- Bitcoin is on track to close September with a rare positive gain of 4.5 percent.

- Historically, a green September has preceded an average Q4 rally of over 50 percent.

- If the pattern holds, Bitcoin could be eyeing the 170,000 dollar region by year-end.

In a powerful and rare defiance of its own grim history, Bitcoin is on the verge of closing the books on a positive September.

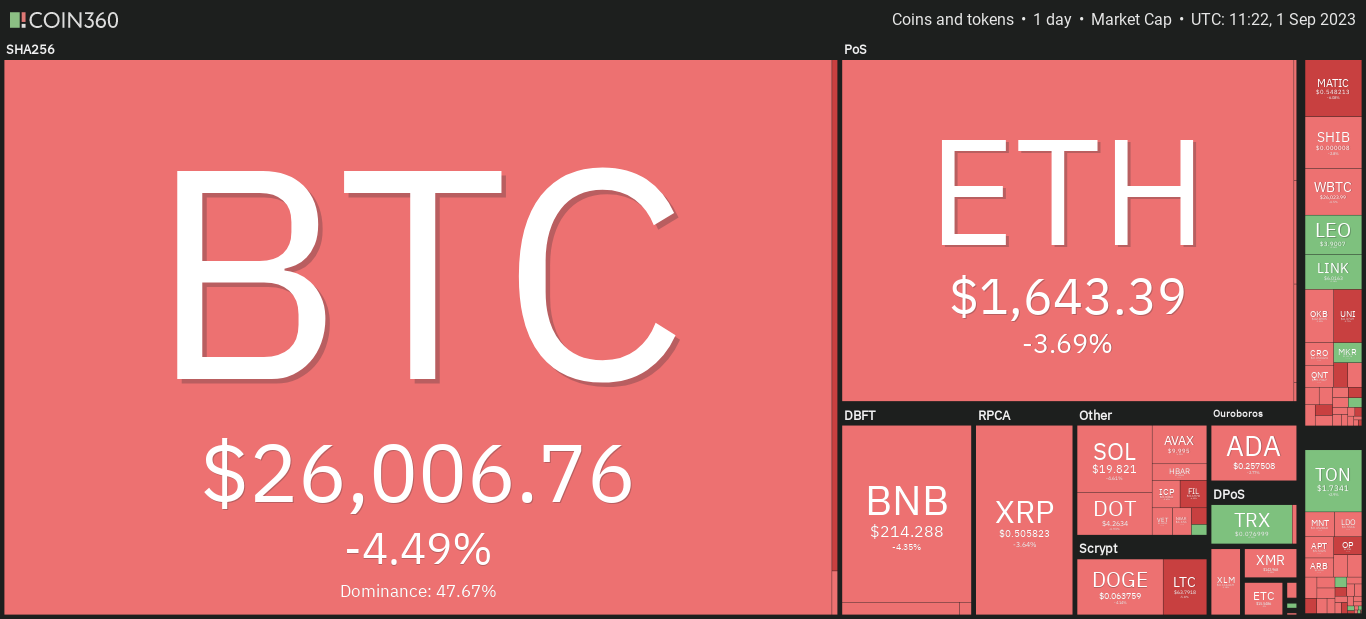

This is no small feat. The month has long been the cruelest on the crypto calendar, a consistent sea of red that has earned it the ominous nickname “Red September.”

But this year, a 4.5 percent gain has flipped the script, and in doing so, it may have just lit the fuse for an explosive rally into the final quarter of the year.

A prophecy written in the charts

History doesn’t repeat, but it often rhymes. And in the world of Bitcoin, the rhyme of a green September is a powerful and bullish prophecy.

According to historical data, on the rare occasions that Bitcoin has managed to close September in positive territory—in 2015, 2016, 2023, and 2024—the final quarter of the year has produced spectacular results, with average returns soaring to more than 53 percent.

In those instances, the fourth quarter returns have ranged from a powerful 45 percent to a stunning 66 percent.

If that historical pattern were to play out again this year, Bitcoin could be eyeing the 170,000 dollar region before the calendar flips to 2026.

The data shows that October typically acts as the launchpad for these powerful moves, with an average gain of 21.8 percent, while November continues the ascent.

This seasonal effect has been particularly profitable in the years following a Bitcoin halving, as a potent cocktail of capital inflows and bullish market positioning combine to push the asset into a fresh phase of price discovery.

The view from the blockchain: a bullish tide is turning

This bullish seasonal setup is not just a statistical anomaly; it is being actively confirmed by the deep undercurrents of the blockchain itself.

Key on-chain metrics are now flashing green, signaling a fundamental and powerful shift in market momentum.

The Spot Taker Cumulative Volume Delta (CVD), a crucial indicator that tracks the difference between market buy and market sell volumes, has flipped positive on a 90-day basis for the first time since mid-July.

This is a clear and direct signal that a “Taker Buy Dominant Phase” is underway, a period where buying pressure is now decisively outweighing selling activity.

At the same time, the Coinbase premium index has been highlighting consistent and aggressive accumulation by US investors throughout the third quarter.

The powerful alignment of these two key on-chain metrics reinforces the view that a new wave of buying momentum is not just coming—it’s already here.

The stage is set, the signals are aligning, and the final quarter of the year could once again prove to be a decisive and explosive one for the world’s leading digital asset.