Key Takeaways

- Long-term holders are accumulating Bitcoin, with two-thirds of the supply stagnant for over a year

- Our Head of Research, Dan Ashmore, writes that liquidity on the demand side is also drying up, with order books thin and stablecoins fleeing exchanges

- This will kick up volatility in the short-term, leaving Bitcoin open to aggressive moves to both the upside and downside

- Long-term the impact of a dwindling supply is a different discussion, but for now, risk is elevated in the already-risky crypto markets

A lot is made of the demand for Bitcoin. Are institutions giving up on it following a disastrous 2022 that saw the entire crypto sector go up in flames? Is the market moving back in now that interest rate forecasts have softened following the relentless rate hikes over the past year?

But rather than the demand, it is the supply of Bitcoin that is often the more intriguing to look at. Famously sporting a fixed cap of 21 million coins, Bitcoin’s supply schedule is coded into the underlying blockchain. This quality has given rise to a million different theories around the future place – and price – of Bitcoin in the world.

But there is another interesting analytical angle to Bitcoin: before the anonymous Satoshi Nakamoto launched Bitcoin in 2009, the world never had an asset that provided so much visibility over the supply distribution. The nature of the blockchain is that, while the individual holders are anonymous, the distribution of all coins is available for the world to see at all times. So, let’s have a look.

Long-term holders are accumulating Bitcoin

Central to many Bitcoin bulls’ long-term thesis is the idea that long-term holders will suck up supply, leading to an inexorable price rise.

Looking at current holdings, two-thirds of the supply has not moved in a year. That is certainly a large number, and we will get into what that means in the next paragraph. Pushing the timeline further out, over half the supply (53.6%) has been stagnant for over two years, 39.7% has not moved in 3+ years, and 28.6% has been idle for 5 years or longer.

What does this mean for price?

These are large numbers by any stretch. It is impossible to compare them to other asset classes, given that none are trackable on a ledger like the blockchain. Perhaps only commodities such as precious metals can compete with the above numbers, yet that is only speculation.

But what does it mean? Is this a bullish sign? Well, yes and no. The immediate conclusion is that less supply means less demand is needed to push the price up, and the cap at 21 million Bitcoins certainly means if that demand keeps rising, the price has nowhere to go but up.

However, there are mitigating factors here. The first is the reality that some of the above “long-term holders” are in fact just lost coins, be it through people who have passed away, forgotten about their coins or lost access to their wallets.

Bitcoin creator Satoshi Nakamoto is one of those, the mysterious enigma holding approximately 1.1 million bitcoins, equivalent to a mammoth 5.2% of the supply. None of his/her/their coins have moved since they were mined back in the first eighteen months of Bitcoin’s existence.

Not to get too tangential, but below is the value of Nakamoto’s holdings over the last 13 years, assuming a stash of 1.1 million Bitcoin from mid-2010. That is a lot of capital that holders must surely hope never floods the market.

Volatility to rise with less liquidity

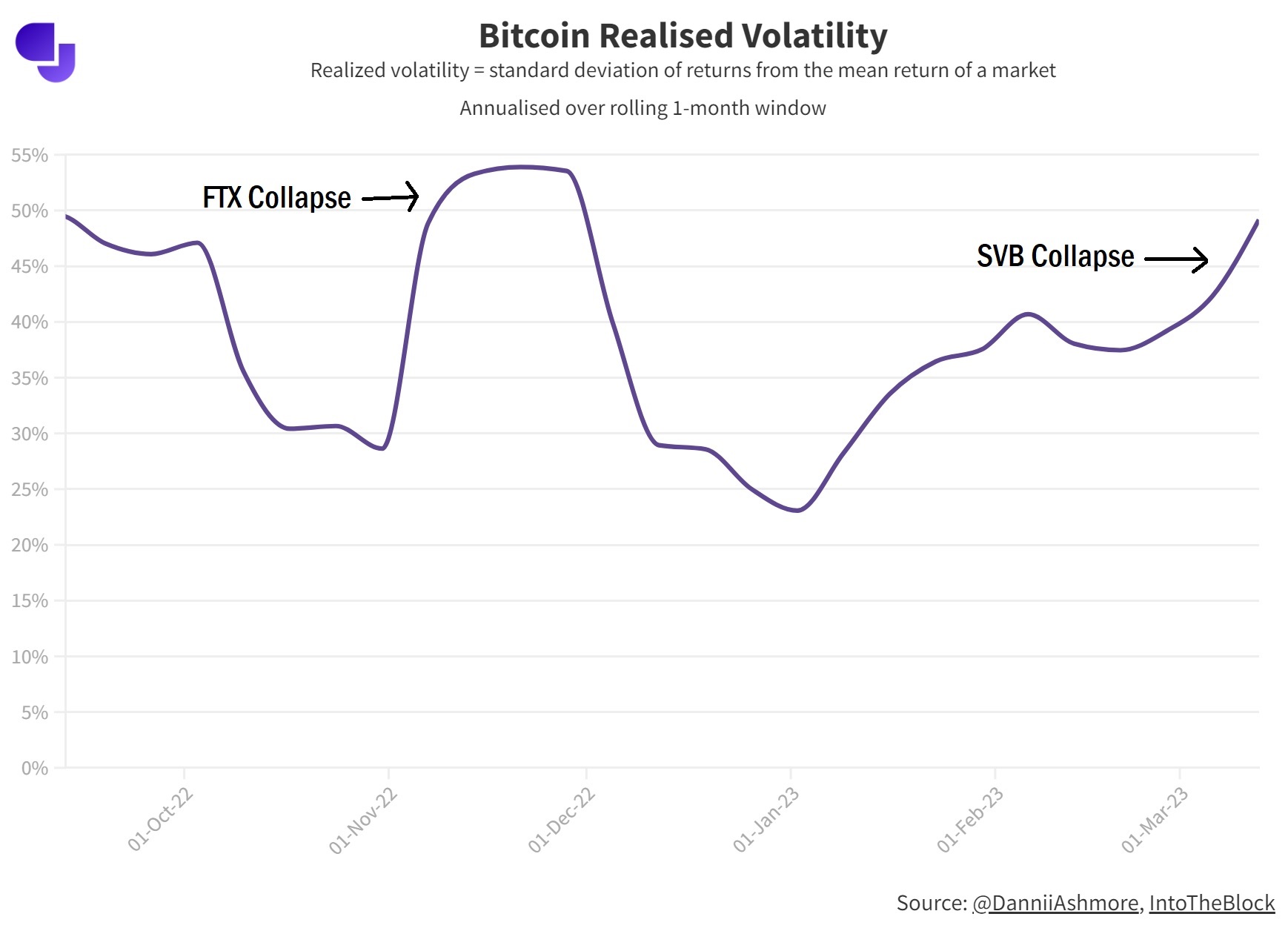

Regarding the impact of these large stashes of Bitcoin which are “removed” from circulation, the greatest impact – for now, at least – may be on the volatility rather than price.

In the following chart, I have plotted the amount of Bitcoin sitting on exchanges, currently at a 5-year low.

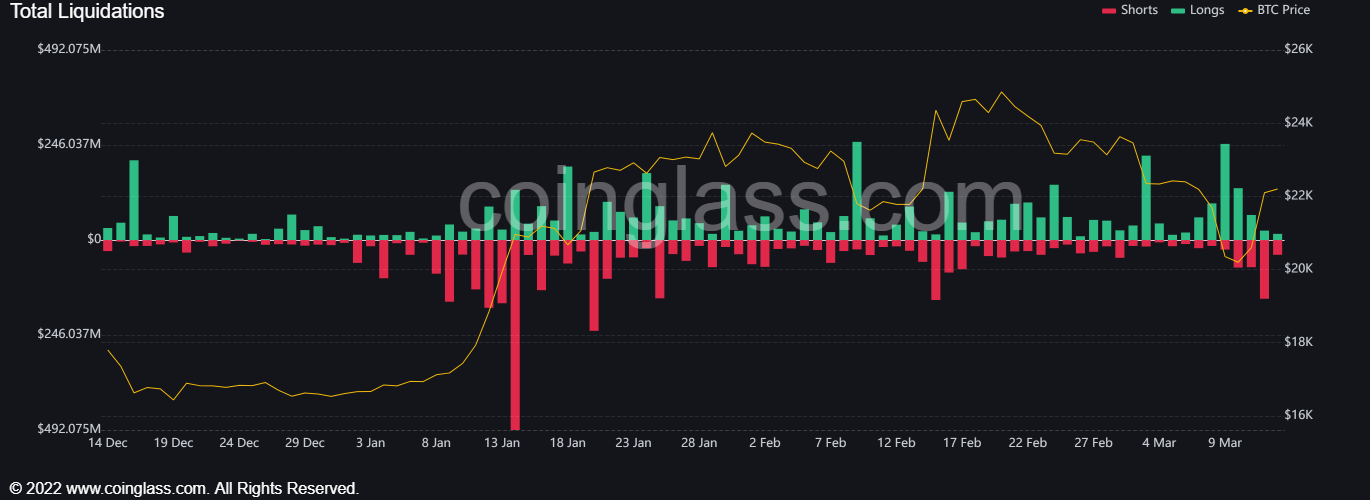

Not only is the amount of Bitcoin on exchanges dwindling, but stablecoins are doing the same. Over half of the balance of stablecoins have flooded out of exchanges since December.

This means liquidity on both the demand and supply side of Bitcoin is thin – and the same conclusion will be reached if an order book is downloaded from an exchange. Liquidity has dried up hugely, especially since FTX went under in November.

This lack of liquidity only serves to jack up the already sky-high volatility in the Bitcoin market, exacerbating moves to both the upside and the downside. This is part of the reason why volatility recently spiked to its highest level since mid-2022, and also a factor in Bitcoin’s massive run-up this year.

By definition, it takes less to move a thin market, and with forecasts around the future path of monetary policy shifting to a more optimistic stance in recent months, Bitcoin has moved up with minimal resistance in its path.

While the supply-side dry-up is intriguing in the long-term, looking into that with regard to Bitcoin’s future performance is a different discussion entirely. In the short-term, capital has fled crypto markets at an unprecedented pace, and we are now in a spot where the market is primed for violent moves in either direction. Like always in crypto, the short-term is difficult to predict, however, and the risk remains extreme – perhaps even more so currently than normal.