Category: NEWS

-

Smartest man in the room has a warning about Bitcoin prices

-

Morgan Stanley’s Mike Wilson is seen as one of the best analysts in Wall Street.

-

He warned that the S&P 500 is ripe for another 21% crash.

-

If this view is valid, we could see BTC prices crash as well.

Bitcoin price dipped to about $24,000 as a somber mood engulfed the stocks and cryptocurrency industry. After rising to a high of $25,373 during the weekend, the BTC/USD price has struggled to retest it this week. And now, one of the best sell-side analysts in Wall Street, has issued a blistering warning about the market.

Morgan Stanley’s Wilson warning

In a note on Tuesday, Mike Wilson, the Chief Equity Strategist at Morgan Stanley, warned that the S&P 500 could crash by another 21%. If this happens, it means that the index could crash from the current $4,000 to about $3,140.

Wilson noted two main things that could push the S&P 500 index much lower in the near term. First, there is a reset of expectations about the Federal Reserve. The argument is that investors were expecting the Fed will start pivoting soon.

However, the reality is that recent data point to more hikes this year. Inflation remains stubbornly high while the unemployment rate has fallen to a multi-decade low of 3.4%.

Second, corporate earnings have been a bit weak. Companies like Goldman Sachs and Home Depot published relatively weak financial results. According to FactSet, S&P 500 constituent companies have had a blended growth of -4.7% in the quarter, the worst since 2020.

Further, with the bond yield being highly inverted, there is a likelihood that the US will go through a major recession. Stocks tend to underperform in such a period. Mike Wilson is not the only analyst worried about stocks. In a widely-read report, Jeremy Grantham warned that the S&P 500 could crash to about $3,200.

Implications for Bitcoin prices

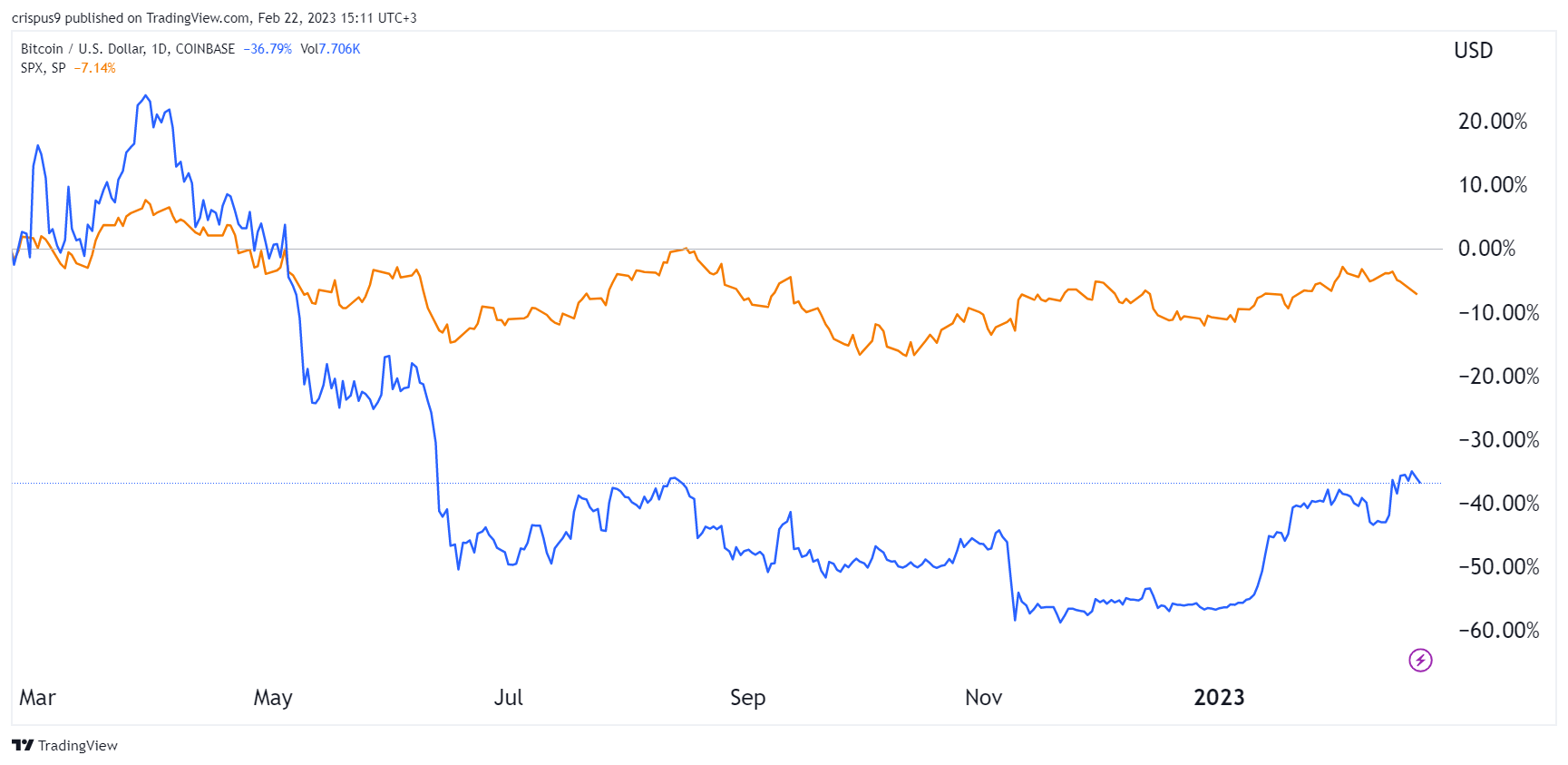

Mike Wilson did not mention Bitcoin prices in his note. He did not also mention cryptocurrencies in general. However, if his warning materializes, the fact is that it will have serious implications for BTC and other cryptocurrencies.

In the past few months, Bitcoin and stocks have had a close correlation. A close look at the data shows that BTC and S&P 500 have a correlation coefficient of 0.91. A correlation of 1 or close to 1 is usually a sign that the two assets are closely correlated.

Therefore, if the S&P 500 crashes by 20%, there is a high possibility that Bitcoin price will drop further than that. As such, while it is too early to predict whether Mike Wilson will be right, it makes sense to start taking profits.

-

-

Bitcoin’s break to $25k was fueled by massive liquidations

- Bitcoin price broke above $22,500 to new highs above $25,000 amid the hunt for short stops and liquidations.

- The move to $25k resulted from short liquidations of over $155 million.

- While price could retreat to $24k, Bitfinex analysts say recent price movements could be indicative of a bottom.

Bitcoin price rose above $25k briefly before slipping back under the key psychological and technical area.

According to analysts at crypto exchange Bitfinex, the retreat to this week’s lows comes after a 10% upswing and a green weekly candle. However, the benchmark crypto did not hit a crucial daily candle close at that zone.

Even then, it is likely the price movement is another major step towards “the latter stages of a gruesome bear market,” the analysts noted in a report.

BTC spike to $25k fueled by massive liquidations

Bitfinex analysts also suggest that Bitcoin’s breakout from the $22,500 price level to highs above $25,000 was fueled by the massive liquidations recorded over the past few days.

Commenting on BTC price outlook and what could lie awake in coming weeks, they said in a statement shared with CoinJournal.

“Over the past two weeks, the BTC price has been hunting both over-leveraged long positions, as well as liquidating over-eager shorts of over $155 million. It reached an eight-month high of $25,000 in the process. Another sharp but short-lived pullback caught out some short-term bullish speculators off-guard who were betting on a push to the upper $25,000-$26,000s on Thursday, February 16th, as evidenced by a spike in long position liquidations on that day. Profit-taking in the wake of the recent rally and a stop-run on those who had gotten overly aggressive chasing the upside might well send Bitcoin back below $24,000 in the week ahead.”

On what happens next, the analysts say price action as has played out recently has historically, resulted in ranged price movement. This is due to the action that has seen both longs and shorts have been simultaneously wiped off.

“The most probable move going forward is to scale out of positions partially and wait for the range to form without a strong directional bias,” they explained.

In a tweeted prediction for Bitcoin price, YouTuber and crypto analyst Sheldon The Sniper says Bitcoin could go to $28k or revisit support at $21k. He shared the outlook above as BTC price continued to hover around $25,683 at 2:15 pm ET on Tuesday.

$BTC update

1Hour chart forming a flag and this is a crucial level for the market

We have a support and resistance trend and ultimately which ever trend we close outside of will give us the next direction . Break of resistance we go to 28K

Break of support we go to 21K pic.twitter.com/1BdbR0wpjR— Sheldon The Sniper (@Sheldon_Sniper) February 21, 2023

-

Bitcoin “shrimp” addresses hit 43.2 million

- Bitcoin “shrimp” wallets, which hold 1 bitcoin recently surged to 43.2 million.

- Bitcoin addresses with 0.01 BTC or less have also hit an all-time high of 32.6 billion.

- Data also shows bitcoin wallets in profit have reached 70% after recent price gains.

Bitcoin price recently reached an eight month high when it rallied to highs above $25,000 last week.

Despite this, the latest market data from asset manager CoinShares shows Bitcoin investment products saw outflows of $25 million, about 78% of the $32 million that exited amid negative sentiment. But a new report shared by crypto exchange Bitfinex indicates that Bitcoin still saw massive growth in terms of the address count with one BTC or lower.

Bitcoin “shrimp” addresses hit 43.2 million

According to data shared in the Bitfinex Alpha report published Monday, 20 February 2023, Bitcoin addresses with less than one bitcoin, or “shrimps”, recently jumped to 43.2 million – the highest the count has hit in the flagship cryptocurrency’s history.

No doubt this has been greatly helped by the massive growth in addresses with 0.01 BTC or less. Per the Bitfinex report, and from on-chain data by analytics platform Glassnode, the number of wallets with balances of 0.01 BTC or under recently hit 32.6 million.

Overall, wallet addresses with non-zero balances are at an all-time high, which Bitfinex researchers say is indicative of “an influx of new investors.”

As CoinJournal recently covered, shrimps actually increased their buying even as prices fell after the FTX collapse. And it is this increase in the number of non-zero wallets that could have fueled Bitcoin’s recent upside momentum, the Bitfinex team noted in their report.

Is it the start of a new Bitcoin bull market?

Bitcoin has been largely upwards in January and February, with nearly 50% in overall gains year-to-date as of 21 February. In fact, as Glassnode data shows, the number of Bitcoin wallets in profit (7-day moving average) has also just hit a 10-month high.

📈 #Bitcoin $BTC Percent Addresses in Profit (7d MA) just reached a 10-month high of 70.955%

View metric:https://t.co/ik5IkrcQZM pic.twitter.com/E9XGf1M3cT

— glassnode alerts (@glassnodealerts) February 21, 2023

While analysts warn of a potential pullback amid profit booking across crypto, the sentiment is still mostly bullish for BTC in the short term. And the recent growth in shrimp wallet addresses aligns with historical market trends in a bear market.

In this case, bull markets have traditionally been highlighted by wealth distribution, with the entry of new short term holders a metric that helps signal the shift in market direction.

However, as Bitfinex analysts noted in their report, the latest data is only a “snapshot of the current situation.” In short, it is hard to predict where the market goes next at any one given time.

-

Bitcoin price rose despite $25 million in product outflows

- Bitcoin products saw $25 million in outflows last week, according to asset manager CoinShares.

- There was $3.7 million in short Bitcoin as investor sentiment flipped negative on recent regulatory concerns.

- But crypto prices still recorded huge moves, with BTC hitting a six-month high above $25,000.

Bitcoin price hit its highest price level in six months last week, with the flagship cryptocurrency testing bears’ resolve above the $25,300 zone.

However, digital asset management firm CoinShares says despite reaching a new year-to-date high, the flagship cryptocurrency still bore the brunt of the negative sentiment that pierced the market as US regulators upped their crackdown on multiple industry sectors.

Digital assets see $32 million in outflows

As CoinShares Head of Research James Butterfill points out in a weekly funds flow report released on Monday, Bitcoin recorded the largest share of outflows seen in the digital assets investment products last week.

Per the researcher, total crypto funds outflows totaled $32 million this past week, the largest single week outflows since December last year. But almost $25 million of the outflows were in Bitcoin products, with negative sentiment seeing short Bitcoin investment products account for $3.7 million in inflows.

Infact, as US Securities and Exchange Commission (SEC) increased its crackdown on stablecoins and staking services among other sectors of the crypto industry, crypto outflows hit $62 million. The market did record significant outflows as Bitcoin led the market in holding prices above key levels.

According to Butterfill, the mid-week flip in sentiment (with Bitcoin price soaring more than 10%) helped digital assets products register $30 million in inflows. This in turn helped push the total assets under management in exchange-traded products (ETPs) to its highest level since last August. Butterfill noted:

“The negative sentiment amongst ETP investors was not expressed in the broader market with Bitcoin prices rising by 10% over the week, this price appreciation pushed total assets under management (AuM) to US$30bn, their highest level since August 2022. We believe this is due to ETP investors being less optimistic on recent regulatory pressures in the US relative to the broader market.”

Crypto assets saw mixed flows

While Bitcoin recorded over 78% of the outflows, Ethereum products saw $7.2 million in outflows last week. Other top altcoins with large withdrawals included Cosmos ($1.6 million), Polygon ($0.8 million), and Avalanche ($0.5 million).

Yet, investment products for Aave, Binance, Fantom, XRP, and Decentraland saw inflows of between $0.36 million and $0.26 million, CoinShares highlighted in its report.

Elsewhere, while crypto assets experienced a second consecutive week of outflows, blockchain equities had a more positive outlook from investors, with $9.6 million in inflows last week. Blockchain equities have now had six consecutive weeks of inflows.

-

Top 10 Coins To Buy For Massive Gains in 2023

With 2023 only just getting underway, this year is already looking much more positive than the rough 2022 experienced by practically all crypto projects. With hopes that the space has now reached the bottom of its bear market, investors are turning their attention to identifying which projects have the potential to deliver incredible profits in 2023 and beyond.

Figuring out which project offers the highest bang for your buck is easier said than done, though. As such, here are the top 10 coins supporting the most highly regarded projects investors agree could offer massive gains in 2023:

- Metacade (MCADE)

- Chainlink (LINK)

- Avalanche (AVAX)

- Hedera (HBAR)

- Bitcoin (BTC)

- LTO Network (LTO)

- Ripple (XRP)

- Monero (XMR)

- Shiba Inu (SHIB)

- Polygon (MATIC)

1. Metacade (MCADE)

Metacade is already taking the investment world by storm with a presale that is amazing onlookers, having raised a phenomenal $7m in only 13 weeks since it launched. Fundraising continues at pace, with the presale now in stage 4 and an increasing number of investors scrambling to get on board while they can. This alone could place it comfortably at the top of the list of top 10 coins, but it is the features of the platform which really stand out.

The main driver pushing up presale figures is Metacade’s comprehensive plans provided in the platform’s whitepaper. It outlines an innovative blueprint for reaching the project’s goals, objectives, and roadmap. Metacade is en route to revolutionize the video game business, in part, by constructing the largest play-to-earn (P2E) arcade on the planet.

The P2E arcade looks certain to attract a huge number of the millions of global gamers out there, due to the extensive rewards mechanisms implemented across the ecosystem. Gamers of all stripes will reap rewards, earned across both casual gaming and more competitive community play. By taking this approach, Metacade establishes a broad appeal that can provide the project with a potentially huge total addressable market (TAM).

Rewards will also be implemented for user actions that benefit the broader Metacade ecosystem. Users who contribute in ways like writing game reviews or engaging with the community will be eligible for rewards. This incentivizes all users to constantly improve the platform. It creates a significant driver for user retention and growth that many other projects out there cannot compete with.

The project uses a utility token known as MCADE to power the ecosystem, and MCADE plays a key role in how the platform operates. As well as being used to distribute rewards, MCADE more broadly represents the currency of the platform, meaning that for all exchanges of value across the entire ecosystem — such as for tournament entry fees or for buying merchandise — MCADE is crucial.

The token design also features staking options for holders, which allows investors who are holding for the likely price appreciation of the MCADE token to benefit from a passive income by putting their tokens to work while they wait.

One feature that is often referenced is the Metagrants program, providing significant value at all levels of user engagement. It achieves this simply, by allowing game developers and teams to pitch game ideas to the Metacade community. MCADE holders can then vote on the projects which are most deserving of funding from the Metacade treasury. This level of involvement will help improve user retention by giving them a meaningful role in the future of the gaming library.

>>> You can participate in the Metacade presale here <<<

2. Chainlink (LINK)

Chainlink is a project that is taking on the so-called ‘oracle problem,’ which deals with the challenge faced by Web3 in being able to access accurate and secure data from off-chain in a trustless way.

The Chainlink decentralized oracle network (DON) is a complex system of nodes that supply information to the network and stake their LINK tokens to do so. Any node trying to game the system is penalized via a system known as slashing, where providing incorrect data is punished with the loss of LINK tokens by the node.

Chainlink boasts more partnerships than any other Web3 project, and the price feeds it provides on the up-to-date prices of trading pairs is a critical part of the way that the most mature end of DeFi (such as Aave) operates. If DeFi continues to grow and Chainlink remains central to it, then we could well see the price of the LINK token increase dramatically over the course of 2023, making it a solid contender for the list of top 10 coins.

3. Avalanche (AVAX)

Avalanche is a layer-1 project competing with the likes of Ethereum and Solana for market share in the public permissionless space. The project uses three separate blockchains known as the C-Chain, P-Chain and X-Chain to enable the creation of sub-networks called subnets.

These subnets allow an amount of flexibility in the features of the Avalanche network, meaning that the parameters can be tailored to the specific use case at hand. This has led to calls from the passionate Avalanche community that the scalability of the Avalanche network is unbeatable, which makes investing in the native token, AVAX, a promising opportunity.

The Avalanche network hasn’t seen much growth following the surge in the 2021 bull run, however, with a large and passionate community behind it, 2023 could be the year that the project secures more market share and those who have invested in the AVAX token reap the rewards.

4. Hedera (HBAR)

The Hedera network isn’t actually a blockchain at all; the project uses a technology known as directed acyclic graphs (DAG) to enable the Hedera network to provide fast and secure transactions at scale.

The project also takes decentralization seriously but has adopted to take a different approach than most projects by appointing a council of corporate and educational institutions under time-limited terms to hold a seat on the Hedera council.

There are rumors abound that the Hedera network may well see some large use cases go live in 2023, which could see the utility token HBAR benefit in the form of price rises. With some positive movement already seen, it could be the start of a significant stint of price appreciation for the HBAR token.

5. Bitcoin (BTC)

Bitcoin may be seen by many as the most conservative investment in the crypto space, but there’s no doubt that it remains the flagship project of Web3. With more and more regulation likely to arrive in 2023, the project stands to benefit from the absence of a centralized party running it, alongside the fame that the project holds.

If regulation continues to err on the side of defining Bitcoin as a commodity, it could well open the floodgates for institutional investors to flood funds into the market over 2023 and beyond, meaning that the price of BTC could well increase far above what we’ve already seen so far when TradFi starts to drive green candles instead of just the movement of the occasional crypto whale.

6. LTO Network (LTO)

LOT Network is a Netherlands-based project that focuses primarily on use cases where a hybrid solution is needed. These are usually use cases that require private data storage but public verification, and so LTO Network hopes to secure a big chunk of the enterprise market in this way.

The project already boasts some impressive partners, having worked with both the United Nations and IBM on different use cases. The project has also explored developing a Digital Identity (DID) product, which could open the door to more use cases in the future.

As the LTO token is used for all transactions on the project, we’re likely to see the price of LTO increase in line with the usage of the network, and so should more projects with high transaction volume appear in 2023, LTO holders might be in for a pleasant surprise.

7. Ripple (XRP)

Ripple has been locked in its legal battles with the SEC for years now, and for the dedicated community of supporters behind it, there is the belief that 2023 will be the year that the lawsuit is over.

Most analysts believe that it’s likely that Ripple will win the lawsuit with the SEC, which could mean that many established use cases gain the green light to formally acquire the XRP token for use in the primary Ripple use case — cross-border payments.

Should that happen, then we’re sure to see the price of XRP climbing to the highs it has not seen for years, if not even higher.

8. Monero (XMR)

Monero is a privacy-focused project that is looking to build an anonymous digital cash that allows for untraceable transactions across the globe, for everyday transactions all the way through to those of a crypto whale.

Monero faces an uncertain future in light of the increasing focus on regulation that governments have going into 2023. However, XMR holders are confident that the technical complexity of the project means that it cannot be stopped, and so should regulators reach some sort of cease-fire with the project, it could benefit the price of XMR.

9. Shiba Inu (SHIB)

Shiba Inu is a project that has built and maintained a passionate community of followers known as the Shib Army. The project may have started out as a meme coin following in the footsteps of the Dogecoin (DOGE) project, but the team has used the popularity of the project to pivot to a more utility-based DeFi offering.

The advantage that Shiba Inu has over Dogecoin is that the DeFi utility allows the project to continue to evolve over time, and this could help build and maintain excitement about the project as time progresses.

10. Polygon (MATIC)

Polygon is a layer-2 project for Ethereum, and the project aims to enable platforms on the Ethereum network to access its benefits in a more scalable way.

Polygon’s network has its own validators, but crucially also has the MATIC bridge — a bridge to the Ethereum network. This means that other projects built on Polygon are able to store data back on the Ethereum network periodically while benefitting from cheaper and faster transactions on Polygon in the meantime.

Polygon has already managed to secure a number of big enterprise projects, such as Starbucks and Nike, so it would not be a surprise to see the price of MATIC post big gains throughout 2023.

What project is the best choice for investors?

Metacade looks like an excellent choice from the top 10 coins for investors looking for major gains. By providing investors with incredible potential found in the platform’s features and implementation, not to mention significant discounts available in the presale, there’s no question that the largest potential upside is to be found in investing in MCADE.

As MCADE is so closely tied to the usage of the platform, 2023 is likely to see huge increases in token price. As the platform goes live and gamers flood the platform, those that take advantage of the presale for the limited time it remains open are certain to have an amazing journey ahead of them.

You can participate in the Metacade presale here.