- Polygon token (POL) soared as most altcoins dipped on Monday and early Tuesday.

- While POL has given up some of the gains to $0.26, bulls appear to be in control.

- Gains for the altcoin come as its network’s total value locked (TVL) jumped to a year-to-date high.

Polygon’s native token, POL (ex- MATIC) (POL), is one of the gainers in the past 24 hours as cryptocurrencies look to bounce off the latest dump.

Altcoins such as Chainlink and XRP are eyeing fresh gains.

While POL price has slipped from highs of $0.27, it’s currently holding above $0.25 as a potential rebound coincides with a spike in the network’s total value locked (TVL).

Polygon price today

The POL token’s price is up 3% in the past 24 hours at the time of writing, and nearly 12% in the past week.

However, intraday gains reached 6% as POL rose to $0.27, with this coming amid growth in Polygon’s ecosystem, fueled by decentralised finance activity and strategic integrations.

While most of the crypto market remains in the red today, @0xPolygon $POL is green and now surging! $POL is up almost 7% on the day and nearly 12% on the week 😈 pic.twitter.com/GB32ZQsdvs

— Nofuturistic.eth 👻 (@Nofuturephoto) August 19, 2025

As the price of POL rose, Polygon’s TVL, which has jumped amid bullish momentum, topped a 43% increase year-to-date.

The TVL spiking not only reflects the price gain, but the growing adoption, user trust and capital flows.

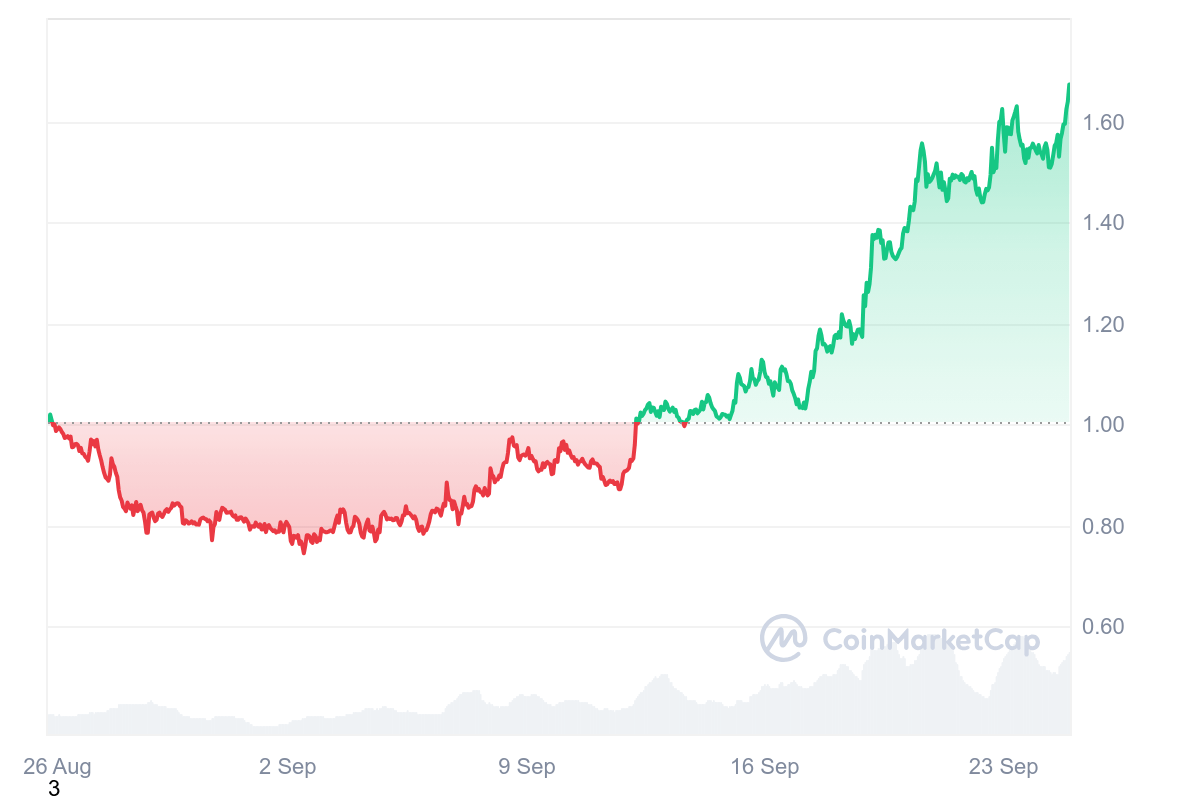

Per Token Relations, Polygon saw its total value locked metric fall to $788 million in April.

However, the metric has since witnessed a steady climb to break above $1.23 billion as of August, highlighting the blockchain network’s appeal and attraction as a DeFi player.

Stablecoin growth

Additionally, Polygon has seen a notable spike in stablecoin use.

The recent integration of Agora’s stablecoin, AUSD, on Polygon by Miomi Game is a key development.

Miomi is a web3 esports platform that boasts over 950,000 users.

Polygon also surged to a record $2.56 billion in stablecoin payments in July, with peer-to-peer transfers rising as USDC active addresses jumped to 3.16 million.

Meanwhile, USDT supply on Polygon rose to a new high of $1.29 billion during the month.

Polygon’s surge in dApps, combined with stablecoin adoption and regulatory moves, spotlights the network’s utility.

“Why are institutions building on Polygon? Trusted infrastructure, designed for greater efficiency and ready to scale for institutional demand,” Polygon Labs recently posted on X.

Polygon price prediction

Looking at Polygon’s price charts, the overall outlook is bullish.

The network’s strategic initiatives and cross-chain interactions, which are contributing to organic growth, are evidence that bulls can establish the upper hand.

Polygon’s price surge and TVL spike allude to this. Metrics such as active addresses and transactions are key to buyers breaching the supply wall around $26 and $30.

On the flip side, bears can target the psychological support level at $20.