- Whale opened $295m ETH longs with up to 10x leverage.

- ETH ETFs attracted one year’s worth of inflows in six weeks.

- Institutional ETH reserves surged from $6bn to $17bn in a month.

An old Bitcoin (BTC) whale has moved millions into Ethereum (ETH), marking one of the largest visible portfolio shifts this quarter.

Blockchain data shows the whale deposited $76 million worth of BTC into Hyperliquid, sold it, and then opened leveraged long positions in ETH across multiple wallets.

This transition comes at a time when Ethereum is outperforming Bitcoin, both in returns and institutional inflows, a trend some are calling the start of an “Ethereum season.”

The move also coincides with surging ETH exchange-traded fund (ETF) inflows and growing treasury allocations to altcoins.

Whale repositions holdings into Ethereum

According to blockchain analytics firm Lookonchain, the whale originally acquired 14,837 BTC seven years ago from HTX and Binance at an average cost of $7,242 per coin.

That purchase, worth $107.5 million at the time, has since grown to more than $1.6 billion.

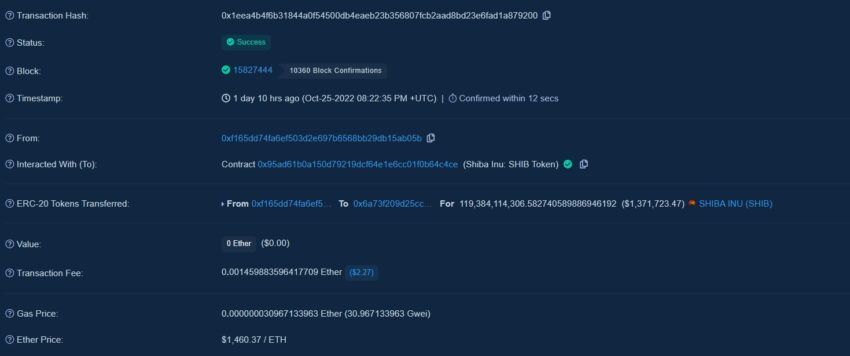

Recent transactions show the whale deposited 670.1 BTC, valued at $76 million, into the decentralised trading platform Hyperliquid.

Following the sale, they initiated long positions worth 68,130 ETH (around $295 million) across four wallets.

Most trades were executed with leverage of up to 10x, amplifying potential gains or losses.

Latest HypurrScan data revealed that all of the whale’s wallets are now facing unrealised losses totalling $1.8 million.

Despite that, the large-scale diversification highlights a clear shift towards ETH during a period when its performance is outpacing BTC.

Market data from Coinglass shows ETH has delivered a 71.91% return so far in the third quarter, compared to just 6.28% for BTC.

Ethereum’s gains have pushed analysts to identify the current period as “Ethereum season,” where capital is increasingly flowing into ETH instead of Bitcoin.

The momentum has been mirrored in market activity, with Ethereum consistently outpacing Bitcoin in daily returns since the start of the quarter.

Institutional shift fuels Ethereum demand

Institutional interest in Ethereum has risen sharply. Corporate purchases of Bitcoin for treasury reserves have declined, with just 2.8 companies per day adding BTC to their holdings. By contrast, Ethereum is seeing sustained inflows.

The Strategic ETH Reserve website reported that ETH holdings by institutional entities rose from $6 billion to $17 billion in the past month, representing an 183% increase.

This accumulation points to confidence in Ethereum’s market trajectory and its positioning in the broader crypto cycle.

The whale’s leveraged entry into ETH aligns with this wider trend, suggesting individual and institutional strategies are converging on Ethereum as the asset leading the altcoin phase of the cycle.

Ethereum season signals next altcoin cycle phase

Ethereum’s surge is widely viewed as part of the broader “altseason” cycle. In this framework, capital first flows into Bitcoin, then Ethereum, and eventually spreads across other altcoins before a peak.

With ETH already outperforming BTC in both Q2 and Q3, and institutional investment accelerating, analysts suggest the market may now be entering the second phase of the altcoin cycle.

The whale’s move to convert part of its BTC into ETH reflects this trend, with its $76 million bet highlighting how long-term holders are adapting to market shifts.