Key Takeaways

- Bitcoin is back in the 20s, Ethereum has crossed $1,500 and altcoins are powering north in what is the biggest crypto rally in 9 month

- Optimism that Federal Reserve will pivot off high interest policy sooner than expected, following cooler inflation data

- Next big day for crypto markets is February 1st, when the Fed will decide on the latest interest rate policy

- Solana is up 130% since the start of the year, leading the altcoins

- Even memes are rising, with Dogecoin and Shiba Inu again making moves

- Some analysts fear the market is premature in pricing in an earlier-than-expected Fed pivot

Crypto markets are dishing out a heavy dose of nostalgia to start the year, off to their strongest rally in 9 months.

Bitcoin is trading close to $21,000, Ethereum is at $1,500 and altcoins are powering aggressively upward, too.

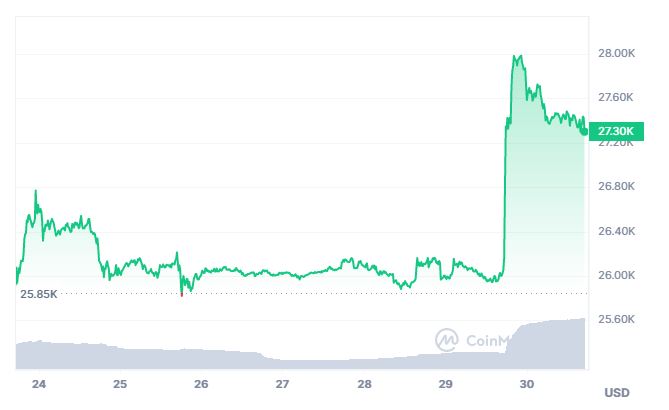

I took a snapshot of the market on this day last week, when markets had bounced to start the new year. One week later, the direction is the same – but the rally has been taken up a notch. The below chart presents crypto price returns to start the year, a sea of upward moves:

What is causing prices to rise?

Over the past year, inflation has perhaps replaced pandemic as the dirtiest word in our vocabularies. But it is for good reason, with the globe gripped by an inflation crisis the likes of which we haven’t seen since the 1970s.

But in the last few weeks, just a little bit of optimism that inflation has peaked has seeped into the market. This has led to investors betting that the Federal Reserve will peel away from interest rate rises sooner than previously expected. And the markets are doing something that most people forgot they could – they’ve gone up.

The market in general has risen. The S&P 500 is up close to 5%. Crypto prices can throw up a 5% candle in a matter of minutes, but the stock market is obviously less volatile, and 5% amounts to a strong move – there were only four occasions throughout what was a very volatile 2022 when the market rose by this much in a week.

Interest rates hold the key for the crypto markets. Altcoins trade like levered bets on Bitcoin, and Bitcoin has been trading like a levered bet on the S&P 500 over the last year or so. Ever since interest rates began to be hiked in April 2022, the Bitcoin price has been freefalling.

While there have been wobbles drawn from the crypto market itself (the LUNA death spiral, Celsius crash and staggering FTX debacle spring to mind), the key variable is undoubtedly tight monetary policy suppressing the value of all risk assets. Bitcoin will not be allowed to rise until the Fed pivots, and this past week has seen investors move towards a stance that expects that pivot earlier than previously.

Will it continue?

The next key date is February 1st, when the Federal Reserve will meet to decide the latest interest rate policy. These FOMC meetings, alongside the monthly CPI report, have been the key drivers in markets over the last year.

I wrote five days ago about how we would get volatility to end the week as we ran into the CPI report. That report came in as anticipated, but reflected another month of falling inflation, which as described earlier propelled markets upward.

Nonetheless, the surge in prices is somewhat surprising when considering the words that have thus far come out of Fed chairman Jerome Powell’s mouth. He has been adamant that a pivot is not coming and has even taken swipes at the market’s perceived premature assumption that monetary policy will be loosened again.

Indeed, there had been plenty of false starts in the market over the last year, with investors repeatedly betting that the Fed was bluffing over the extent and speed that interest rate hikes would be implemented. This is part of the reason that the subsequent move downward has been so fierce.

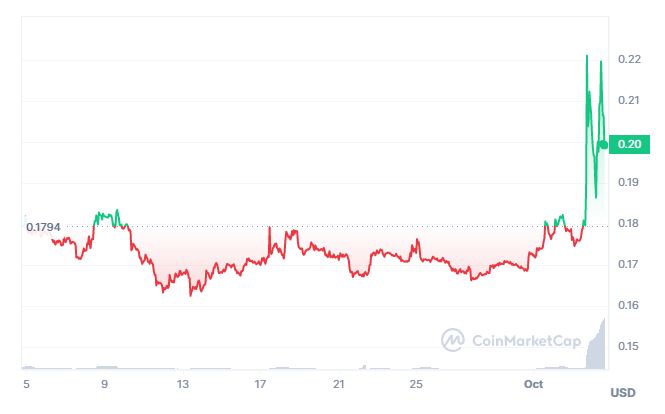

In truth, the below chart paints the picture better than a thousand words:

Altcoins making greater moves

As we have seen repeatedly throughout crypto history, the higher-beta altcoins are printing gains significantly higher than Bitcoin. Of course, this comes from a lower base – the downside of higher beta is that when times are tough, the pain is that much more severe, and altcoins have certainly experienced that throughout this crypto winter.

The gains have been led by Solana, the Layer 1 that has had a tumultuous year even by crypto standards. I wrote a deep dive on it two weeks ago, but the coin had plummeted from at one point holding the third spot behind Ethereum and Bitcoin to barely hanging on inside the top 20.

A combination of repeated outages, top projects leaving for rival blockchains and a close connection with the disgraced Sam Bankman-Fried all contributed to Solana shaving 97% from its all-time high of $260, trading towards the end of 2022 at $7.70.

But in typical crypto standards, a flip of sentiment led by the outright inexplicable meme coin BONK has helped to boost the coin, which is now trading at $23.40, having more than doubled in the last two weeks.

Meme coins have been enjoying the gains across the board. This would normally be the part where I’d try input some analysis about why, but we know by now that there is no real pattern to the meme coin madness, so instead I will simply list the returns. Shiba Inu is up 29%, while the Daddy of them all, Dogecoin, has added 20% and is now trading at a market cap of $11.2 billion.

What happens next?

For now, investors are enjoying the gains, having simply tried to survive throughout 2022. But in looking at the market, while prices have soared, volatility remains low and volumes are still way off what they were during the pandemic.

The market has been uncharacteristically serene since the FTX implosion, and this is the first real move of any significance. While optimism is obvious, investors remain somewhat cautious and prices are still extremely suppressed from this time last year.

A 75% fall followed by a 20% rally still amounts to a 70% fall. So while the green candles are pretty this morning for traders – and long overdue – the scale of the damage to crypto here is still severe. Institutional adoption has likely been dented harshly by the myriad scandals, there is still the potential for more dominoes to fall in the FTX web of contagion, and macro/inflation remains highly uncertain.

The last two weeks amount to some much-needed positive news not only for crypto, but for the economy as a whole. Investors are celebrating that with surging charts, but these are still uncertain times with many twists and turns ahead.

Share this article

Categories

Tags