- A large-scale holder has just offloaded 3 million FARTCOIN.

- The meme token’s price has dropped 20% on the 24-hour chart.

- Meme cryptos have plunged after the latest criticisms from Solana’s co-founder.

Digital tokens recorded mixed performances in the past 24 hours, with most coins plunging.

The meme token space witnessed multiple activities.

While Gemini announced DOGE and SHIB as collaterals, a dramatic move shocked the Fartcoin community.

According to Lookonchain, address 24BLFj has dumped a massive 3 million FARTCOIN tokens, pocketing $3.65 million.

The investor sold at $1.22 as Fartcoin plunged from the intraday high of $1.4017.

Whale 24BLFj sold another 3M $Fartcoin($3.65M) at $1.22 9 hours ago.

This whale bought 8.89M $Fartcoin(cost $2.31M) at an average price of $0.26 from Feb 26 to Mar 21.

He still holds 1.89M $Fartcoin($2.16M), with a total profit of $8.07M(+349%).https://t.co/PwSotDsDwN pic.twitter.com/DXWPBFbb3n

— Lookonchain (@lookonchain) July 29, 2025

The meme cryptocurrency fell to $1.1253, a 19.71% decline from the daily peak.

While Solana co-founder’s latest criticism of meme assets contributes to FARTCOIN’s weakness, the whale sell-off adds to the selling pressure.

Anatoly Yakovenko said NFTs and meme cryptocurrencies lack intrinsic value.

Meanwhile, this whale has invested in Fartcoin since late February, accumulating 8.89 million coins at discounted prices.

Notably, the whale spent $0.26 on average to purchase the assets between 26 February and 21 March.

The strategic investment, worth only $2.31 million, has grown to a massive profit of $8.07 million, a 349% ROI.

While the large-scale offload has impacted the markets, it also shows that the investor played a long game with FARTCOIN.

Most importantly, the sale could indicate dwindling confidence in FARTCOIN’s short-term performance.

Is the meme token set for further declines?

Fartcoin has plummeted continuously from $1.6843 on 23 July.

Nevertheless, the whale has not dumped all his stash.

They still hold FARTCOIN worth approximately $2.15 million (1.89 million coins).

Thus, the offload signals a potential strategy change, not a complete exit. The investor could be bracing for more returns in a rebound.

Most importantly, the sale reflects a calculated move.

While panic sellers dump all their assets at once, the smart whale takes partial profits while waiting for any future rally.

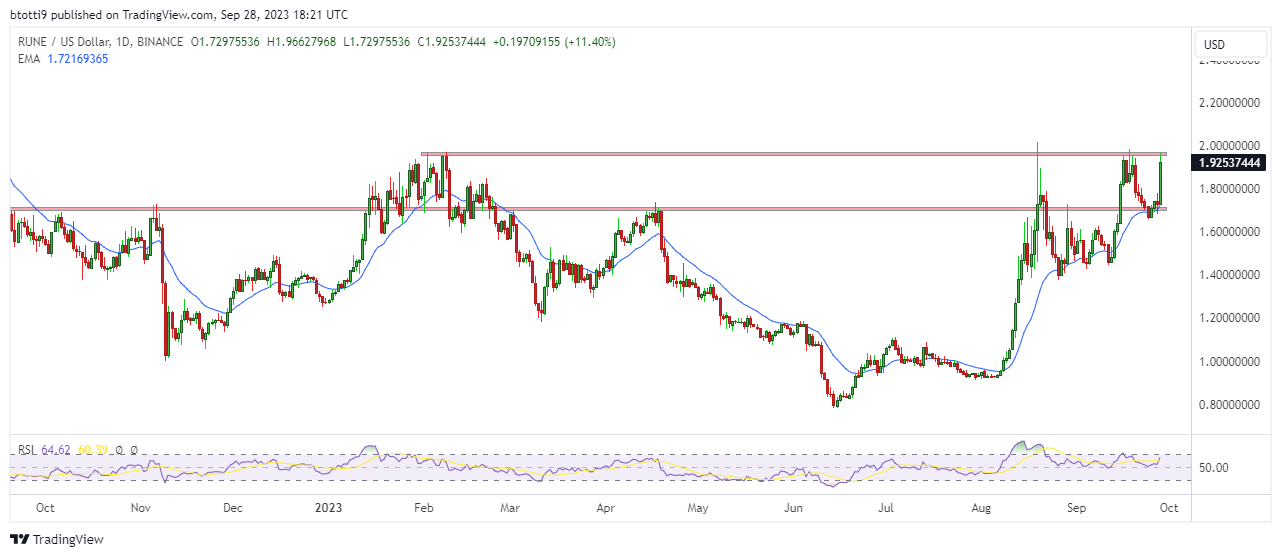

FARTCOIN price outlook

The meme coin trades at $1.18 with a bearish structure.

The 50% increase in daily trading volume signals intensified trader activity in FARTCOIN.

That signals players seeking opportunities in the prevailing volatility or exiting their positions.

The prevailing broad market sentiments support continued struggle for Fartcoin.

Meme coin market overview

The meme cryptocurrency space endured a bloodbath on Tuesday, with Dogecoin, Shiba Inu, and PEPE losing up to 10% on their daily charts.

The seven-day timeframe also confirms bearish dominance.

Only PENGU (+8.5%) and SPX (+18%) exhibit 7D days among the top meme coins by value.

CoinGecko data shows the meme coins’ market cap plunged 4.6% the previous day to $79.55 billion.

The substantial daily trading volume dip indicates dwindling interest in themed digital coins.

The latest critique by Solana co-founder Anatoly Yakovenko magnified bearish sentiments in the meme crypto space.

While meme activity has fueled Solana’s growth, Yakovenko blasted the asset class.

He boldly said that “memecoins and NFTs are digital slop and have no intrinsic value.”

I’ve said this for years. Memecoins and NFTs are digital slop and have no intrinsic value. Like a mobile game loot box. People spend $150b a year on mobile gaming.

— toly 🇺🇸 (@aeyakovenko) July 27, 2025

Nevertheless, meme cryptocurrencies have proven crucial for the digital assets economy, often used as a proxy for broad market sentiments.

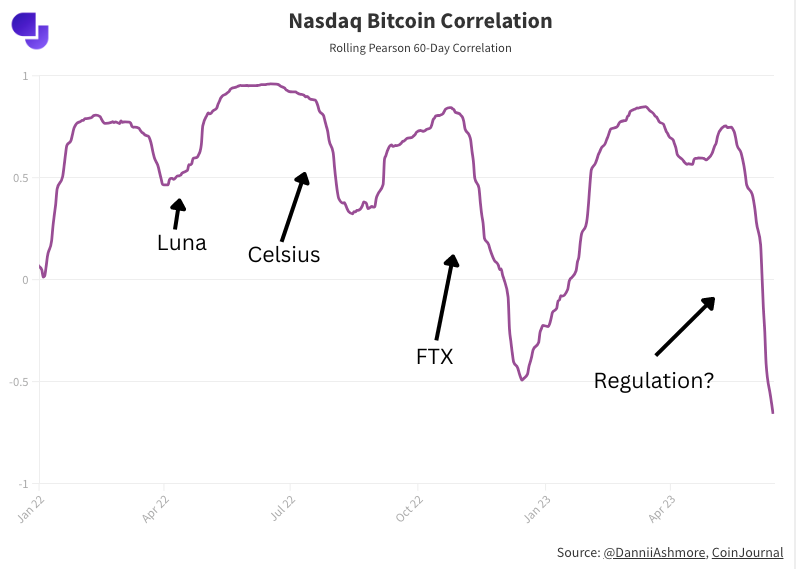

Indeed, what is different about November (FTX) and today is that we see a Bitcoin fall happening at the same time as a Nasdaq surge. While the Luna and Celsius incidents hurt crypto immensely, they came as stocks were also struggling and so the effect is not as dramatic in terms of correlation breaks (although is still tangible on the chart).

Indeed, what is different about November (FTX) and today is that we see a Bitcoin fall happening at the same time as a Nasdaq surge. While the Luna and Celsius incidents hurt crypto immensely, they came as stocks were also struggling and so the effect is not as dramatic in terms of correlation breaks (although is still tangible on the chart).