- Pi Network halts wallet requests after large-scale scams target users.

- Scammers exploit public balances and impersonate trusted contacts.

- PI trades near $0.20 amid low liquidity and token unlocks.

Pi Network has temporarily disabled its wallet payment request feature in response to a surge of sophisticated scam activity that has led to the loss of millions of PI tokens from user wallets.

The move, announced by the Pi Core Team on social platform X, comes as attackers increasingly exploit the platform’s payment request function to trick users into approving fraudulent transfers.

According to on‑chain data shared by community observers and reporting outlets, scammers have siphoned off more than 4.4 million PI by sending deceptive payment requests to holders with large balances.

One single scammer address reportedly received hundreds of thousands of tokens each month throughout 2025.

Tokens approved through these requests are moved instantly to the attacker’s wallet and cannot be reversed, meaning victims have no recourse once a transfer is authorised.

The Pi Core Team stressed that this issue stems from social engineering rather than a flaw in the network’s protocol.

Because wallet balances and addresses are publicly visible on Pi’s blockchain, bad actors can identify high‑value wallets and impersonate trusted contacts, friends, moderators, or even official accounts, to convince users to authorise transfers.

To curb further losses, the network has disabled the payment request feature across its ecosystem while assessing potential safeguards.

The suspension is intended to be temporary, but the team has not yet announced a specific timeline for restoring the function.

In the meantime, community moderators and safety advocates are urging users to refuse all unsolicited payment requests.

Scam tactics and broader security concerns

Experts and user reports indicate that the scams are part of a broader uptick in deceptive schemes targeting Pi users.

Fraudsters cast a wide net, from phishing links claiming fake airdrops or price promotions to counterfeit portals that ask for wallet credentials or private keys, which can lead to full account takeovers.

Pi Network’s core team has repeatedly warned against sharing sensitive information or engaging with unverified links circulating on social media and messaging platforms.

While Pi Network itself is not widely regarded as an outright scam project by independent analysts, its rapid growth, mobile‑centric model, and referral‑based incentives have drawn scrutiny and made its large user base a target for scammers.

Users are advised to stick strictly to official communication channels and exercise heightened caution when interacting with unverifiable contacts.

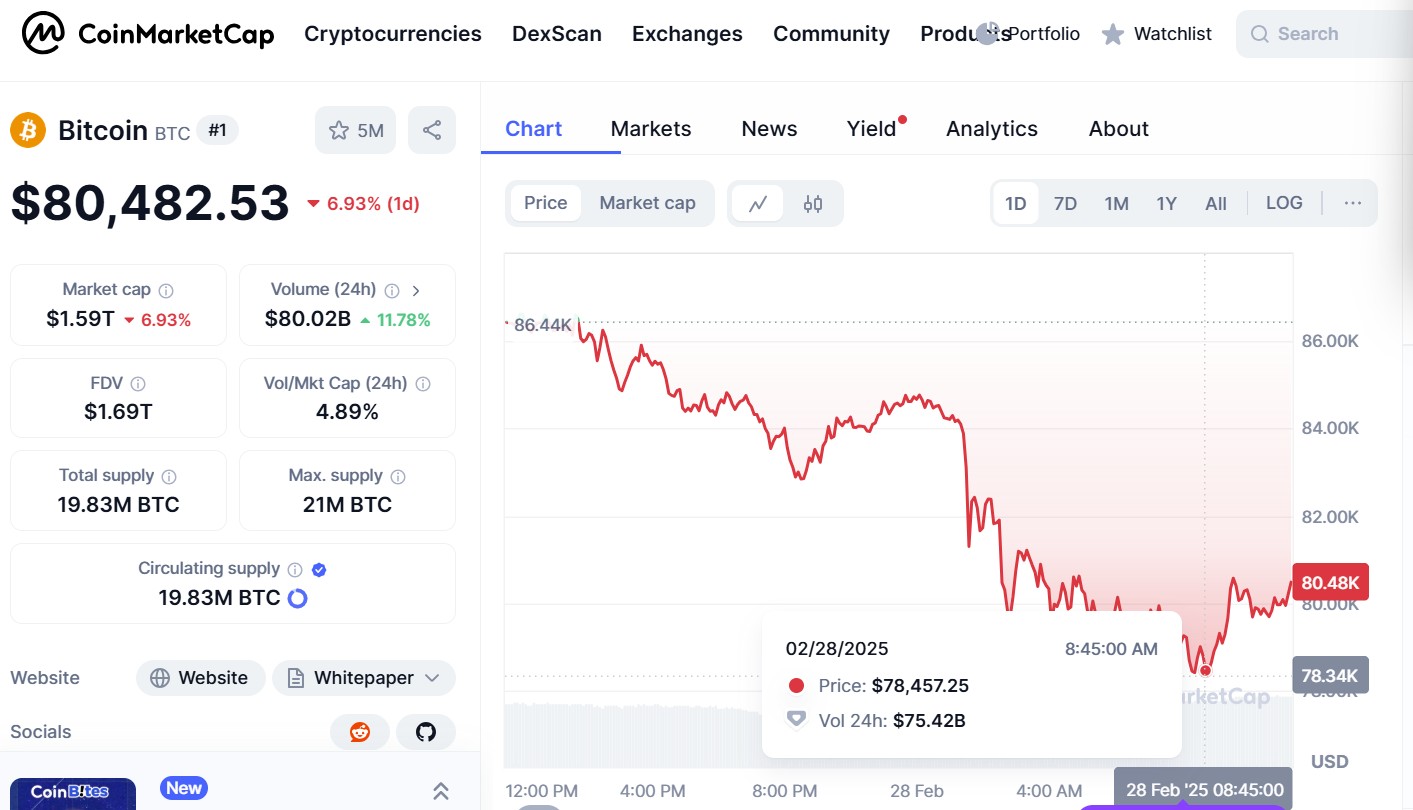

Impact on PI token price

The payment request suspension arrives amid mixed sentiment around the PI token’s market performance.

While Pi token’s price forecast remains optimistic, it currently trades near the $0.20 level, up only 1% in two weeks.

Notably, the PI coin price has been weighed down by low liquidity and ongoing token unlocks, with significant amounts entering circulation in recent months.

The token has struggled to absorb the added supply, and daily trading volumes remain moderate.