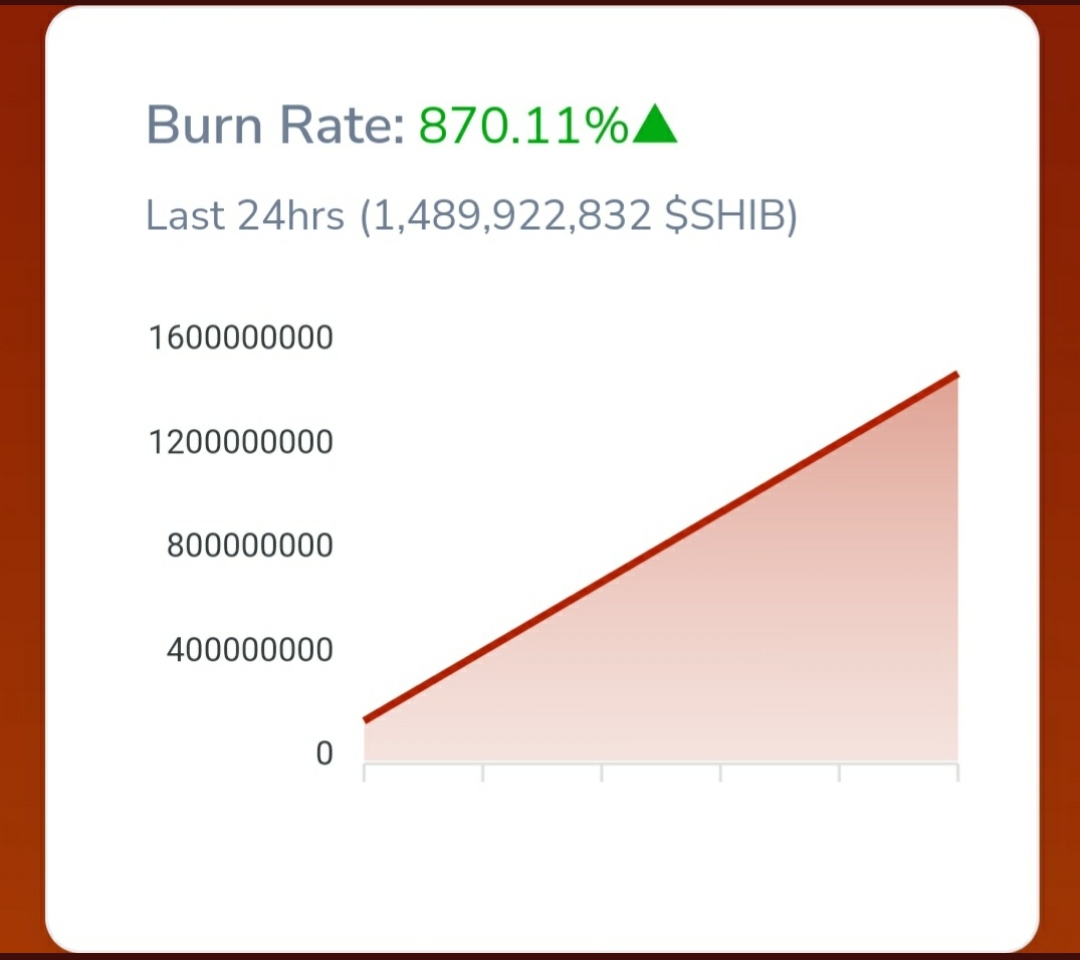

![]() Shiba Inu Supply410,343,685,857,241Total burnt from initial supply999,991,595,231,526Max Total Supply589,656,314,142,758Total Supply553,775,848,615,341Circulating Supply35,880,465,527,416Staked (xSHIB)Burn Rate: 903.75

Shiba Inu Supply410,343,685,857,241Total burnt from initial supply999,991,595,231,526Max Total Supply589,656,314,142,758Total Supply553,775,848,615,341Circulating Supply35,880,465,527,416Staked (xSHIB)Burn Rate: 903.75

SHIB BURN RATE IS UP 850% today will shib hit $0.1 POWERED BY OMAX TOKEN

WANT A NEW 10000X GEM HERE IS OMAX TOKEN ..

What Is OMAX TOKEN (OMAX)?

OMAX is a community-driven token which was launched on 3rd of November 2021 with the intention to have its own blockchain to educate the next generation of investors and make crypto simple and safe for everyone.

OMAX is one of the fastest growing projects which is moving from BEP20 to their own network (blockchain OMX20) which is also a EVM compatible. It is way ahead of the roadmaps and the blockchain is already on testnet and open for public testing with 87K TPS with estimated 100K+ TPS on mainnet.

It further plans to launch a marketing campaign on Twitter to raise awareness and reach 100,000 holders. That will likely go hand in hand with launching of their blockchain.

OMAX was advertised in Times square NY and famous celebrities promoted across the globe. Promotion videos can be found in the social media.

What Makes OMAX Unique?

In contrast to many other coins, OMAX promises to feature a complete ecosystem that gives its token real value. Its blockchain, Ecommerce integration, Crypto card. By integrating our Blockchain into popular e-commerce and shopping cart platforms, we aim to grant users the ability to easily complete their everyday purchases using their crypto currency balances.

OMAX blockchain on mainnet is scheduled to launch by the end of July 2022.

OMAX is headquartered in DUBAI, UAE because of its friendly crypto law. Though the owners are from Australia and United Kingdom. They have a plan to launch the OMAX exchange in January 2023.

How Many OMAX Tokens (OMAX) Are There in Circulation?

OMAX has a total supply of 10 billion tokens. 4% of that was already burned. In addition, OMAX follows the patented approach of deflationary tokens by burning 4% of each token at a BUY&SELL transaction. Doing that, the team wants to constantly shrink the existing token supply and increase the value of OMAX.

How Is the OMAX (OMX 20) Network secured?

OMAX Chain relies on a system of PoS consensus that can support short block time and lower fees. The most bonded validator candidates of staking will become validators and produce blocks. The double sign detection and other slashing logic guarantee security, stability, and chain finality. The OMAX Chain also supports EVM-compatible smart contracts and protocols. This is the native and only usable currency in the OMAX ecosystem.

These are the key links to the explorer and whitepaper for their own blockchain and the website is http://OMAXCOIN.COM

Visit their website:

BEP20 http://OMAXTOKEN.COM

OMX20 http://OMAXCOIN.COM

Explorer: https://t.co/Pdj5qlCxW3

Testnet: https://t.co/eMLHHW6zCd

Faucet: https://t.co/XP8WuAd1xF

How to integrate to Metamask to check the transaction.

RPC url: https://t.co/j1IroqtGgU

Chain id: 1254

Network name: OMAX testnet

Symbol: OMAX

Block explorer url: https://t.co/eMLHHW6zCd