- Linea token LINEA has jumped by over 14% to reach highs of $0.029 amid major SWIFT news.

- Reports say SWIFT and bank partners including PNB Paribas and BNY are set to test blockchain messaging system.

- SWIFT has selected Linea for the pilot.

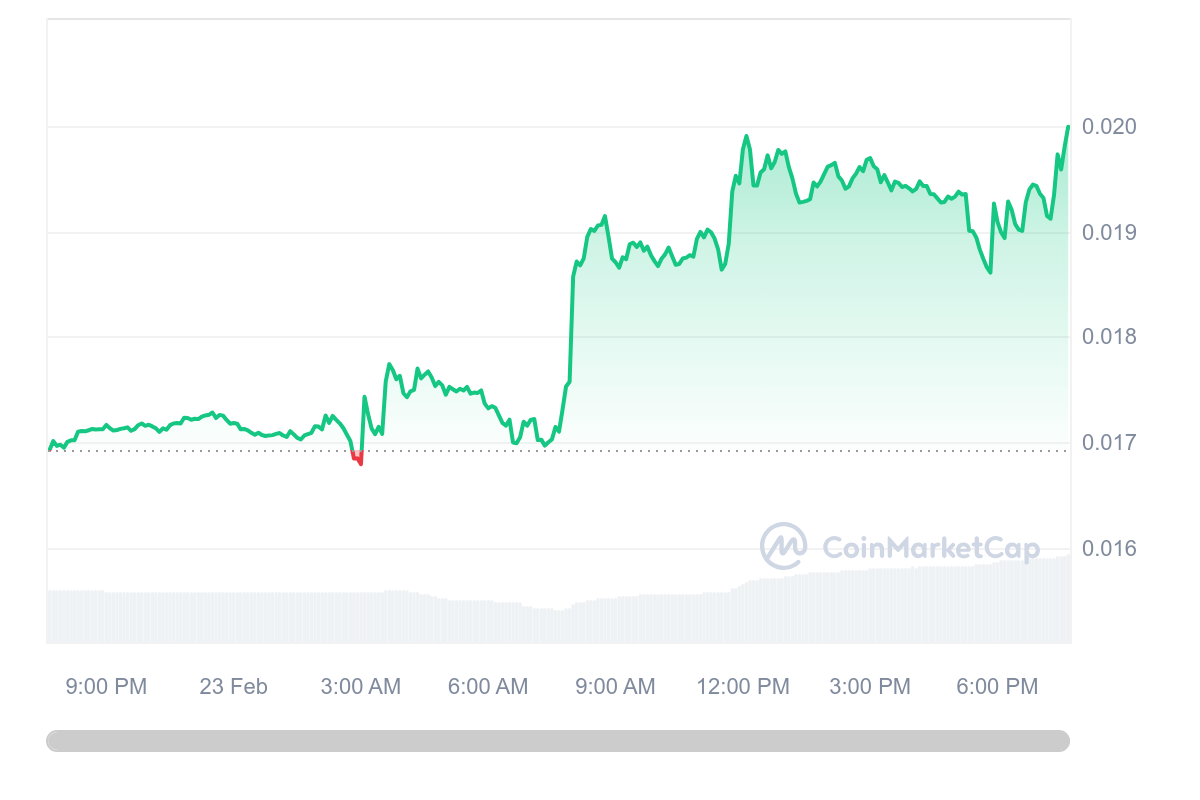

LINEA, the native token of the Ethereum Layer 2 network Linea, has surged by 14% in the past 24 hours, with a sharp spike coming on the back of a major SWIFT announcement.

The token reached intraday highs of $0.029 as news emerged that the interbank messaging platform has selected Linea for testing its system on the blockchain. Gains saw LINEA outpace many altcoins that struggled amid broader crypto price turmoil.

SWIFT to test messaging system on Linea blockchain

SWIFT, the Society for Worldwide Interbank Financial Telecommunication, which facilitates secure messaging for over 11,000 financial institutions across more than 200 countries, is embarking on a transformative experiment.

According to exclusive insights from The Big Whale, SWIFT has partnered with Consensys-developed Linea, an Ethereum Layer 2 solution, to explore migrating its core messaging system onto the blockchain.

Gregory Raymond, co-founder of The Big Whale, shared the news on X.

🟥 Exclusive @TheBigWhale_

SWIFT chooses Linea for blockchain testing

According to information gathered with @BukovskiBuko3, SWIFT and several major global banks (including BNP Paribas and BNY) have chosen @LineaBuild, the Ethereum layer 2 developed by @Consensys, to experiment… pic.twitter.com/EaWLg1IfKp

— Grégory Raymond 🐳 (@gregory_raymond) September 26, 2025

The collaboration will also involve global banking giants, with over 10 banks including BNP Paribas and BNY.

SWIFT is also set to team up with over a dozen institutions on the project, said The Big Whale, with many of these already engaged in the initiative’s proof-of-concept phase.

According to a well-placed source, the project, though still in development, could herald a significant technological overhaul of the international interbank payments industry.

Why the layer 2 blockchain Linea?

Linea’s appeal lies in its emphasis on privacy, enabled by advanced cryptographic proofs.

The banks see this as aligning with the regulatory and security demands of the banking sector.

Linea offers an enterprise-grade infrastructure platform for global finance.

Per details on its website, the network already supports financial institutions like Mastercard, Visa and JP Morgan.

The Consensys-backed platform is designed for blockchain solutions, including tokenization, trading, payments, and onchain settlement.

It allows for integration with decentralized finance protocols, custodians, and real-world asset tokenization platforms.

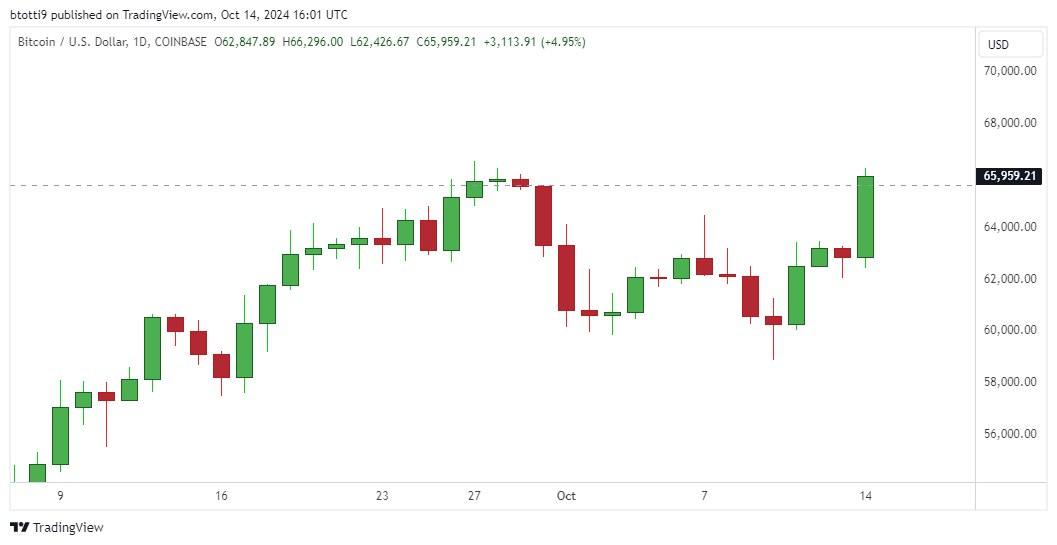

LINEA price spikes amid news

SWIFT’s plans and The Big Whale’s report on the development triggered a notable market reaction from the LINEA community.

As the token soared over 14%, the price increase was accompanied with a 6% increase in daily trading volume to $353 million.

The gains saw Linea join the likes of Subsquid, Solv Protocol and Lombard in outpacing the top coins.

Linea price reached its all-time high of $0.04657 on September 10, 2025.

The uptick could, therefore, see bulls attempt to retest this level.

Holders and stakeholders will closely monitor the progress of SWIFT’s pilot as it unfolds.