- Stacks (STX) drops 2.5% as Bithumb announces temporary halting of transactions.

- Network upgrades aim to boost Stacks’ security and features.

- The suspension of transactions is scheduled to begin on July 29.

Stacks (STX) token has seen its price drop by 11.4% in a week, even as the Bitcoin (BTC) price remains largely bullish.

The decline comes at a time when excitement is building around Bitcoin-based DeFi and key network upgrades are underway.

However, a major development from South Korean exchange Bithumb appears to have influenced investor sentiment, triggering notable short-term pressure on the STX token.

Price pressure hits Stacks (STX) despite DeFi momentum

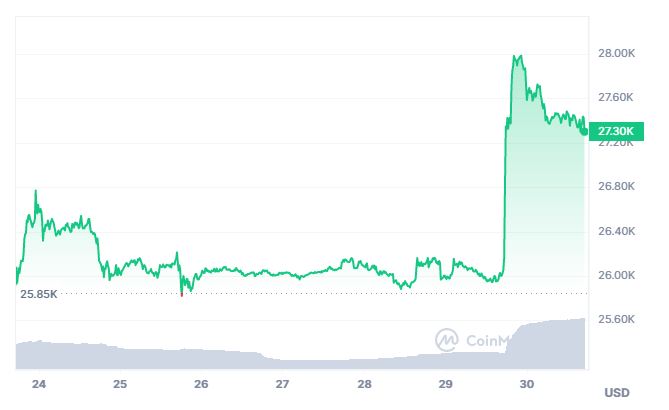

STX is currently trading at $0.7786, marking a drop of 2.5% today and a sharp 11.4% decline over the past seven days.

This drop comes even as Bitcoin, the asset it is built to complement, maintains a largely positive trend.

The downward move has raised eyebrows among market watchers, especially given the recent momentum around the Stacks DeFi ecosystem.

But despite the drop, STX has still gained more than 15% over the last month, driven in part by the ongoing “STX DeFi SZN” campaign — a collaborative launch among leading Bitcoin DeFi protocols.

Through a partnership with Zealy.io, the campaign is offering 50,000 STX in rewards for users completing on-chain quests.

While the broader DeFi push is designed to strengthen the ecosystem, it hasn’t been enough to offset short-term fears triggered by external factors.

Bithumb’s temporary suspension fuels uncertainty

One of the main catalysts behind STX’s recent price dip is the news of Bithumb’s announcement of a temporary suspension of STX deposits and withdrawals.

Scheduled to begin at 03:00 UTC on July 29, according to a report by Bitcoin World, the suspension is aimed at supporting a significant upgrade of the Stacks network.

For many traders, however, the move has sparked concern.

Even though such suspensions are standard during blockchain upgrades, the market often reacts with caution.

Investors worry about temporary inaccessibility and possible disruptions in trading activity.

As a result, some may have opted to sell early to avoid complications, contributing to the current price decline.

Stacks upgrades bring long-term promise

The Stacks Network upgrades themselves are crucial milestones for the network.

Stacks is a Bitcoin Layer 1 blockchain that enables smart contracts and decentralised apps (dApps) to run using Bitcoin as the settlement layer.

It brings programmability to Bitcoin without changing Bitcoin itself.

Transactions on Stacks are automatically hashed and secured by Bitcoin’s hashpower through a mechanism known as Proof of Transfer (PoX).

This approach makes Stacks one of the most secure smart contract layers available today.

The upcoming upgrade is expected to enhance this security while improving performance and enabling new features for developers and users alike.

Moreover, STX plays a central role in this ecosystem. It is used for transaction fees, governance decisions, and stacking, where users can earn Bitcoin by locking their tokens.

As the Stacks network upgrades progress, STX may gain greater utility and adoption, potentially reversing the current downtrend over time.