- Regulatory reforms in Japan boost JasmyCoin’s bullish sentiment.

- Bitcoin Dogs introduces unique gaming and social experience in the canine crypto world.

- Bitcoin Dogs’ 0DOG token presale is underway with limited supply.

JasmyCoin (JASMY) and Bitcoin Dogs have recently made headlines with their remarkable performances.

JasmyCoin, Japan’s leading cryptocurrency project, has witnessed an impressive surge in value, while Bitcoin Dogs, a new innovative platform on the Bitcoin blockchain, is grabbing attention with its unique features and the ongoing 0DOG token presale.

Let’s delve into the details of these crypto phenomena and explore whether they present enticing investment opportunities.

JasmyCoin’s meteoric rise: a tale of bulls and whales

JasmyCoin’s recent price rally has left the crypto community buzzing. Over the past week, JASMY has experienced a staggering 199% surge, reaching $0.01863, marking a remarkable 265% growth in the last month.

JasmyCoin price chart

JasmyCoin price chart

This surge is not just a short-lived hype; it’s a result of strategic moves by influential stakeholders, colloquially known as “whales.”

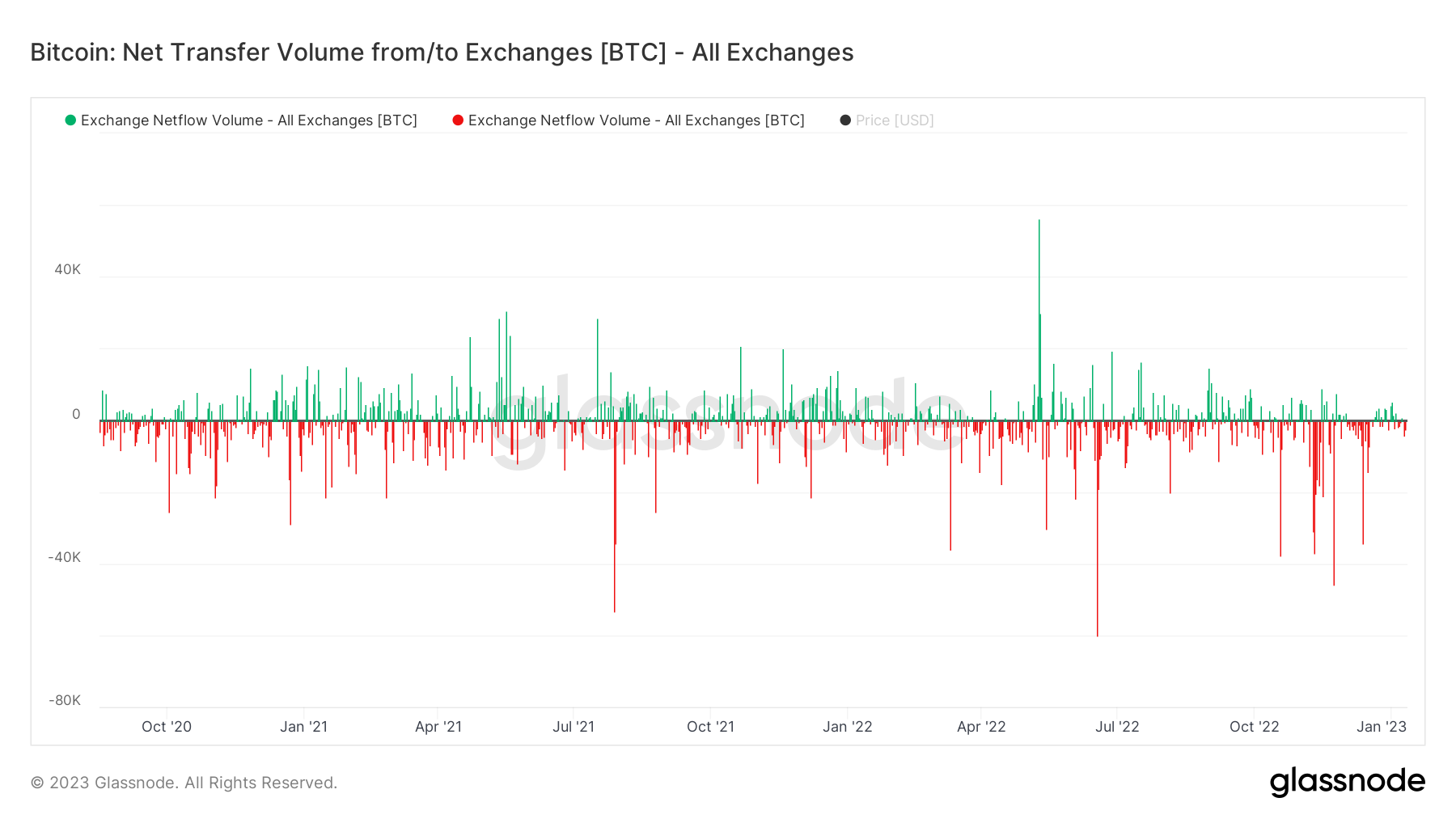

These whales, who have been accumulating JASMY since October 2021, have been withdrawing significant amounts of JASMY coins from exchanges with a majority of it seemingly flowing into Binance.

$jasmy exchange balance, look 👀 who’s been accumulating during this whole move down and recovery… @binance now holds almost 20% of the entire $jasmy circulating supply (just under 9bil tokens). Big moves are coming 🚀🚀🚀🚀 #JASMY #jasmycoin #JASMYCHAIN pic.twitter.com/6OmyOLErN0

— Scott (@cozacs) February 19, 2024

These moves not only triggered market sentiment but also demonstrated a continued interest in JASMY despite market fluctuations.

The bullish sentiment surrounding JasmyCoin is further fueled by Japan’s regulatory reforms, notably the approval of venture capital investments in crypto projects. As Japan takes steps to make direct investments in cryptocurrency projects more accessible, JasmyCoin stands to benefit, solidifying its position as the country’s largest crypto project.

Bitcoin Dogs: innovation in the canine crypto world

While JasmyCoin dominates the Japanese crypto scene, Bitcoin Dogs is making waves on the global stage with its groundbreaking approach. Billing itself as the “First Ever ICO on the Bitcoin Blockchain,” Bitcoin Dogs is not just a cryptocurrency; it’s a playful universe where dog lovers and crypto enthusiasts converge to trade, collect, and have a good barking time.

Bitcoin Dogs introduces a unique gaming and social experience in its immersive Dogaverse metaverse where users can feed their virtual dogs, engage in social interactions with ripple effects, and challenge others to PvP Duel Races, enhancing the overall play-to-earn dynamics. There is also the 10k Ordinals NFT Club that caters to both casual admirers and devoted enthusiasts, offering a variety of collectibles to parade, collect, and trade.

The roadmap for Bitcoin Dogs unveils exciting milestones, from the Grand Opening and BRC-20 claims to the launch of the metaverse and strategic partnerships in the coming quarters. Its native token, 0DOG, is currently in its presale stage, with a limited supply of 900 million tokens.

At press time, the presale had raised over $3.450 million in just seven days. The 0DOG token is going for $0.0198 in the current presale stage though it is expected to rise to $0.0224 in the next presale stage, which is just a day away. To take part in the presale, visit the Bitcoin Dogs website and purchase your 0DOG tokens.

Are JasmyCoin and Bitcoin Dogs good investments?

As the crypto landscape continues to evolve, the question arises – is it a good time to invest in Bitcoin Dogs and JasyCoin?

Well, JasmyCoin’s surge aligns with both market dynamics and regulatory changes in Japan. The positive sentiment is evident, fueled by increased trading volume and a growing market capitalization. Investors eyeing JasmyCoin may find the current market conditions conducive to potential returns.

On the other hand, Bitcoin Dogs’ innovative approach, coupled with the growing interest in play-to-earn gaming and NFTs, positions it favourably. However, potential investors should carefully evaluate the project’s whitepaper, understand the risks associated with the ICO, and consider the overall viability of the gaming and social features.