- Total BTC treasury holdings have hit a record high of 840,000 BTC.

- However, the average purchase size has collapsed by a staggering 86 percent.

- This waning demand was the key driver of the Q2 Bitcoin rally.

They were the heroes of the last great rally, the talk of the town at the recent BTC Asia conference, their voracious appetite for Bitcoin single-handedly driving the market to new heights.

But a shadow has fallen over the world of the corporate Bitcoin treasury.

A new report reveals a worrying trend beneath the surface: while their total holdings are larger than ever, their conviction, measured by the size of their buys, has collapsed.

The great contradiction: more players, smaller bets

The on-chain data, laid bare in a new report from CryptoQuant, tells a tale of two conflicting truths.

On one hand, the aggregate Bitcoin treasury holdings have surged to a record 840,000 BTC, a war chest led by the titan Strategy, which holds 637,000 BTC. Transaction activity also remains near record levels, with 46 deals in August alone.

But on the other hand, the average size of these purchases has fallen off a cliff. Strategy bought just 1,200 BTC per transaction in August, while other firms averaged a mere 343 BTC.

Both of these figures are down a staggering 86 percent from their peaks in early 2025. In total, Strategy acquired only 3,700 BTC in August, a whisper compared to the 134,000 BTC it bought at its peak last year.

This is not the behavior of a market brimming with confidence; it is the sign of smaller, more hesitant buys, a clear signal of liquidity constraints or waning conviction.

The ghost of rallies past

This dramatic slowdown is a major concern for investors because it was the relentless engine of treasury accumulation that drove Bitcoin’s spectacular price growth in the second quarter.

As CoinDesk reported at the time, by late August 2025, institutions were absorbing more than 3,100 BTC a day against a mere 450 being mined.

This created a powerful 6-to-1 demand-supply imbalance that sent prices soaring.

Now, that engine is sputtering. This slouching demand raises the critical risk that the market’s current price strength may not be sustainable if the giants of the space continue to nibble cautiously rather than devour at scale.

A new hope? The rise of Asia’s treasury front

But as the Western giants grow hesitant, a new front in the treasury movement is opening in the East.

According to a Bitwise report, 28 new treasury companies were formed in July and August alone, collectively adding over 140,000 BTC to their coffers.

More significantly, Asia is emerging as the next major battleground. Taiwan-based Sora Ventures has launched a massive 1 billion dollar fund specifically to seed new regional treasury firms, with an initial commitment of 200 million dollars.

This new vehicle will pool institutional capital to support a fresh wave of entrants, a different model from the region’s current largest player, Metaplanet.

The stage is now set for a fascinating and pivotal confrontation.

The central question that will define the next phase of Bitcoin adoption—and its price—is whether this new, hungry wave of Asian treasuries can offset the shrinking appetite of the incumbents who first blazed the trail.

Market updates

BTC: Bitcoin remains resilient for now, trading in the 110,000–113,000 dollar range. The price is being supported by broad expectations of Federal Reserve rate cuts and continued, if smaller, institutional inflows via ETFs.

ETH: Ethereum is trading near the 4,300 dollar level. Its recent weakness, marked by a 3.8 percent weekly decline, is being attributed to ETF outflows and the historically subdued trading that characterizes “Red September.”

However, its longer-term outlook remains positive, buoyed by deep institutional interest and growing staking activity.

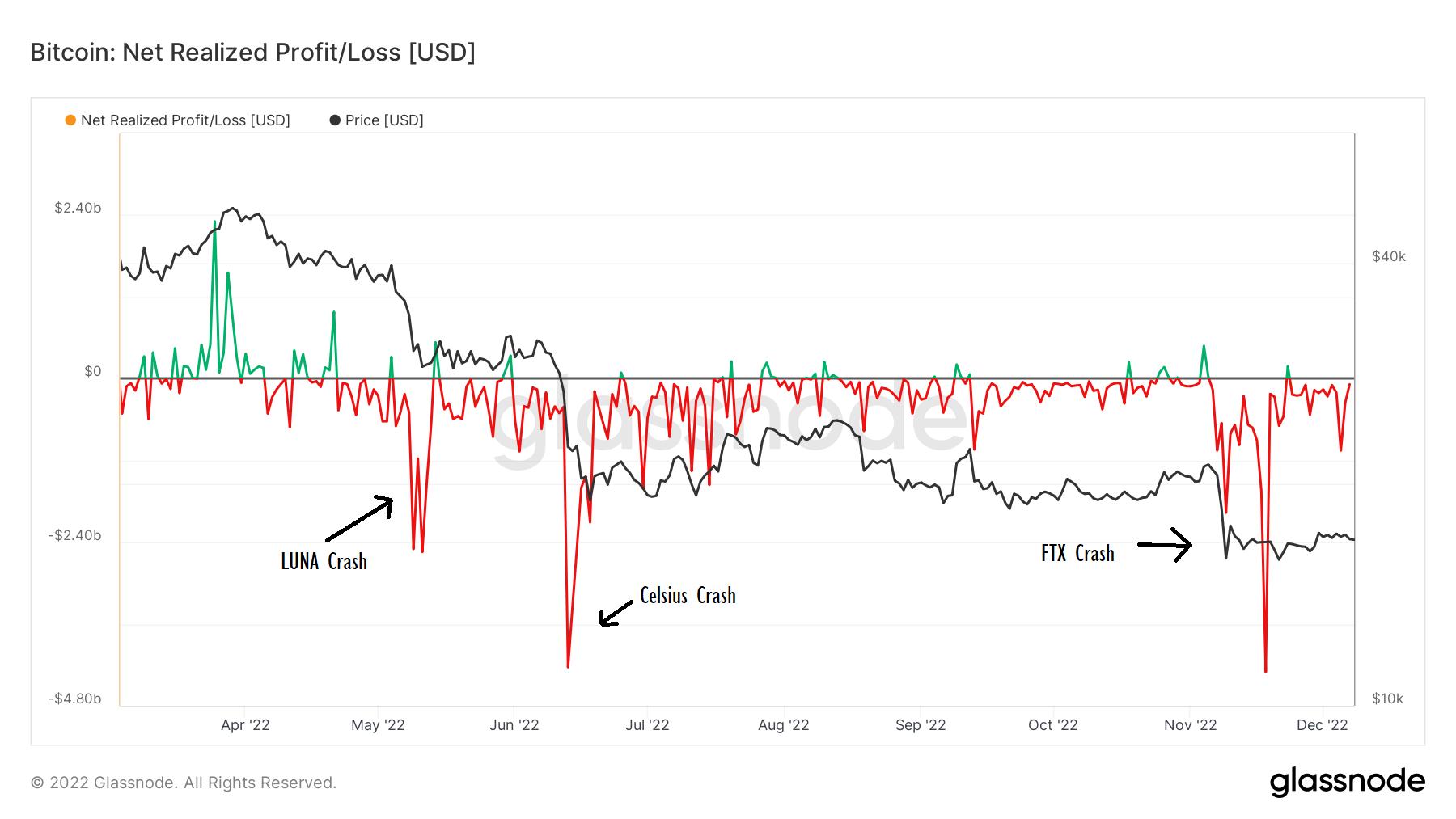

FTX was a central part of the ecosystem, and its bankruptcy understandably rocked the market. As I wrote recently, this contagion

FTX was a central part of the ecosystem, and its bankruptcy understandably rocked the market. As I wrote recently, this contagion