Category: NEWS

-

Back to basics for Chainlink. Bulls have to defend $6 before a further crash happens.

-

Chainlink traded at $6 on Monday, stabilising at the crucial support

-

LINK buyers have always defended $6 against the onslaught of bears

-

LINK could fall further if a break in the crucial support happens

The start of Chainlink staking ignited an interest in the native token LINK. The cryptocurrency was on an uptrend in the last two weeks of November, ahead of the crucial milestone in early December. But as the early access kicked off, LINK has failed to register gains. Instead, the token has succumbed to the bear market. Bulls are battling $6, as the price now faces a brutal collapse if bears win. But will this happen?

Chainlink price outlook and analysis

$6 is an important price level for Chainlink. Past price action shows that bulls have defended this crucial level since June. The level has been tested severally, offering clues that LINK could overcome a further slump.

Nonetheless, there is no price action signal to support a recovery up to this point. From the daily chart below, multiple inside bars are forming at the crucial level, underlying indecision in the market. Since this happens in a bear market, it signals the exit of sellers or the entry of buyers.

From a technical outlook, LINK trades below the 20-day and 50-day moving averages. The moving averages have almost been flat, indicating that LINK is better considered to be in an extended consolidation. The cryptocurrency is recovering slightly, although the RSI signals that bears remain in control.

Will Chainlink recover?

The next price action will shape the direction of Chainlink. LINK price has stabilised at $6, but the bear pressure is still on. If the cryptocurrency loses this support, a lower price of around $5.4 will remain in sight.

Where to buy LINK

eToro

eToro offers a wide range of cryptos, such as Bitcoin, XRP and others, alongside crypto/fiat and crypto/crypto pairs. eToro users can connect with, learn from, and copy or get copied by other users.

Bitstamp

Bitstamp is a leading cryptocurrency exchange which offers trading in fiat currencies or popular cryptocurrencies.

Bitstamp is a fully regulated company which offers users an intuitive interface, a high degree of security for your digital assets, excellent customer support and multiple withdrawal methods.

-

-

Shiba Inu (SHIB/USD) nears a demand zone

-

Shiba Inu recovered 1.21% on Monday after a bearish move

-

The developers teased a “countdown,” as some fans speculate the Shibarium update

-

SHIB could touch the June lows next

Shiba Inu (SHIB/USD) gained 1.21% on Monday to trade at $0.0000087. The token is slightly recovering from a bottom price of $0.0000080 over the weekend. This is an important zone for SHIB, or rather, the cryptocurrency could touch a demand zone that was crucial to bulls in the past.

A historical price movement of SHIB shows that $0.0000072 is a potential demand zone for SHIB. At the height of a bear market earlier this year, SHIB settled at this zone in June before embarking on a strong recovery. The gains took SHIB to a high of $0.0000179 in August before another bear cycle followed. Amid the intraday gains, this is the next level to watch for SHIB.

Meanwhile, the Shiba Inu community is guessing about the Shibarium beta test. This was after a weekend tweet teased users with a “special countdown.” The countdown was still running down at 7 hours and 48 minutes as of press time. It is unclear what this countdown is all about, but users started to speculate on the Shibarium update. Others quashed it as a distraction to unimportant partnerships and hire.

As the “countdown” unfolds, Shiba Inu fans will keep their hands crossed that something important will pop up. Probably, this could coincide with reports that SHIB is alongside BTC and ETH, the most watched cryptocurrencies on Binance. But technical indicators show a potential further slump.

SHIB recovers slightly from an oversold level near the June lows

On the daily chart, SHIB is on a slight upside after touching a level slightly above the June lows of $0.0000072. The trend is still bearish, and a potential decline to June’s bottom could be on the card. The RSI reading is still below the midpoint, signalling a bear control.

When will SHIB become bullish?

The $0.0000072 could attract buyers again if bulls fail to capitalise on the current SHIB price recovery. This is the level to watch for bullish reversal signals.

Where to buy SHIB

eToro

eToro offers a wide range of cryptos, such as Bitcoin, XRP and others, alongside crypto/fiat and crypto/crypto pairs. eToro users can connect with, learn from, and copy or get copied by other users.

Bitstamp

Bitstamp is a leading cryptocurrency exchange which offers trading in fiat currencies or popular cryptocurrencies.

Bitstamp is a fully regulated company which offers users an intuitive interface, a high degree of security for your digital assets, excellent customer support and multiple withdrawal methods.

-

-

Arguing that governments can’t shut down Bitcoin is missing the point

Key Takeaways

- Chair of the US Banking Committee has suggested a ban on all cryptocurrencies

- Many declare that crypto is immune to government shutdowns, but this is only true directly

- By attacking the ecosystem and the ability to access it, crypto can be curtailed significantly by lawmakers

Bitcoin cannot be shut down, so the saying goes. But this misses the point.

Firstly, let me be clear and affirm that this mantra is true, technically at least. Bitcoin exists on the Internet and hence it is immune to being shut down. Unless, of course, you somehow shut down the Internet. But for all intents and purposes, Bitcoin is decentralised and exists in the online world, a feat of technology that makes it resilient to being restrained.

Bitcoin can’t be shut down directly, but indirectly is a different story

But while a direct shutdown of the blockchain is impossible, governments can, at least theoretically, dent Bitcoin heavily and curtail its adoption by the masses. It might not qualify as technically shutting it down, and I am not commenting on the likelihood that this happens, but there is little doubt that if a concerted enough effort is made, an assault by lawmakers on Bitcoin could be devastating.

We need only look at the prevalence of centralised entities in the space. While Bitcoin itself is decentralised, in order for the masses to access it, the vast majority go via centralised companies such as Binance or other exchanges. And what happens if governments go after these companies?

These companies will be forced to abide by the laws. Sure, decentralised exchanges (DEXs) will remain, and like Bitcoin itself, are resilient to being directly shut down. But would you expect Bitcoin to achieve mainstream success and continue to grow into a legitimate financial asset if DEXs were the only option?

Not only would institutions be reluctant to pursue this route, but they could also just be banned from holding it.

US Banking Committee Chair suggest banning cryptocurrencies

I write this article now in the wake of the story which emerged regarding the US Banking Committee Chair, Sherrod Brown, suggesting a ban on cryptocurrencies.

Brown said:

“I’ve already gone to the Treasury and the Secretary and asked for a government-wide assessment through all the various regulatory agencies. … The SEC has been particularly aggressive, and we need to move forward that way and legislatively if it comes to that.”

It has been scoffed at in some quarters, but it’s worth paying attention to. The US is the financial capital of the world. Were the SEC to come out and ban it, this would have a seismic impact.

Think of the chunk of the market that could be forbidden from holding Bitcoin – institutions, pension funds, public companies, etc. Or all the infrastructure that would be torn down, such as exchanges.

On the flip side, it does remain a remote possibility. And getting back to my point earlier about how people overlook the potential for governments to shut Bitcoin down, Brown did acknowledge that “We want them to do what they need to do at the same time, maybe banning it, although banning it is very difficult because it would go offshore, and who knows how that would work.”

Final Thoughts

I’m not predicting any sort of demise for Bitcoin or crypto off the back of this. I just think that too many overlook how damaging governments can be towards the world’s biggest cryptocurrency.

Sure, the beauty of the blockchain is that it cannot be shut down directly. But indirectly? That is a different story. Governments carry too much power to be written off as “irrelevant” when it comes to Bitcoin.

So far, there is nothing to think that countries such as the US will make such drastic moves to ban crypto. But after a torrid 2022 that has seen scandal after scandal rock the space, comments such as Sherrod Brown’s are not surprising.

In the remote possibility that these words were ever put into action, it would be foolish for investors to write it off as a benign development for crypto.

-

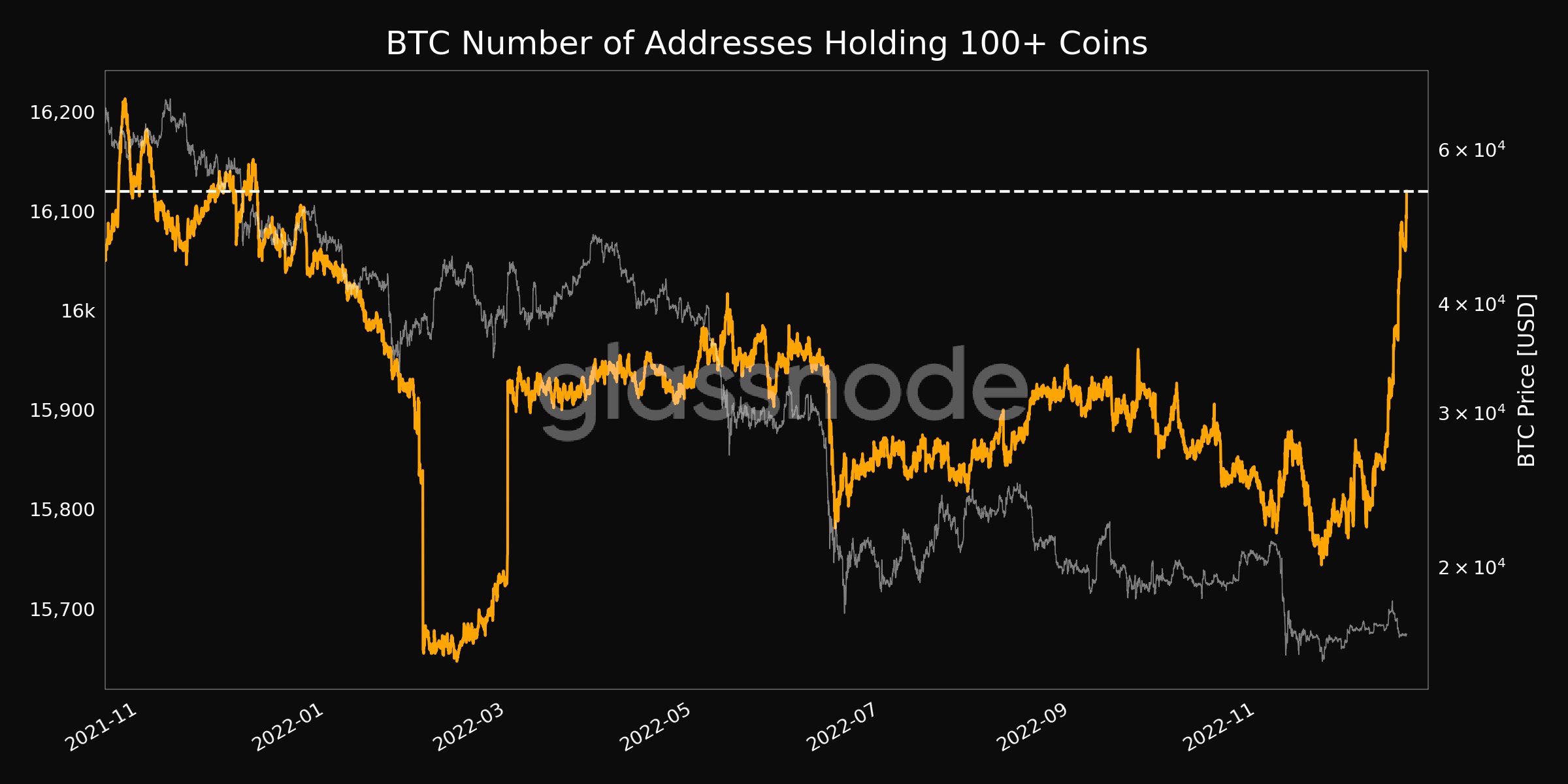

Bitcoin wallets with 100+ coins hit new one-year high

- Bitcoin addresses with 100 or more coins hit 16,120 on 19 December 2022.

- Each address is worth $1.67 million at current prices, increasing the number of Bitcoin millionaires to the highest level since December 2021.

- Data also shows hodling is on the rise despite crypto winter, with 46% of BTC last active in 2+ years and 1.6 million coins last active in 1-3 months.

Bitcoin continues to consolidate around $16,700 after weathering recent sell-off pressure. Bears remain very much in the picture, given last week’s jump to above $18,000 and then the sharp fall to current levels.

But there’s an opportunity in the midst of all the contagion – and that is what Bitcoiners are capitalizing on.

Addresses with 100+ coins hit 1 year high

According to the on-chain and exchange flows monitoring platform Glassnode, sharks and whales have aggressively added to their overall holdings in the past few days.

Indeed, as the flagship cryptocurrency’s price hovers above its notable base on Monday, on-chain alerts for BTC indicate that addresses with 100+ bitcoins now hold the most coins since last December. Per the data, large accounts with at least $1,670,000 worth of BTC as of 19 December 2022 had jumped to 16,120.

This is a new all-time high, with the last 1-year high being 16,106 addresses recorded on 23 December 2021.

Bitcoin addressed holding 100 or more BTC reach one year high. Source: Glassnode

Bitcoin addressed holding 100 or more BTC reach one year high. Source: Glassnode46% of Bitcoin last active 2+ years

As large investors scoop Bitcoin on the cheap, the number of hodlers (people who buy Bitcoin and hold onto their assets long term regardless of market conditions) has also increased. As CoinJournal recently reported, whales have been busy, buying over $726 million worth of BTC despite the FTX contagion.

The latest data on this metric shows that the amount of BTC supply last active 2+ years has 46.3%, a 22-month high. According to Glassnode, 7.5 million BTC was being HODLed (the metric also counts lost coins) as Monday 19, December 2022. The last time the measure of hodled or lost BTC was this high was in January 2021.

Meanwhile, the number of coins last active 1-3 months is now more than 1,603,380 bitcoins. The moving average translates to a 3-month high for the number of coins that have not moved for the last 30 to 90 days.