Tag: Worth

-

MicroStrategy buys another $56.4 million worth of Bitcoin

- MicroStrategy reportedly bought approximately 2,500 BTC between 1 November and 24 December, 2022.

- The company now holds 132,500 BTC acquired for approximately $4.03 billion.

- MicroStrategy did however sell 704 BTC for $11.8 million on 22 December for what it termed as tax benefits.

MicroStrategy, a publicly traded company that’s the world’s largest corporate holder of Bitcoin, has reported buying more of the flagship cryptocurrency even as the market hit turbulence beginning early November.

As per the filing submitted on 28 December to the US Securities and Exchange Commission (SEC), MicroStrategy says it purchased an additional 2,500 bitcoins between 1 November and 24 December, 2022.

Altogether, the software analytics and business intelligence firm purchased Bitcoin worth approximately $56.4 million in nearly two months and $4.03 billion in total.

MicroStrategy now holds 132, 500 bitcoins

As crypto navigated the turmoil caused by FTX’s collapse that had crypto price tapping new multi-year lows, MicroStrategy saw an opportunity to buy Bitcoin. In short, the company added 2,395 bitcoins worth $42.8 million to its holdings between 1 November and 21 December, 2022.

The total BTC acquisition in this period cost the firm $42.8 million at an average purchase price of $17,871 per coin.

On 22 December, 2022, MicroStrategy sold 704 bitcoins for $11.8 million. According to the company, the sale was at an average price of $16,776 per coin. Although the sale was at a loss, the company plans to offset the capital losses against capital gains made earlier.

Despite the BTC sale, MicroStrategy went to the market again on 24 December 2022. It bought another 810 bitcoins at an average price of $16,845 and for a total outlay of $13.6 million. By 27 December 2022, the company had added 2,500 bitcoins at a total cost of $56.4 million.

As of this report, MicroStrategy had increased its Bitcoin holdings from 130,000 BTC at the end of October to 132,500 bitcoins by 27 December, 2022.

The recent purchases means MicroStrategy has spent $4.03 billion on acquiring BTC since its first purchase in 2020. The coins’ average purchase price currently stands at $30,397 per bitcoin.

-

October’s Largest Whale Buys ~4 Trillion Tokens Worth $43 Million

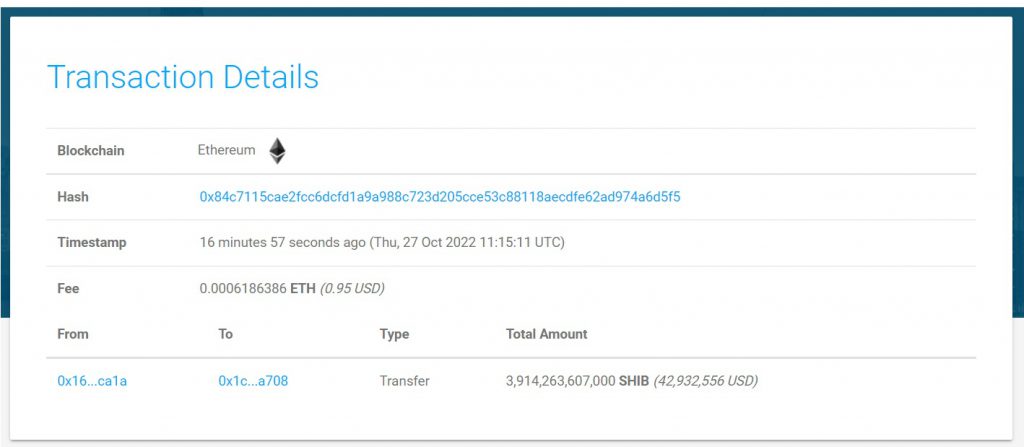

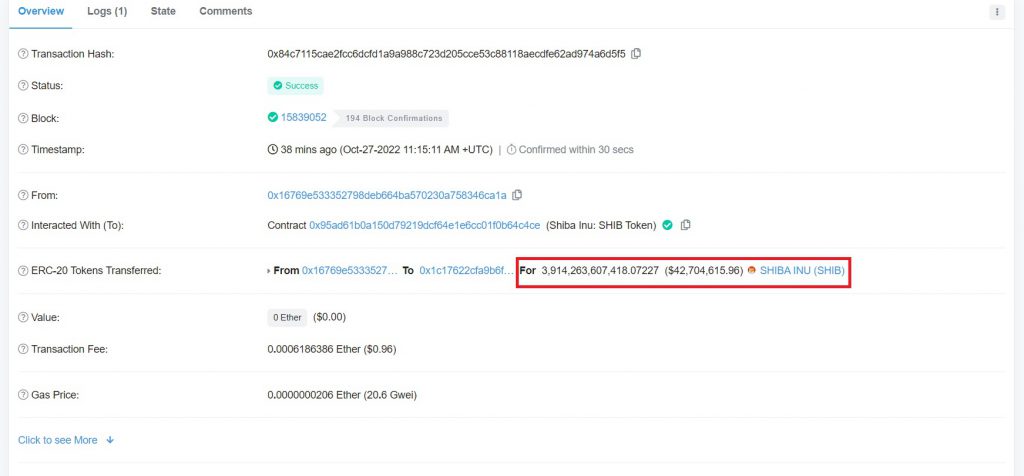

A mysterious and unidentified Shiba Inu whale purchased nearly 4 trillion SHIB tokens worth a staggering $50 million on Thursday. The transaction can be called the biggest whale transfer recorded in October 2022 for SHIB. The anonymous address picked up 3,914,263,607,418 Shiba Inu tokens for $42,704,615.You can go through the enormous SHIB transaction details from Etherecan.io here.

Also Read: $1,000 Investment in Shiba Inu Turns Into $19 Million in October 2022

Source: Etherscan.io The identity of the whale remains to be a mystery and the reason for the large purchase is unknown. It is not known if the whale is taking an early entry position before the Shibarium documentation release.

Source: Etherscan.io The ETH-rich list has been splurging on Shiba Inu since mid-2021, and the trend didn’t slow down even during the bear markets this year. Both whales and retail investors alike believe SHIB can deliver the desired financial results in the long run. This blind faith in the token alone is what’s keeping SHIB afloat in the markets despite the harsh conditions.

Also Read: Will Shibarium Burn 100 Trillion Tokens? Shytoshi Responds

Just recently, another whale picked up nearly 166 billion SHIB tokens worth $1.87 million. You can read more details about the whale transactions in October 2022 here.

In addition, another whale moved nearly 3.3 trillion SHIB tokens on Wednesday. The exact reason for the transfer is unknown and it’s unclear whether the whale transferred or dumped the tokens. You can read more details about the 3.3 trillion SHIB token transaction here.

Also Read: Can Shiba Inu Make You A Millionaire By 2030? Here’s Your Answer

Shiba Inu: The Tale of Shibarium & Bone

Source: Pixabay Shiba Inu is attracting buying pressure as investors are keen on taking an early entry position before the Shibarium layer-2 network’s release. Shibarium’s governance token Bone outperformed SHIB in price jumping 23% this week, while Shiba Inu was up only 10%. Bone will be used as gas on the Shibarium network making it get an important use case in the ecosystem.

Therefore, both Shiba Inu and Bone are rallying in the hopes of a Shibarium documentation release. However, the tentative release date for Shibarium documentation remains to be unknown. Unification, the firm that building the L2 network confirmed in the blog post that Shibarium will be out “sometime shortly thereafter” post Q3 of 2022.

Also Read: ShibaEternity Criticized by Community, Ask For Shibarium Instead

At press time, Shiba Inu was trading at $0.00001085 and is up 4% in the 24 hours day trade. On the other hand, Bone was trading at $1.10 and is up 6.3% in the day’s trade.