- Bitcoin (BTC) trades near $110K (at $109.7K), challenging recent “summer stagnation” predictions after a 3.26% weekend surge.

- QCP Capital noted BTC was “stuck in a tight range,” with signs of fatigue like softening open interest and tapering ETF inflows.

- Bitcoin’s breakout coincides with US-China trade talks and a $22B US Treasury bond auction, injecting market uncertainty.

Bitcoin (BTC) is currently trading just shy of the $110,000 mark, changing hands at around $109,700 as the Asian trading week continues.

This upward momentum challenges a prevailing market narrative that had anticipated a period of summer stagnation, and it comes even as analysts point to underlying signs of market fatigue.

Meanwhile, developments in the Ethereum ecosystem suggest a significant shift towards institutional adoption, particularly in staking.

Bitcoin’s surprise move: breaking out of the “tight range”

The recent price action for Bitcoin has caught some market watchers by surprise. Over the weekend, the leading cryptocurrency surged 3.26%, climbing from $105,393 to $108,801.

This move was accompanied by a significant spike in hourly volume, reaching 2.5 times the 24-hour average, according to CoinDesk Research’s technical analysis model.

Bitcoin decisively broke above the $106,500 level, establishing new support at $107,600, and continued its ascent into Monday’s session, briefly touching $110,169.

This rally comes on the heels of a recent note from QCP Capital which had emphasized suppressed volatility and a lack of immediate catalysts for a major price move.

QCP’s Telegram note had pointed to one-year lows in implied volatility and a pattern of subdued price action, stating that BTC had been “stuck in a tight range” as summer approached.

They suggested that a clean break below $100,000 or above $110,000 would be necessary to “reawaken broader market interest.”

Even with this breakout, QCP had warned that recent macroeconomic developments had failed to spark strong directional conviction.

“Even as US equities rallied and gold sold off in the wake of Friday’s stronger-than-expected jobs report, BTC remained conspicuously unmoved, caught in the cross-currents without a clear macro anchor,” the note stated.

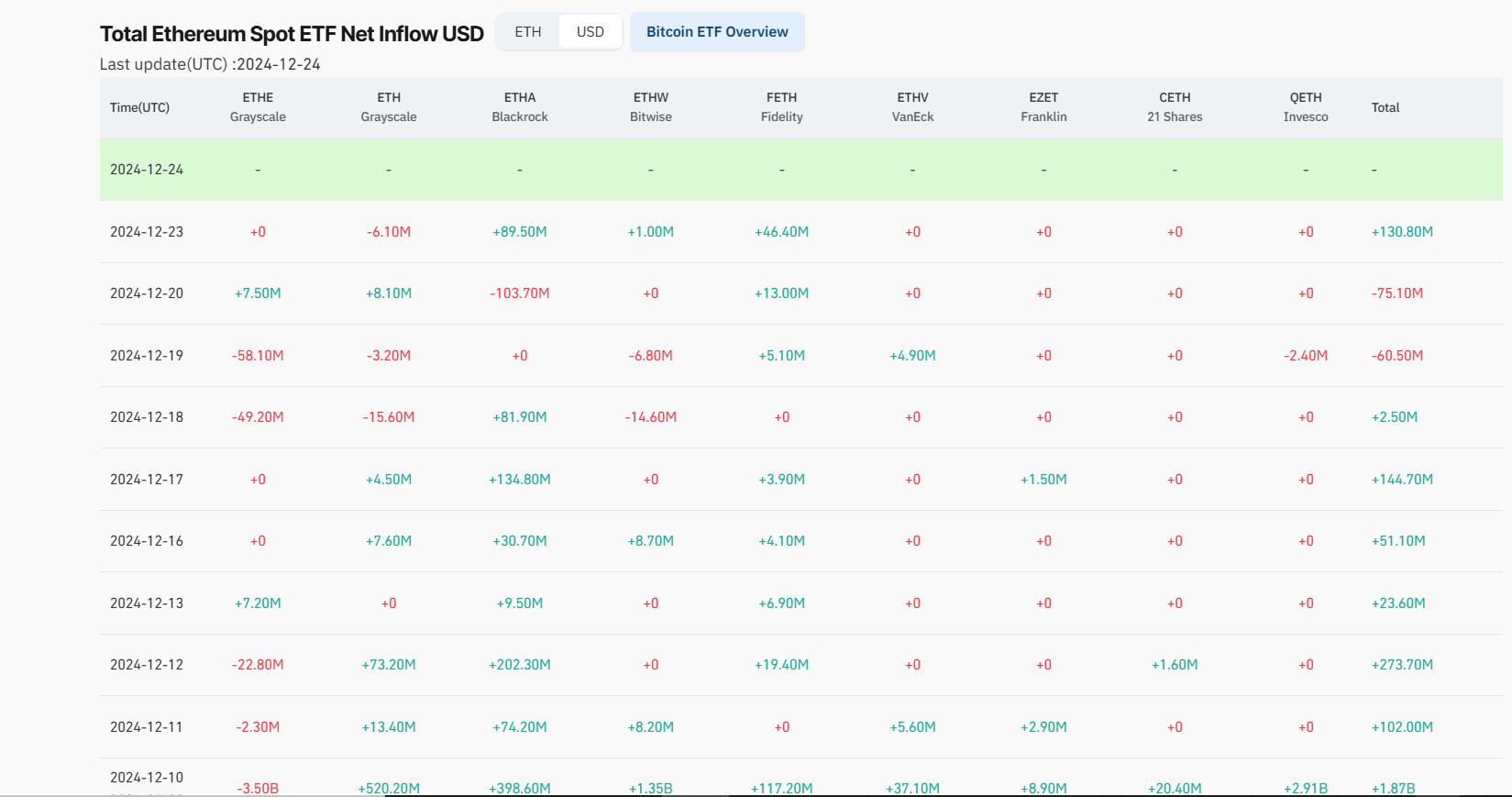

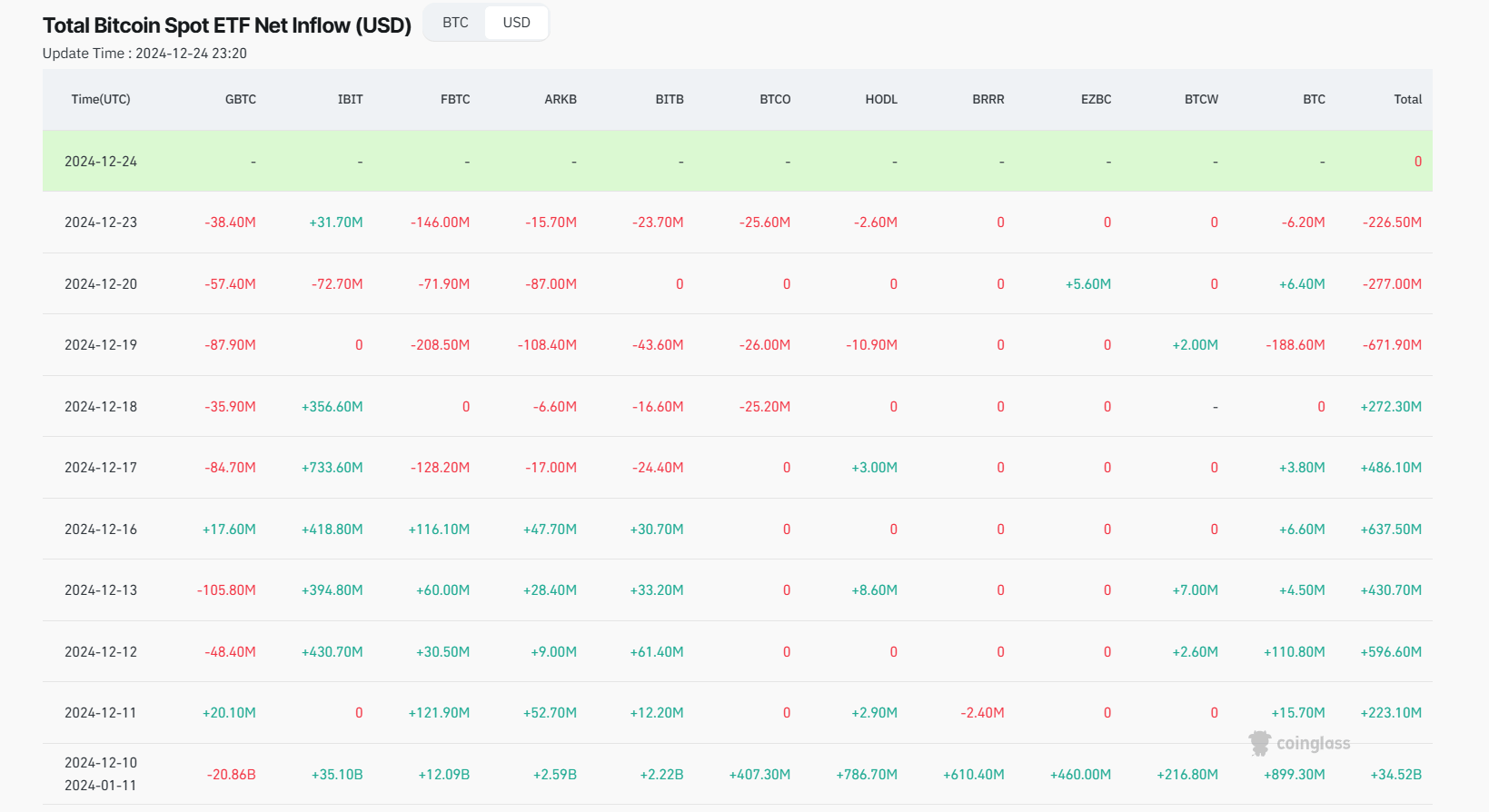

“Without a compelling narrative to spark the next leg higher, signs of fatigue are emerging. Perpetual open interest is softening, and spot BTC ETF inflows have started to taper.”

This context makes Bitcoin’s current push towards $110,000 all the more noteworthy.

The breakout also coincides with a tense macroeconomic backdrop, including ongoing US-China trade talks in London and a significant $22 billion US Treasury bond auction later this week, both of which have injected uncertainty into global markets.

While these events could drive fresh volatility, QCP cautioned that recent headlines have mostly led to “knee-jerk reactions” that quickly fade.

The pressing question now is whether Bitcoin’s move above $110,000 has genuine staying power or if the rally is running ahead of its underlying fundamentals.

Ethereum’s institutional awakening: staking takes center stage

While Bitcoin navigates its price dynamics, Ethereum (ETH) is experiencing a potentially transformative shift, with signs pointing towards accelerating institutional adoption, particularly in the realm of staking.

Critics of Ethereum have often highlighted centralization risks within its ecosystem, but this narrative is reportedly fading as institutional infrastructure matures and recent protocol upgrades directly address past limitations.

“Market participants will pay for decentralization because it’s in their economic interest from a security and principal protection standpoint,” Mara Schmiedt, CEO of institutional Ethereum staking platform Alluvial, told CoinDesk.

“If you look at [decentralization metrics] all of these things have massively improved over the last couple of years.”

Alluvial co-founded Liquid Collective, a protocol designed to facilitate institutional staking, which currently has $492 million worth of ETH staked.

While this figure may seem modest compared to Ethereum’s total staked volume of around $93 billion, its significance lies in the fact that it originates predominantly from institutional investors.

“We’re really on the cusp of a truly massive shift for Ethereum, driven by regulatory momentum and the ability to unlock the advantages of secure staking,” Schmiedt noted, highlighting a pivotal moment for the second-largest cryptocurrency.

Central to Ethereum’s increasing institutional readiness is the recent Pectra upgrade, a development Schmiedt described as both “massive” and “underappreciated.”

“I think Pectra has been a massive upgrade. I actually think it’s been underappreciated, just in terms of the tremendous amount of change it introduces into the staking mechanics,” Schmiedt said.

A key component of Pectra, Execution Layer (EL) triggerable withdrawals, provides a crucial compatibility upgrade for institutional participants, including Exchange Traded Fund (ETF) issuers.

This feature enables partial validator exits directly from Ethereum’s execution layer, aligning with institutional operational requirements such as T+1 redemption timelines.

“EL triggerable withdrawals create a much more effective path to exit for large-scale market participants,” Schmiedt added.

Ultimately, she expressed strong confidence in Ethereum’s institutional appeal, stating, “I think we’ll see that a lot more [ETH] in institutional portfolios going forward.”

Share this article

Categories

Tags