Category: NEWS

-

Bitcoin bulls push BTC to highs of $23,300

- Bitcoin hit highs of $23,342 on Binance, with a breakout above $22k extending year-to-date gains.

- BTC price is up 30% in a month and has recovered 47% since the decline to $15,500 lows.

- Short liquidations were around $376 million in the past 24 hours.

Bitcoin price roared to highs above $23,000 on Saturday morning, rising to $23,342 on Binance as the price of the world’s largest cryptocurrency by market cap hit levels last seen in mid-August 2022.

BTC was changing hands around $22,900 at the time of writing, about 9% up in the past 24 hours after shedding some of the gains.

The price of Bitcoin was, however, still 35% up in the past 30 days, and as crypto trader and analyst Rekt Capital pointed out earlier this morning, BTC had rallied over 47% since falling to lows of $15,500 amid the FTX dump.

Bitcoin price chart showing BTC rally to $23,000 on 21 January, 2023. Source: TradingView

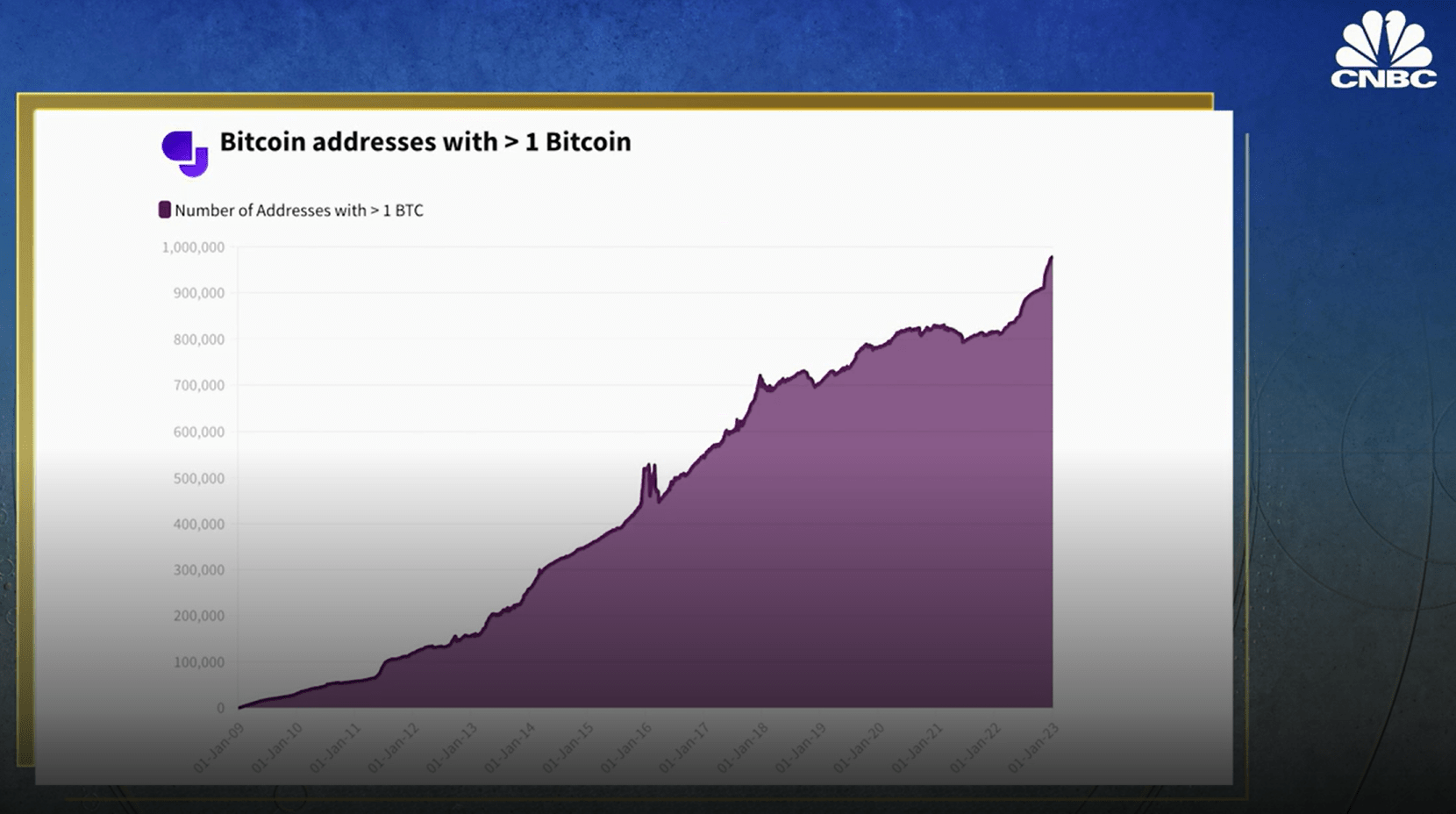

Bitcoin price chart showing BTC rally to $23,000 on 21 January, 2023. Source: TradingViewOn-chain data platform Santiment noted just before today’s break above $23k that Bitcoin’s price rally has come amid a bullish outlook from large BTC investors. As the firm highlights in the chart below, whale addresses with 1,000 to 10,000 BTC have in the past two weeks accumulated over 64,638 bitcoins worth more than $1.46 billion.

🐳 #Bitcoin has now surpassed $22.7k for the first time since August 18, 2022. The price rise has come as the large whale tier group of addresses holding 1,000 to 10,000 $BTC has collectively accumulated 64,638 ($1.46 billion) $BTC in the past 15 days. 👍 https://t.co/H6jCsZDgUR pic.twitter.com/RaN2I48ybg

— Santiment (@santimentfeed) January 20, 2023

Over $376 million in shorts liquidated

As Bitcoin raced to highs near $23,350, liquidation data showed that in the past 24 hours, about 80,497 traders had been liquidated.

According to Coinglass, the largest short liquidation was on Bitmex where an order worth $4.53million was rekt. The total liquidations as of 06:10 am ET on 21 January were $376.61 million.

Notably, total liquidations are not at the levels seen when BTC/USD broke above $20,000 last week towards erasing all post-FTX losses. Nonetheless, it still shows some traders are convinced this could be a gigantic bull trap.

But as it is, further upside momentum could see bulls target $25,000 or possibly higher if sentiment across risk markets helps bouy buy pressure.

-

Bitcoin’s recovery will depend on a lot of macro-activities affecting the market, says Dan Ashmore

-

Coinjournal’s Dan Ashmore says numerous factors, including inflation and rate hikes, have affected the prices of most cryptocurrencies.

-

He told CNBC that Bitcoin’s recovery would depend on numerous macro events affecting the market.

-

Bitcoin and the broader crypto market have lost more than 65% of their value since the all-time high of November 2021.

Bitcoin’s recovery will not happen overnight

Dan Ashmore, a cryptocurrency analyst at Coinjournal, told CNBC in a recent interview that the price recovery of cryptocurrencies will not happen overnight. When commenting about the price collapse last year, Ashmore said;

“Entering 2022, we were at the tail-end of one of the longest and most explosive Bull Runs in recent memory. And then the world is gripped by this inflation crisis post-pandemic. We also experienced one of the swiftest rate hike cycles in recent memories. That sucked the liquidity out of all these risky assets. It is not overly surprising that we have seen this massive pullback.”

The macro climate will play a role in market recovery

At press time, the price of Bitcoin stands at $21,163, down by more than 60% from the all-time high. While commenting on the possibility of price recovery, Ashmore said the macro climate would play a huge role in that regard. He said;

“In the last month or so, we have seen slightly more positive readings. It still has a long way to go, but it is brighter than it looked a month or two ago. We still have a long way to go before we get back to that $69,000 all-time high. This is not going to be an overnight process.”

He added that the rise depends on a whole range of variables in the macro climate going our way. Furthermore, the avoidance of incidents such as the LUNA, FTX, and Celsius crashes could help boost the market in the long term.

-