- First Trust files for Bitcoin Buffer ETF with SEC, aiming to mitigate risk via options.

- Buffer ETFs gaining momentum, 139 trading on US markets, $32.54B AUM.

- Buffer ETFs don’t guarantee complete protection, or assess risks.

Financial services firm First Trust has recently submitted a filing with the US Securities and Exchange Commission (SEC) to launch a groundbreaking investment product – the First Trust Bitcoin Buffer ETF.

Unlike traditional spot Bitcoin ETFs, this innovative fund aims to provide investors with a unique risk mitigation strategy, utilizing options to safeguard against potential market downturns. Let’s delve into the details of this latest development in the cryptocurrency investment space.

First Trust’s Bitcoin Buffer ETF filing

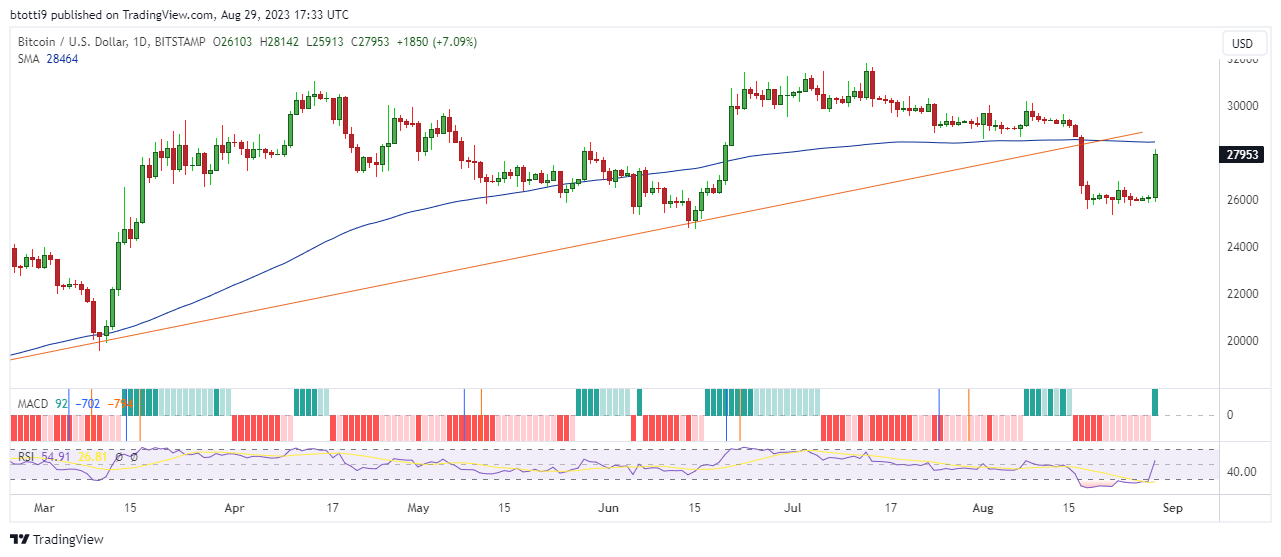

First Trust’s move to file for the Bitcoin Buffer ETF signals a shift in the cryptocurrency investment landscape. This ETF is distinct from spot Bitcoin offerings, as it utilizes options to pursue a defined investment outcome. Acting as a buffer, it imposes a limit on potential losses during market drops.

First Trust’s ETF is structured to participate in the positive price returns of the Grayscale Bitcoin Trust or other Bitcoin-related exchange-traded products (ETPs), providing investors with a unique approach to risk management.

Rise of Buffer ETFs in the market

Buffer ETFs have been gaining traction globally, with 139 such funds currently trading on U.S. markets, amassing a total asset under management of $32.54 billion.

BlackRock, a major player in the ETF space, introduced its iShares buffer ETFs earlier this year. These funds offer investors a specified level of downside protection while capping potential upside gains. Analysts anticipate more entrants in this space with diverse strategies, contributing to the growing trend of innovative investment products aimed at addressing market uncertainties.

While the concept of buffer ETFs provides a novel approach to risk management, investors must understand that these funds do not guarantee complete protection.

First Trust’s filing emphasizes potential risks, including the risk of losing some or all invested capital. Investors should carefully evaluate the suitability of buffer ETFs for their portfolios, recognizing that these products may not be suitable for everyone, and success in providing downside protection is not guaranteed.