Key Takeaways

- Bitcoin mining difficulty has surpassed 50 trillion hashes for the first time ever

- Higher difficulty means more competition and less profit for miners, but also more security for the Bitcoin network

- Higher mining difficulty means greater energy input required to mine Bitcoin, meaning greater cost for miners

- Mining stocks have underperformed Bitcoin significantly over the last year

It has never been so difficult to mine Bitcoin. Literally. Bitcoin mining difficulty continues to rise incessantly, surpassing the 50 trillion hash mark for the first time ever last week.

What is Bitcoin mining difficulty?

If it were not for the Bitcoin mining difficulty adjustment, blocks would be appended to the blockchain at an increasing speed as more miners joined the Bitcoin network. In such a way, the Bitcoin mining difficulty adjusts via an automatic algorithm to ensure blocks are appended to the ever-growing blockchain at consistent 10 minute intervals.

As more miners join the network, difficulty rises. In such a way, blocks do not get discovered quicker as more miners join the network. This difficulty adjustment is thus vital to ensure the supply of Bitcoin is released at a pre-programmed pace, as outlined by the anonymous Satoshi Nakamoto in the Bitcoin whitepaper.

This explains how, in the early days, mining could be carried out on a personal laptop, because Bitcoin was so niche and miners were so few and far between – hence the mining difficulty was far lower. This is why you hear stories of miners who find (or lose) stashes of Bitcoin on old hard drives which were close to worthless when they were mined.

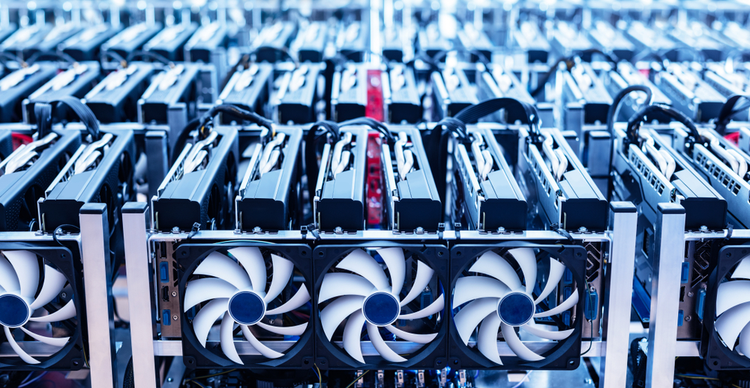

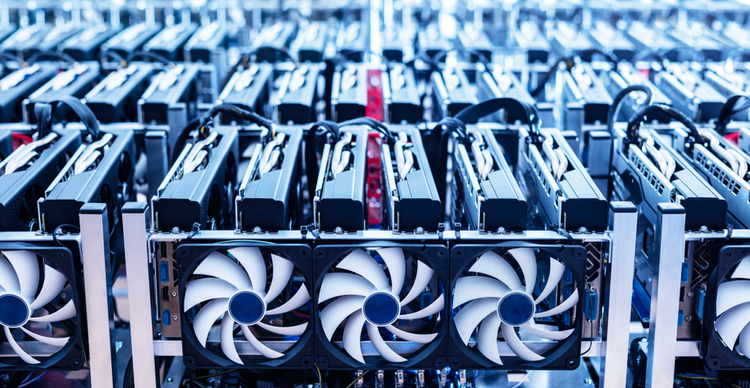

Today, however, Bitcoin is well and truly in the mainstream, and mining difficulty has risen accordingly. Most mining is carried out by supercomputers, while there are many public companies carrying out the task.

What does increasing mining difficulty mean?

Mining difficulty is increasing because more computational power is being put towards Bitcoin mining. The hash rate is what we refer to as the computational power of the Bitcoin network. Looking at the chart, this is at an all-time high – which makes intuitive sense, given mining difficulty is also at an all-time high.

For the Bitcoin network as a whole, this is a good thing. Bitcoin’s hash rate is a crucial indicator of the security of the network. A higher hash rate means Bitcoin is more resistant to an attack by a malevolent actor. This is because the higher the hash rate, the more expensive and implausible it is for an actor (or a group of actors) to seize control of 51% of the network, when Bitcoin could be exposed to what is known as a 51% attack (coins could be double spent and the veracity of the blockchain would be in doubt).

However, there are downsides to this, too. I detailed this in depth last week in a report on Bitcoin mining stocks. In summary, more hash power means greater cost for miners, as the increased difficulty means a greater amount of energy is required to power the computers working to validate the transactions on the blockchain. This is why miners margins are getting cut into as more miners join the network (rising electricity costs also do not help).

“The rapid decline in the Bitcoin price, down from $68,000 at the peak of the bull market in late 2021, has obviously hurt the mining industry”, says Max Coupland, director of CoinJournal. “However, that is far from the only problem facing miners. The mining difficulty hitting an all-time high means greater amounts of energy are required to mine, at a time when inflation and the Russian war have pushed the price of energy up immensely”.

The mining industry is hence extremely volatile, as not only is it sensitive to the volatility of Bitcoin itself, but it also suffers from rising energy costs. The below chart demonstrates how mining stocks have underperformed Bitcoin in recent times. It looks at the Valkyrie Bitcoin Miners ETF, which tracks mining companies and was launched in February 2022.

With Bitcoin mining difficulty hitting an all-time high, racing past the 50 trillion hash mark for the first time ever, things won’t get any easier for miners. However, like always, it will ultimately come down to the Bitcoin price. With block rewards and transaction fees recouped in the form of Bitcoin, and the entire industry built upon this asset, mining companies will go as far as the Bitcoin price takes them.

If you use our data, then we would appreciate a link back to https://coinjournal.net. Crediting our work with a link helps us to keep providing you with data analysis research.