As the crypto world eagerly anticipates the year 2024, it holds a promise marked by a significant event – Bitcoin’s fourth halving. This phenomenon, coupled with optimistic forecasts for cryptocurrencies like Chainlink and Rebel Satoshi ($RBLZ), is poised to shape the landscape of the digital asset realm.

In this article, we delve into the potential implications of Bitcoin’s impending halving and explore the promising outlook for two noteworthy top altcoins.

Bitcoin’s fourth halving: a defining moment

Bitcoin, the pioneer of cryptocurrencies, operates on a unique economic model with a fixed supply capped at 21 million coins. The halving event, which occurs approximately every four years, involves a 50% reduction in the reward that miners receive for validating transactions.

With more than 19 million bitcoins already mined, the fourth halving will further tighten the supply, bringing the total number of bitcoins ever to be mined closer to its 21 million limit.

The halving effect on Bitcoin price

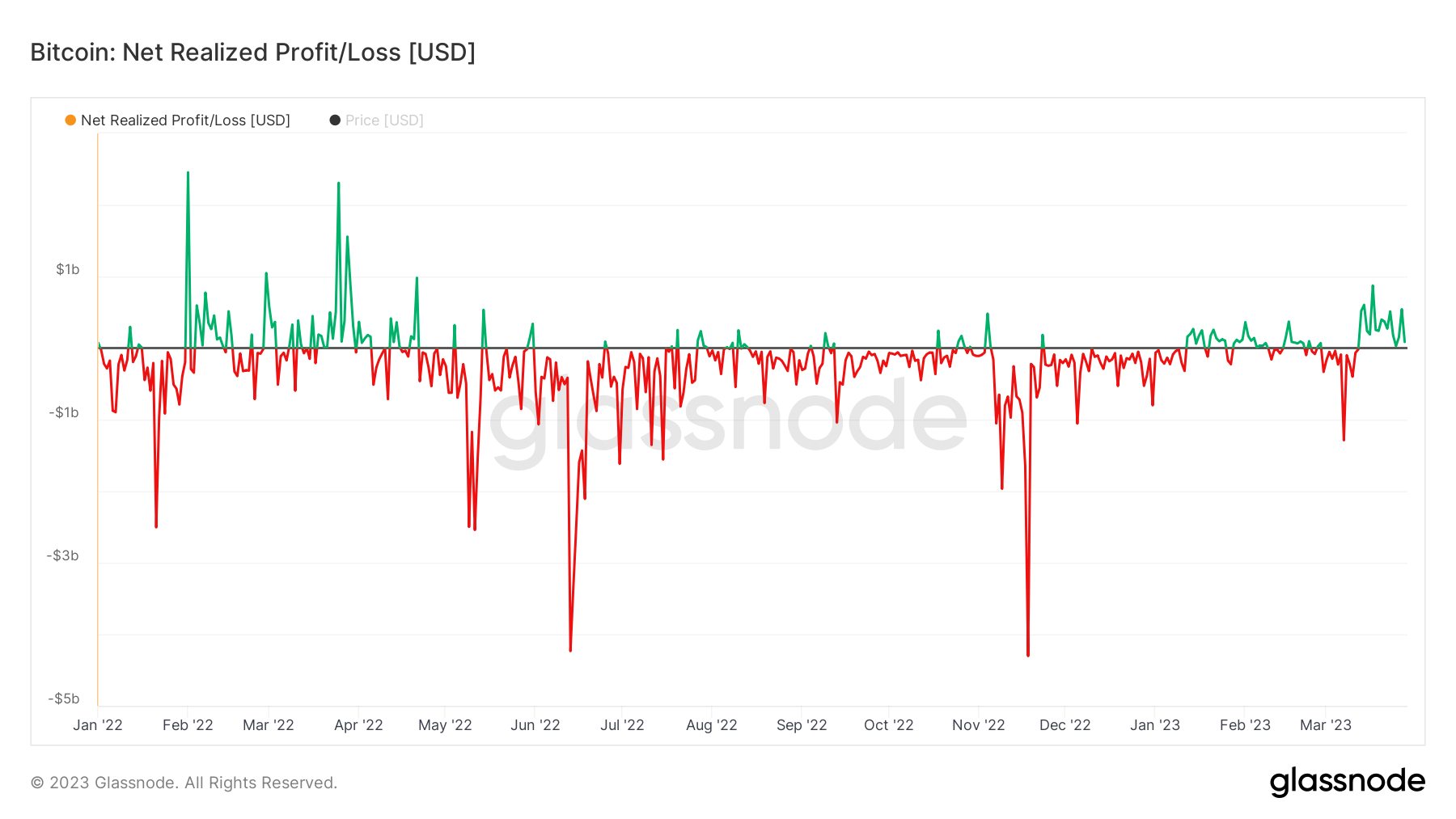

Historically, Bitcoin halving events have triggered significant price movements. While the first halving in 2012 had a negligible effect, subsequent occurrences in 2016 and 2020 witnessed substantial price surges.

As we approach the expected 2024 halving, the crypto community remains vigilant for potential market dynamics. Analysts often observe increased price volatility before and after halving events, presenting both challenges and opportunities for traders and investors.

Chainlink’s promising trajectory

Amidst the anticipation surrounding Bitcoin, top altcoins like Chainlink have been gaining attention for their unique value propositions. Chainlink, a decentralized oracle network, has established itself as a crucial player in bridging smart contracts with real-world data. The project’s versatile use cases, including decentralized finance (DeFi) applications, have contributed to its widespread adoption.

As of recent market analysis, Chainlink’s price appears to be in an accumulation phase, indicating a potential upcoming bullish trend. Technical indicators such as the Awesome Oscillator, Moving Average Convergence Divergence (MACD), and Relative Strength Index (RSI) suggest a favourable environment for Chainlink’s price to experience an upward trajectory.

With key support levels and resistance zones in focus, traders are eyeing the $16.000 mark as a potential milestone for LINK.

Rebel Satoshi (RBLZ): a new player in the crypto arena

In the diverse landscape of cryptocurrencies, Rebel Satoshi (RBLZ) emerges as a notable contender, especially as it garners attention during its presale phase. Having already sold over 100 million RBLZ tokens and raised $1.5 million, the Rebel Satoshi presale is on the brink of reaching the $2 million milestone. Built on the Ethereum network, renowned for its security, Rebel Satoshi stands out as a compelling investment option.

The smart contracts governing Rebel Satoshi have undergone rigorous auditing by Source Hat, a leading auditing firm. This ensures the safety and reliability of the Rebel Satoshi ecosystem. This is one of the reasons why Rebel Satoshi is regarded as the best meme coin. As the presale progresses, investors are urged to consider the potential of Rebel Satoshi, not just as a meme coin but as a project backed by robust technology and a dedicated community.

Investment recommendation

In light of the upcoming Bitcoin halving and the promising trajectories of altcoins like Chainlink and Rebel Satoshi, investors are presented with unique opportunities. While Bitcoin’s halving may contribute to market-wide dynamics, strategic investments in altcoins with solid fundamentals can potentially yield significant returns.

As we look ahead to 2024, the crypto space continues to evolve, offering a dynamic environment for enthusiasts and investors alike. Whether one chooses to ride the waves of Bitcoin’s halving or explore the potential of innovative altcoins, staying informed and vigilant in the ever-changing crypto landscape remains paramount.

Final Thoughts

The year 2024 unfolds with the promise of being a transformative period in the crypto realm. Bitcoin’s fourth halving stands as a key event, influencing market sentiments and potential price movements. In parallel, top altcoins like Chainlink and Rebel Satoshi showcase their unique value propositions, inviting investors to explore diverse opportunities.

As the crypto journey progresses, strategic decision-making and a forward-looking approach become essential for those seeking to navigate the exciting and ever-evolving world of digital assets.

For the latest updates and more information, visit the official Rebel Satoshi Presale Website or contact Rebel Red via Telegram.