoting a central bank digital currency (CBDC), drawing a clear line between decentralised cryptocurrencies and government-backed digital money.

The legislation signals a strong defence of crypto users’ rights within Michigan, providing legal backing for miners, node operators, and token holders against targeted regulatory pressure.

If adopted, it could set a precedent for other states seeking to protect decentralised finance ecosystems.

Federal legislation aims to clarify developer rules

While Michigan pursues state-level crypto integration, Washington is moving ahead with national reform.

US Representatives Tom Emmer and Ritchie Torres recently reintroduced the Blockchain Regulatory Certainty Act, which seeks to establish clear boundaries on who qualifies as a “money transmitter” under federal law.

The Act would exempt developers and non-custodial service providers, such as those who build blockchain protocols or run interfaces that never hold user funds, from financial licensing requirements.

Only those who directly control consumer assets would be subject to oversight.

The lawmakers argue this clarification is needed to keep blockchain talent and startups within the US, rather than pushing them offshore.

“Today, @RepRitchie and I introduced the Blockchain Regulatory Certainty Act to protect blockchain developers and service providers that never custody consumer funds from unjust government prosecution,” Emmer posted on X on 3 May.

The bill aims to address regulatory uncertainty that critics say has slowed domestic blockchain innovation and led to uneven enforcement.

By drawing a regulatory line between developers and custodians, the bill hopes to ease legal pressures on creators and infrastructure providers.

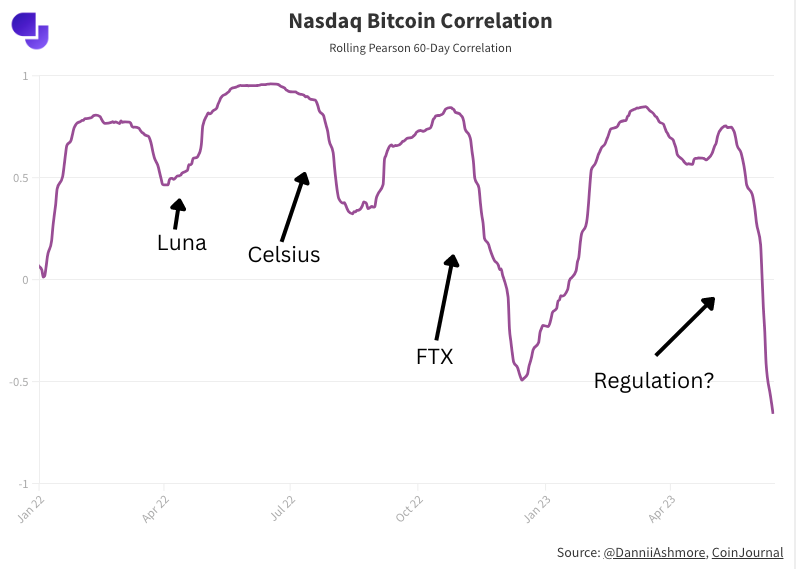

Indeed, what is different about November (FTX) and today is that we see a Bitcoin fall happening at the same time as a Nasdaq surge. While the Luna and Celsius incidents hurt crypto immensely, they came as stocks were also struggling and so the effect is not as dramatic in terms of correlation breaks (although is still tangible on the chart).

Indeed, what is different about November (FTX) and today is that we see a Bitcoin fall happening at the same time as a Nasdaq surge. While the Luna and Celsius incidents hurt crypto immensely, they came as stocks were also struggling and so the effect is not as dramatic in terms of correlation breaks (although is still tangible on the chart).