The cryptocurrency market has been fluctuating for several weeks now. Nevertheless, there are indications that cryptos such as Shiba Inu (SHIB) and OKB (OKB) may be gearing up for potential bullish performance. This state of affairs comes as Big Eyes (BIG), a potential next big cryptocurrency, gains pre-sale popularity.

Undoubtedly, these cryptos have so much potential in these coins, making buying into them worth prioritizing. Thus, this article discusses what the numbers are for Big Eyes (BIG) and why Shiba Inu (SHIB) and OKB (OKB) may be preparing to embark on a bull run. Let us take a look.

Buy Big Eyes Coin For A Chance To Earn Big

The Big Eyes (BIG) pre-sale indicates that the new cryptocurrency is becoming popular among crypto enthusiasts. At the time of writing, Big Eyes (BIG)—now in Stage 5 of its pre-sale—has raised over $7.1 million, with the new altcoin fast selling out.

Big Eyes (BIG) is a community-focused meme token seeking to disrupt the meme sector by revolutionizing how meme tokens function. As such, Big Eye (BIG) aims to drive wealth into the decentralized finance (DeFi) sector by leveraging the wealth-generating capability of non-fungible tokens (NFTs).

Big Eyes’ (BIG) promises to enable users to become wealthy. This promise may be why crypto enthusiasts are rushing to buy the new cryptocurrency, especially during the bear market when many other cryptos are failing to live up to expectations

Watch Out For Shiba Inu As Its Ecosystem Grows

At the beginning of the bear market, Shiba Inu’s (SHIB) price drop was very sporadic, leading analysts to predict that it may not sustain the bear market.

However, its price performance has normalized since the altcoin’s recent drop to 15th position on the list of largest cryptos by market capitalization, per CoinMarketCap.

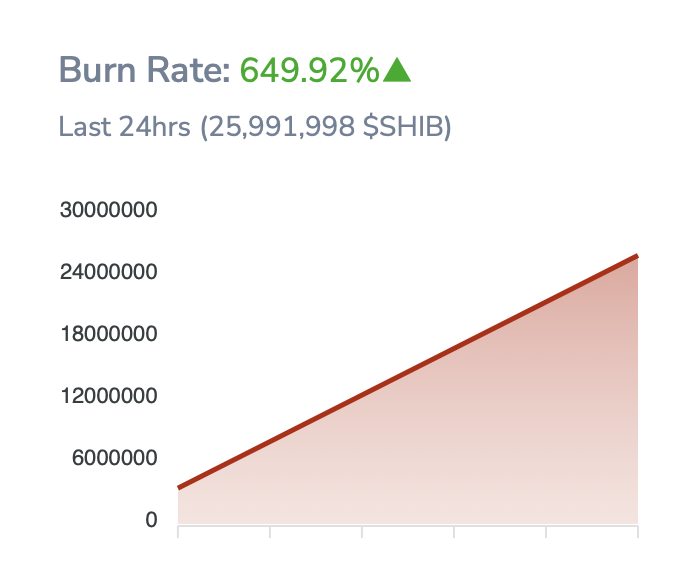

As things stand, the number of crypto enthusiasts showing interest in Shiba Inu (SHIB) is growing steadily. This surge in interest is due to Shiba Inu’s (SHIB) growing ecosystem, which features several key products and beneficial offerings.

Per reports, the number of Shiba Inu (SHIB) holders reached a new all-time high of 2,193,520 a day after the launch of the long-awaited Shiba Eternity play-to-earn (P2E) game. Statistics also show that the number of Shiba Inu (SHIB) holders has increased by 171,763 since July, with 104,200 being added only since September.

In the coming months, more upcoming developments will be key in growing Shina Inu’s (SHIB) price. Also, the growing number of Shiba Inu (SHIB) holders means the altcoin may be on the verge of embarking on a bull run, which will make its price explode.

OKB Is Still In The Game

OKB (OKB) is a cryptocurrency on a steady upward trend. Despite bear market effects, OKB (OKB) continues to stay true to its promise of helping users experience a better future. OKB (OKB) enables users to explore the worlds of decentralized finance (DeFi), decentralized apps (dApps), NFTs, and gaming finance (GameFi).

In September, OKB (OKB) witnessed an over 20% price increase to reach $16.56, up from around $13. Although OKB’s (OKB) price is unsteady due to bear market conditions, reports indicate that the altcoin is currently enjoying increased buy support.

OKB’s (OKB) price is on an uptrend amid short periods of decline, meaning the altcoin may be on its way to a sustained bull run. Experts believe that this could push its price to $20 before the end of 2022.

Based on what we have seen, Shiba Inu (SHIB) and OKB (OKB) are worth keeping an eye on and adding to your portfolio. Both altcoins’ roadmaps show that there is much to look forward to between now and the coming years. Like them, Big Eyes (BIG) boasts a robust roadmap that could help it surpass expectations when it hits the market.

Big Eyes (BIG) currently ranks among the most anticipated cryptos in 2022, and you should leverage its low price to buy the potential next big cryptocurrency during the bear market.

For more information on Big Eyes (BIG), visit these links:

Big Eyes Coin (BIG)

Presale: https://buy.bigeyes.space/

Website: https://bigeyes.space/

Telegram: https://t.me/BIGEYESOFFICIAL

Disclaimer: This article is a paid publication and does not have journalistic/ editorial involvement of Hindustan Times. Hindustan Times does not endorse/ subscribe to the contents of the article/advertisement and/or views expressed herein.

The reader is further advised that Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions.

Hindustan Times shall not in any manner, be responsible and/or liable in any manner whatsoever for all that is stated in the article and/or also with regard to the views, opinions, announcements, declarations, affirmations etc., stated/featured in same. The decision to read hereinafter is purely a matter of choice and shall be construed as an express undertaking/guarantee in favour of Hindustan Times of being absolved from any/ all potential legal action, or enforceable claims. The content may be for information and awareness purposes and does not constitute a financial advice.