- Story (IP) token price surged 15% to above $3, driven by Bitcoin’s recovery and whale accumulation.

- Two major whales acquired 16 million IP tokens worth $47.52 million, indicating strong investor interest.

- Analysts predict IP could retest the $4-$5 supply wall.

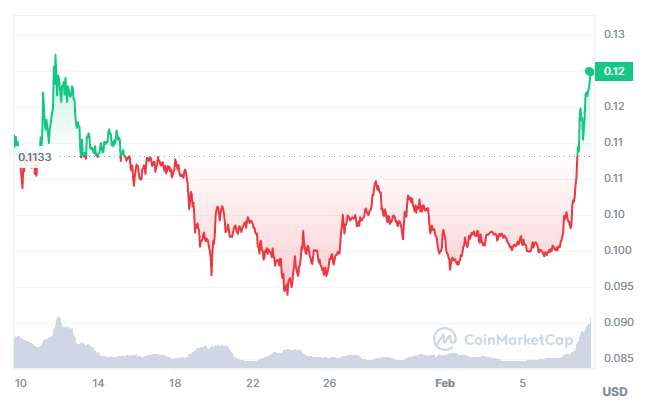

Story (IP) is trading above $3 after surging 15% in 24 hours amid notable market turmoil.

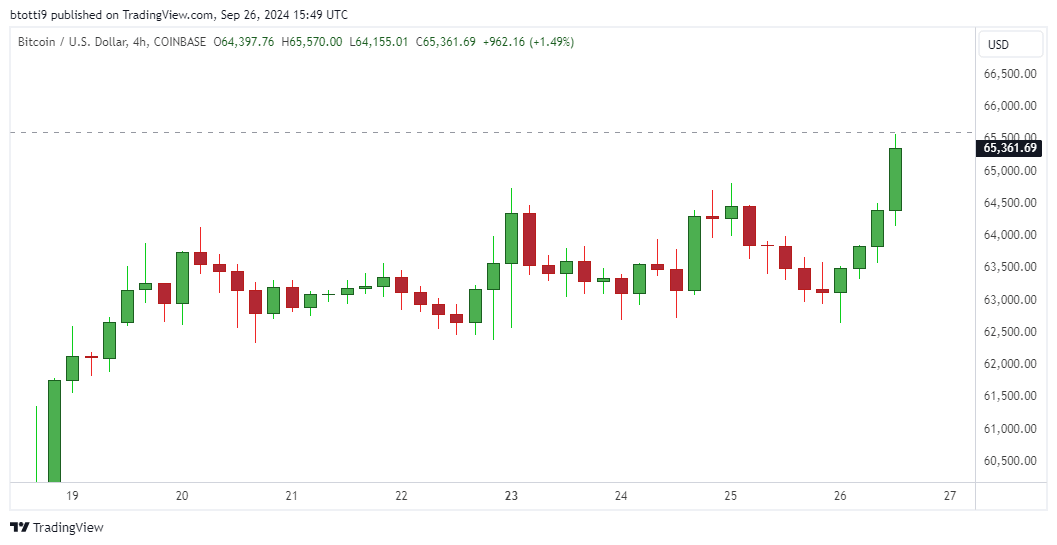

This IP price surge comes in the wake of Bitcoin’s recovery from its recent lows of $98,500, which happened amid rising geopolitical tensions.

But with BTC back above $101k, market sentiment sees Story protocol token IP up.

Commenting on the current market outlook, crypto analyst IncomeSharks said:

Want to know why so many are bearish? It’s in the charts. We saw institutions, hedgefunds, and retail all start selling or shorting the local bottom. Then we had a violent V shape recovery which has squeezed or sidelined most. The FUD has started with moodys, tariffs, war, etc.

Whales buy Story (IP) dip

Recent data from blockchain analytics firm Lookonchain highlights a substantial accumulation of Story (IP) tokens by two major whale addresses.

Whale 0x9921 has amassed 6 million IP tokens, valued at approximately $17.82 million, while whale 0x9057 has acquired 10 million tokens, totaling $29.7 million.

Together, these transactions represent a collective purchase of 16 million IP tokens, worth $47.52 million, executed in recent days.

The blockchain records reveal multiple successful coin transfers to these addresses, with values ranging from 2.5 million to 3 million IP per transaction, accompanied by negligible fees.

This is not the first instance of significant whale interest in IP. Earlier this year, exchanges reported an outflow of $4.67 million worth of IP tokens.

As then, this suggested prior accumulation by large investors.

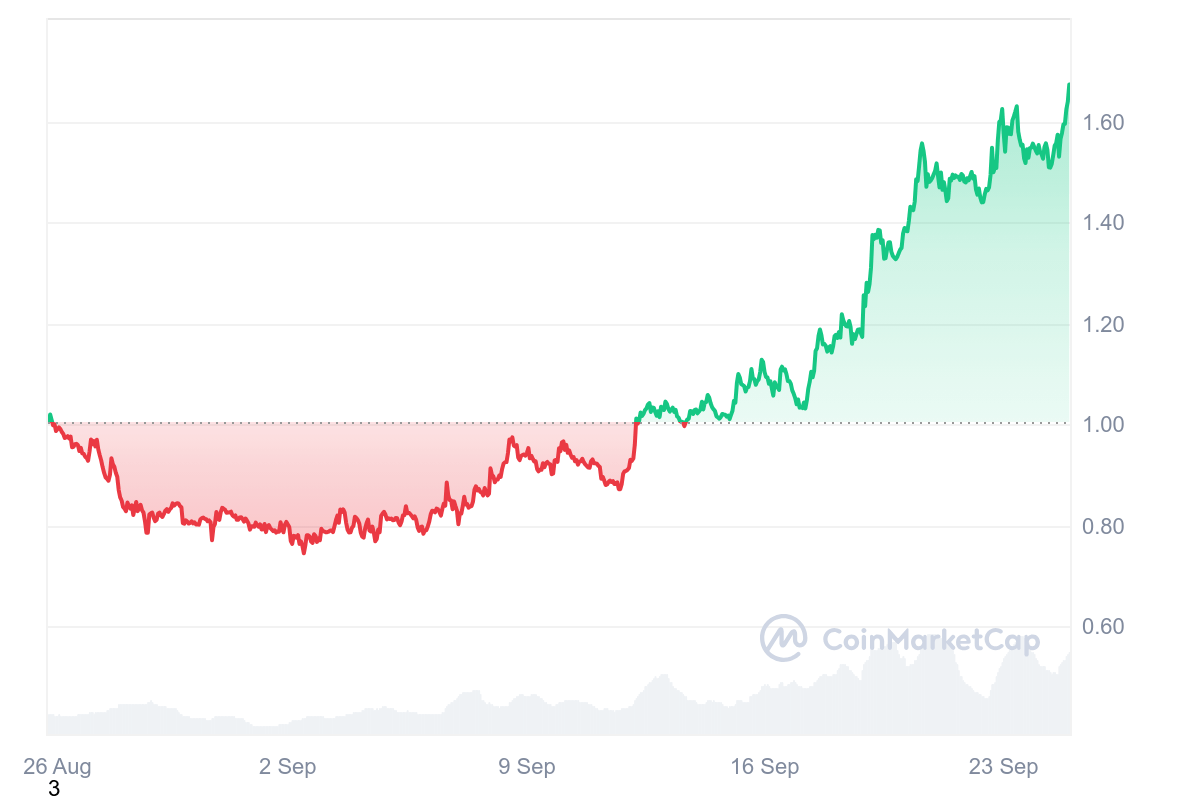

Those purchases preceded a 40% price surge, mirroring the today’s bounce despite broader market’s fading bullish momentum.

The recent whale activity, coupled with a 12.8% daily price increase, underscores a pattern of strategic buying during dips, potentially positioning IP for further gains.

Story price forecast

Market analysts attribute trader optimism to IP’s ranking as a top 100 cryptocurrency by market cap, with a value of $896 million.

The project’s focus on intellectual property asset management is fueling interest.

Based on current whale activity and a bullish market outlook, IP price could target resistance in the $4.00-$5.00 region.

However, if prices flip negative, the altcoin could revisit support levels at $2.75 and $2.50.

Analysts at Sentiment point to what traders may pay attention to in the short term.

IP price hovered around $3.09 at the time of writing. Daily trading volume was up more than 100% to over $46 million. Meanwhile, open interest stood at over $71 million.