Category: NEWS

-

Its the calm before the storm in crypto markets

Key Takeaways

- Crypto volatility has come down and extreme on-chain activity subsided in period of relative calm

- Several concerning developments around Genesis, Gemini and DCG are still ongoing, however

- Volatility could also spark up once the US inflation data is revealed this week

- Period is reminiscent of the low drama environment pre-FTX in October

After a tumultuous rollercoaster following the shocking demise of FTX, a period of notable serenity has descended upon cryptocurrency markets.

With 2022 being a complete and utter bloodbath, it almost feels suspicious that there is even a couple of weeks of low drama in the digital market space.

But the metrics show that the last few weeks have been among the quietest of the last couple of years. Given the fear of contagion that transpired out of FTX’s collapse, that is a good thing.

Fear still elevated in crypto circles

Having said that, there is plenty to be concerned about right now. As Coinbase CEO Brian Armstrong stated yesterday when he announced Coinbase was cutting an additional 20% of its workforce, there are likely “more shoes to drop” and there is “still a lot of market fear” out there.

Crypto lender Genesis last week laid off 30% of its workforce and is reportedly mulling bankruptcy. Crypto exchange Gemini, founded by the Winklevoss twins, has $900 million of customer assets stuck in limbo with Genesis, its sole lending partner for its Earn product.

The twins have demanded Barry Silbert, CEOP of Digital Currency Group (DCG), which owns Genesis, to step down, accusing him of defrauding Gemini Earn customers.

DCG fired back, calling it “another desperate and unconstructive publicity stunt from Cameron Winklevoss to deflect blame”. It also affirmed it was “preserving all legal remedies in response to these malicious, false, and defamatory attacks).

DCG is also the parent company of the Grayscale Bitcoin Trust, which has seen a massive discount to its net asset value, peaking at 50% in the aftermath of the FTX collapse as investors questioned whether reserves were safe (I wrote about GBTC yesterday).

Markets stand firm for now

For now, while all these episodes play out, the markets are standing firm. Action has been relatively muted, and in fact there has been a tangible return to normal levels for a lot of on-chain activity that went wacky over recent periods.

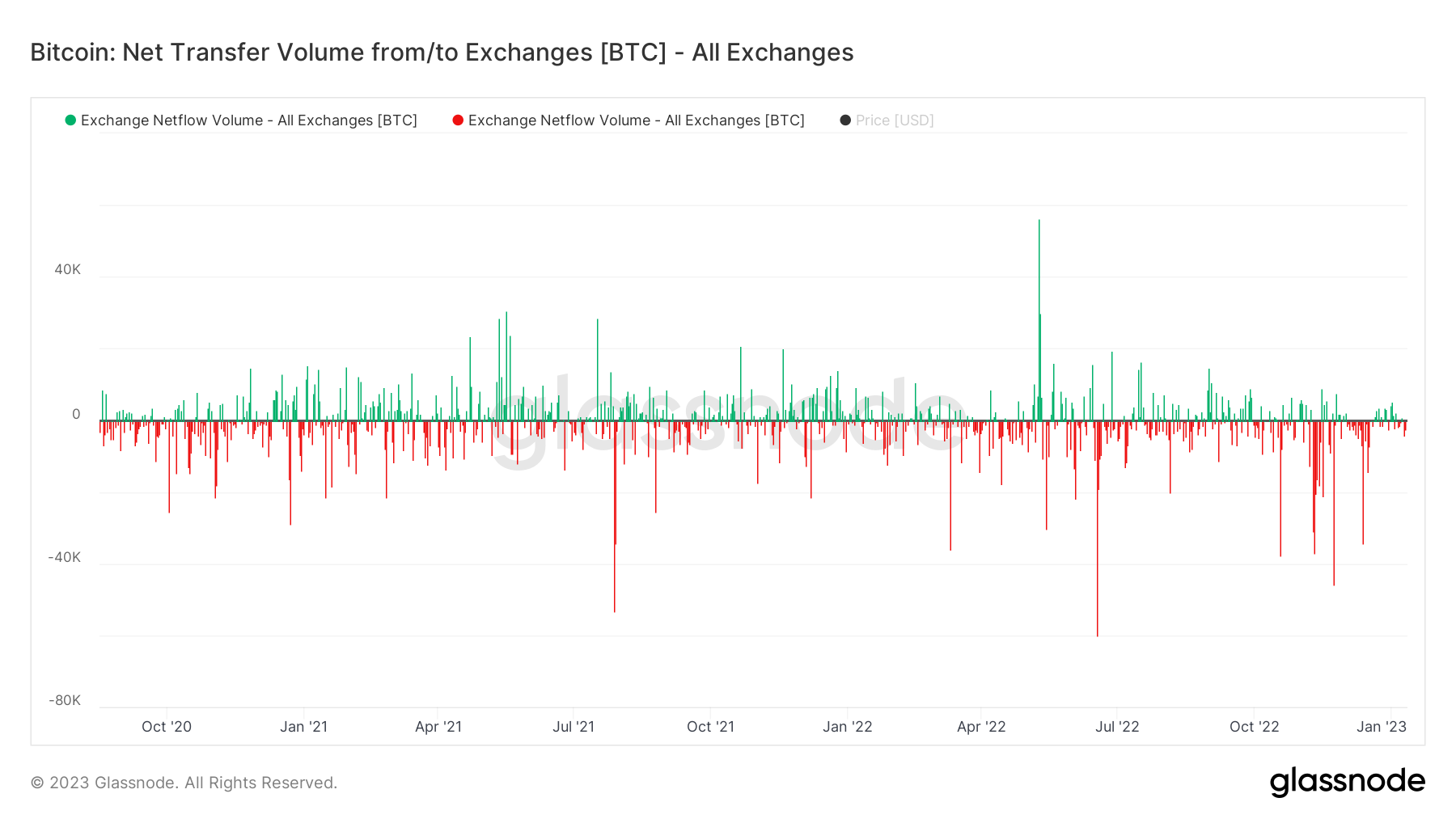

The below snapshot shows the net transfer volume in and out of exchanges. Since the start of the year, the action has been tepid, having spiked to extreme levels in November and December as first FTX collapsed and then the questions spiked about the health of Binance.

This notion that activity has returned to normal is reinforced when looking a the volatility of Bitcoin. The world’s biggest cryptocurrency has been trading sideways for a while now, and the 30-Day Pearson measure of volatility shows how there was a perceptible drop back down to pre-FTX levels in December.

Macro climate looking more optimistic

It hasn’t just been a respite from within crypto circles. The broader macro environment is looking at least a bit brighter today than it did last month. Inflation is still rampant, but there have been two consecutive readings below expectation, and there is renewed hope that it may have peaked.

The most recent round of interest rate hikes kicked rates up 50 bps as opposed to 75 bps in the two prior months, and while Fed chair Jerome Powell and other central bank chiefs have affirmed that rates will continue to rise until inflation is conquered, the market has moved cautiously upward after European inflation came in at 9.2%, compared to 10.1% last month.

Next up is the US CPI reading on Thursday, which will – as always – be a vitally important day in markets. Expect volatility in crypto markets as coins stare at the number to try to assess what Jerome Powell may do with regard to interest rate policy.

After all, we know by now that crypto is very much holding the stock market’s hand – apart from when, you know, high-profile executives are revealed to be fraudulent (FTX), or top 10 coins cease to exist (LUNA).

Never a dull moment for long in crypto

Back in late October, Bitcoin was seemingly locked in crab motion around $20,000. With traders getting impatient, I warned how crypto could be one event away from a nasty downward wick. T

Three weeks later, FTX collapsed. I never imagined this would happen, and the timing was coincidental, but the premise of the piece reminds me of how I feel now. It’s amazing how short memories are in markets, but we have been here before.

Crypto won’t stay silent for long, and the asset class is far from out of the woods yet. The aforementioned ongoings around DCG, GBTC, Genesis and Gemini are just a few of the million things that could turn south at any moment.

There is also the story around Binance chief Changpeng Zhao being under investigation for money laundering offences by the SEC, there is Coinbase laying off 20% of its workforce following a 905 drawdown in its share price, and God knows what will come out of testimonies in the Sam Bankman-Fried court proceedings.

And then there is macro, where anything could happen to inflation, the Russian war in Ukraine or myriad other variables. It’s been a quiet couple of weeks but don’t worry – the madness will return soon.

-

Grayscale Bitcoin Fund up 25% this year, but discount still killing investors

Key Takeaways

- GBTC Fund is up 25% since the start of the year, compared to a 4% rise in the underlying asset, Bitcoin

- The discount is now back to where it was prior to the FTX collapse, at 37%

- The discount had hit an all-time high of 50% only four weeks ago

The largest Bitcoin fund in the world, the Grayscale Bitcoin Trust, has seen its value jump by 25% since the start of the year. Bitcoin, on the other hand, is only up about 4% on the year.

This means that the discount to the underlying asset, Bitcoin, is at its smallest level in months. I had analysed the divergence in December, only four weeks ago, when the discount hit an all-time high of 50%.

Today, the discount sits at 37%, back to where it was before the ignominious collapse of FTX.

What is the Grayscale discount?

Grayscale is a trust which provides an avenue for investors to gain exposure to Bitcoin without physically buying Bitcoin. This can be convenient for institutions or other entities who may not be able to participate I the Bitcoin market directly for regulatory or legal reasons.

But Grayscale has rarely traded at the same price as its net asset value. Previously, it had traded at a premium to the underlying Bitcoin as shares surged with investors desperate to get exposure to the high-flying cryptocurrency.

Today, however, it is the opposite – a steep discount. While there is a chunky fee of 2% that explains some of the discount, this does not come close enough to bridging a discount of 30%+ that we have seen consistently in this crypto winter.

The SEC recently denied Grayscale’s application to convert the trust into an exchange-traded fund, spelling bearish action around the fund. There has also been the rise of more competition, with similar funds being launched, especially in Europe, and filings for Bitcoin ETFs.

But the most significant worry was surrounding the safety of reserves. This issue grew legs after the FTX collapse, as speculation mounted that Grayscale’s parent company, Digital Currency Group (DCG), may file for bankruptcy.

DCG is also the parent company to Genesis, which recently laid off 30% of its staff and is reportedly considering bankruptcy. Concern grew when Grayscale refused to publish a proof of reserves report, suddenly in vogue following the nefarious actions behind the scenes at FTX.

It cited “security concerns” as the reason that this would not be possible, but analysts decried this, with it very unclear what security concerns could be ignited by the publishing of public records on the blockchain.

6) Coinbase frequently performs on-chain validation. Due to security concerns, we do not make such on-chain wallet information and confirmation information publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure.

— Grayscale (@Grayscale) November 18, 2022

Why has the discount closed?

While the discount is still enormous at 37%, this has narrowed from the staggering 50% it reached in the aftermath of the FTX implosion.

There has been increasing pressure on DCG to address this discount, with calls from within the industry that the trust should allow investors to redeem their holdings, which would allow them to realise the full value of the Bitcoin they hold. This clamour may have helped narrow the gap somewhat.

One hedge fund, Fir Tree, even launched a lawsuit against Grayscale, demanding that the company either lower its fees or allow redemptions such that the discount can be closed.

But like everything in crypto right now, macro also has a part to play. The year has begun with crypto prices rising off increased optimism that inflation may have peaked. This follows a relatively serene month or so in crypto markets.

The discount widened to a large degree in the aftermath of the FTX crash because people feared contagion and the chips were still falling. Similar to the peg on Tether slipping when the UST crisis occurred.

Now that normal service has somewhat resumed, the discount has narrowed. Unfortunately for investors, it is still a staggering 37% off the net asset value. In a year where Bitcoin itself has plummeted, layering in a discount on top of that torrid price action is the last thing investors needed…

-

BONK price action spells trouble after becoming an overnight crypto sensation.

-

Bonk token launched on December 25, 2022

-

The cryptocurrency rose by four-digit percentages after the launch

-

BONK price has cooled and trades on a descent and could claim lower levels

Crypto has always treated its fans with twists, turns, and surprises. The crypto community loves it this way, for it becomes a time to make quick bucks as the rest of the market sleeps. In 2022, we were treated to a wild launch of the ApeCoin. Before the dust settled, Optimism airdrop came with a thud! The year couldn’t end in a better way for crypto fans than it did with the Bonk token (BONK/USD).

If you are a fan of meme tokens, then BONK does not miss your watchlist after a heroic entry into the crypto space. Launched on December 25, 2022, BONK has been a sensation, jumping by four digits percentage in price. The token also dominated social trading platforms. Analysts credited the popularity of the newly dog-themed token to the Solana community. The former is based on the Solana network.

Nonetheless, if history is indeed a good teacher, then we should learn that the gains may not last forever. We have seen highly hyped launches boosting token prices, only for them to crash thereafter. BONK may not be an exception. As of press time, the meme cryptocurrency had lost at least 50% of its value from its all-time high. Typical of the phrase, if you didn’t board early, don’t do it now. Technical pointers show BONK could fall further.

BONK on a decline as price finds minor support

BONK/USDT Chart by TradingView

From the 4-hour chart outlook, BONK trades nervously at a support zone. The highs to the upside have been lower, coinciding with a declining price. Buy-side volumes have improved slightly at the support, but not sufficient to boost BONK’s price.

BONK price prediction

As the hype around the BONK launch dies, the price could continue falling. Investors may look at BONK as an overvalued asset. Profit-taking and panic selling may also be at play and force a bearish breakout.

Where to buy BONK

-

-

Bitcoin price (BTC/USD) could tank further, but you might be excited by this Bloomberg prediction

-

Bloomberg report projects bullish Bitcoin in 2023

-

Analysts bank on recession dynamics and central banks’ actions as bull triggers

-

BTC trades on a short-term recovery, with $19,000 in sight

Investors may hold their breath, hoping that 2023 will turn out to be a good year for crypto and stocks alike. But even with these hoped-for expectations, market analysts have warned that 2023 could be the year of a global recession. With the economic depression, notable recoveries may be hard to come by. But Blomberg analysts think a recession would be a bullish trigger for Bitcoin price (BTC/USD). How?

In its cryptocurrency outlook, analysts say Bitcoin will come out ahead in a potential economic shutdown in 2023. Even so, the prediction is not outright. According to the report, Bitcoin could slide to $12,000 or even $10,000. From there, it will stage a strong comeback.

Additionally, the Bloomberg report highlights policy easing in 2023 as a key bullish trigger for Bitcoin and cryptocurrencies. The analysts say central banks could be forced to ease policy on the back of deflationary outcomes. If this happens, the use case of Bitcoin as a digital version of gold will strengthen. The analysts point out that Bitcoin will start performing like the US long-dated treasury bonds and metal. The scenario will be bullish for the digital asset.

Bitcoin price movement as moving averages join the support

Technically, BTC is mildly bullish and trades along a short-term ascending trendline. The price has, for the first time since November, moved above the 50-day moving average. A potential 20-day MA crossover of the 50-day MA could heighten the recoveries. The RSI reading has safely surpassed the midpoint reading of 50, indicating that buyers are in control.

What is the likely target for BTC?

With the upside, Bitcoin now trades below an overhead and crucial resistance at $19,000. Should the current upside continue, the level is the target zone for buyers. Accelerated recoveries will depend on the prevailing crypto sentiment.

Where to buy BTC

eToro

eToro offers a wide range of cryptos, such as Bitcoin, XRP and others, alongside crypto/fiat and crypto/crypto pairs. eToro users can connect with, learn from, and copy or get copied by other users.

Binance

Binance is one of the largest cryptocurrency exchanges in the world. It is better suited to more experienced investors and it offers a large number of cryptocurrencies to choose from, at over 600.

Binance is also known for having low trading fees and a multiple of trading options that its users can benefit from, such as; peer-to-peer trading, margin trading and spot trading.

-

-

Binance coin BNB back to safety as buyers now aim for $295

-

Binance coin has recaptured crucial support at $266 after the latest crash

-

The cryptocurrency was previously weighed by adverse publicity

-

A recovery above $266 sets BNB to the next resistance at $295

Binance (BNB/USD) traded at $274 on Tuesday, slowing from a monthly high of $282 the previous day. BNB buyers would be delighted about how far the cryptocurrency has come since Binance began to be adversely mentioned.

Touching a low of $220 in mid-Dec, there were fears of further downside for BNB after the collapse of FTX. That’s particularly because, at the price level, BNB had lost crucial support at $266, which kept it stable. However, relentless buying has seen BNB recover to the level which now supports the price.

BNB price is at least now back to safety above $266. However, Binance’s woes seem to be far from over. The latest cryptocurrency news suggests that US federal prosecutors have started to investigate the crypto exchange. According to reports, several American firms have been issued subpoenas for their communications with Binance. The exchange is reportedly being probed for violations of the US Bank Secrecy Act. The regulations mandate financial entities to verify their clients in a bid to curb money laundering. BNB price is yet to react to the potential litigation.

BNB recovers above $266 support as price turns mildly bullish

A technical outlook gives BNB $295 as the likely price target. This is the next resistance zone, and BNB has in the past hit the target each time price has recovered above $266. The MACD indicator is shifting above the neutral zone, underlining a bullish momentum. Similarly, BNB trades above the moving averages. The 50-day MA could hold as the dynamic support, coinciding with the $266 level.

Is investing in BNB now a good idea?

A retest of the $266 support would open buy trades on the cryptocurrency. Investors should watch for bullish price action signals at the support to buy BNB and ride to the $295 resistance.

Where to buy BNB

eToro

eToro offers a wide range of cryptos, such as Bitcoin, XRP and others, alongside crypto/fiat and crypto/crypto pairs. eToro users can connect with, learn from, and copy or get copied by other users.

Bitvavo

The Bitvavo platform was launched in 2018, with the goal to bridge the gap between traditional currencies and digital assets. Bitvavo is making digital assets accessible to everyone, by offering transparent fees, a wide range of assets and an easy to use platform.

-