ROBINHOOD EXCHANGE TEASES BINANCE OTHER EXCHANGES IN A RECENT TWEET

IN A RECENT TWEET ROBINHOOD TEASES OTHER EXCHANGES INCLUDING BINANCE ETC

ROBINHOOD EXCHANGE TEASES BINANCE OTHER EXCHANGES IN A RECENT TWEET

IN A RECENT TWEET ROBINHOOD TEASES OTHER EXCHANGES INCLUDING BINANCE ETC

ROBINHOOD EXCHANGE TEASES BINANCE OTHER EXCHANGES IN A RECENT TWEET

BABYDOGE IS ALL SET TO TAKE OVER NFT WORLD WITH ITS COLLECTION OF NFTS

1.5 million #BabyDoge holders Only 5300 NFTs left for public mint What could happen ?

Let’s goooo #BabyDogeArmy

BITCOINLFG CEO SUHAILMATTU IS BULLISH ON BABYDOGE AND PREDICTS THAT IT CAN BEAT BORED APE YATCH CLUB IN FUTURE WITH BIG SPONSORSHIPS GOING ON .BabyDoge NFTs are officially live on the occasion of 4/20 (April 20th) and users can mint their favorite digital artwork of their choice. In no surprise, the launch was scheduled exactly at 4:20 PM EST to commemorate the special day. The newly launched NFTs are available for minting on OpenSea and around 450 artworks are currently up for grabs. In another surprise, a poll conducted by BabyDoge shows that 69% of investors are eager to mint the NFTs.

You can check out BabyDoge NFT collections on OpenSea here. Their tagline on the open platform reads, “Just a baby doge trying to make some NFTs.” The page is also officially verified on OpenSea

Why Bitcoinlfg CEO is Bullish on KISHU INU . AS KISHU INU IS TRENDING WORLDWIDE ON BITCOINLFG PLATFORM

bitcoinlfg ceo suhailmattu explains why he is bullish on KISHU

UTILITY , WHALES AND TEAM which tokens lack nowadays u can have a great utility but not whales u can have whales but not a great team but KISHU have all in the long run i am expecting KISHU to Hit $3 BILLION market cap with big sponsorships they have currently will build token reputation and can outplay market sentiments in nearby future

The team aims to turn the project into something more than just a meme or a joke, and most importantly, to empower the KISHU token with the qualities of a real long-standing currency. The main competitive difference from comparable coins is that Kishu Inu is completely community-owned: the developers do not reserve tokens for the team, but rely on donations.”

Kishu Inu details several features in its roadmap like the Kishu Swap, the Kishu Crate non-fungible token (NFT) marketplace, the Kishu sWAG merchandise store, and more.

a tweet by ronaldhino gaucho confirmed that he is partnering with #BabyDoge to help support the biggest army in crypto with an NFT collection.

book your ads now http://t.me/coinmarketingagency for 30 days starting at cheap price

OVER 1.2 MILLION FOLLOWERS ON TWITTER BABYDOGE IS THE KING OF MEMES

BABYDOGE CAN OUT PERFORM OTHER MEMECOINS DUE TO ITS INCREASING INFLUENCE AND DECREASING FUD AND BIG UPCOMING FUTURE SPONSORSHIPS BABYDOGE IS LIKELY TO OUT PERFORM MANY ALTS LIKE SHIBA INU , DOGECOIN,FLOKI ETC AS PREDICTED BABYDOGE CAN HIT $5 BILLION MCAP THIS YEAR MAKING IT A 12 TO 15X COIN IN THE MARKET\

For those who are new to the Crypto investing platform, Shibnobi, commonly known as SHINJA is a community-driven token/platform that envisions developing one of the best investment Ecosystems for the next generation. It plans on making crypto extremely easy and safe for all the people who are interested in investing in cryptocurrencies. Its mission statement is to make the crypto space safe, fair, and more informative for the average investors and vetted projects.

Shibnobi (SHINJA) is a revolutionary deflationary token that introduces a multi-chain swap (DojoSwap) between Ethereum (ETH), Binance (BNB), and Polygon (POLY) (MATIC).

Shibnobi, led by developer Cliff Fettner, aims to provide a user-friendly multi-chain switch in the DeFi ecosystem, with incentives for early adopters. Shibnobi’s mission is to become the dominant DeFi protocol, a one-stop-shop for all EVM-compatible network traders, ushering in a new age of user-friendly and intuitive cryptocurrency trading for DeFi novices and professionals alike.

Shibnobi was released at 7 p.m. UTC on November 15th, 2021. It provides an easy-to-use multi-chain token swap, allowing any crypto enthusiast to join in. Staking is included in the project, which also includes charity fundraising and a video game.

remember this is not a financial advice do your own research before investing into crypto

bitcoinlfg ceo suhailmattu explains why he is bullish on Babydogecoin

growth in holders will HELP in Reputation of the meme coin at Global stage

UTILITY , WHALES AND TEAM which tokens lack nowadays u can have a great utility but not whales u can have whales but not a great team but Babydogecoin have all in the long run i am expecting Babydogecoin to Hit $3 BILLION market cap with big sponsorships they have currently will build token reputation and can outplay market sentiments in nearby future

According to on-chain data provided by WhaleStats, the number of BabyDoge holders has reached the local high of 1.6 million+ holders and more

Currently, whales are holding more than 45-60 trillion BabyDoge, which is a relatively low number compared to holdings in smaller wallets. Compared to Shiba Inu, BabyDoge does indeed follow its predecessor’s steps, when smaller wallets fueled the rally while whales came to the party later

What is BabyDoge?

Baby Doge Coin (BABYDOGE) is a hyper-deflationary token that claims to be an “improved’ form of the more famous Dogecoin, as it will become more scarce over time, with the goal of increasing transaction speeds.

Saitama has more then 350000+ holders has a All time high of diluted marketcap reaching 2 billion plus dollars

bitcoinlfg ceo suhailmattu explains why he is bullish on saitama

UTILITY , WHALES AND TEAM which tokens lack nowadays u can have a great utility but not whales u can have whales but not a great team but saitama have all in the long run i am expecting Saitama to Hit $10 BILLION market cap with big sponsorships they have currently will build token reputation and can outplay market sentiments in nearby future

According to data of Bitcoinlfg , the number of BabyDoge holders has reached the local high of 1.6 million+ holders and more

Currently, whales are holding more than 45-60 trillion BabyDoge, which is a relatively low number compared to holdings in smaller wallets. Compared to Shiba Inu, BabyDoge does indeed follow its predecessor’s steps, when smaller wallets fueled the rally while whales came to the party later

What is BabyDoge?

Baby Doge Coin (BABYDOGE) is a hyper-deflationary token that claims to be an “improved’ form of the more famous Dogecoin, as it will become more scarce over time, with the goal of increasing transaction speeds.

Will baby Doge get listed?

Baby Dogecoin is not currently listed on Binance, nor is it on other leading cryptocurrency exchanges such as Coinbase. However, it is now listed on Okex where users are free to trade Baby Doge securely.

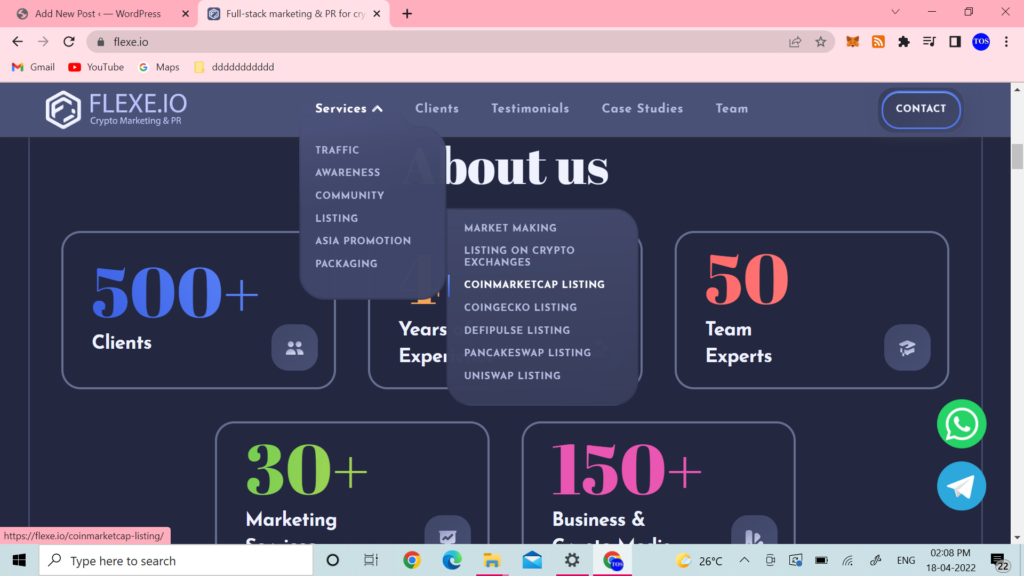

is listing scams by taking money through their insiders real

and how trusted investors are getting scammed by coinmarketcap.com the reason?

by being the most trusted coin tracker coin market cap has a responsibility to provide security to their investors but how listing is being sold by the coinmarketcap for thousands of dollars

but taking money is not the issue they can charge whatever they want the issue is not kyced developers and audited contracts without the data they list coins by their insiders who had taken money from tokens to list them in a short period of time investors invest token pumps developers take profit and leaves or abandons the coin . many investors has faced the same

but who is responsible who has insiders who gets paid and who gets scammed will they take responsibility ?

the clear answer is no . because the independent coin tracker is now owned by binance and binance is clearly allowing that the projects can scam without even caring about their investors . yes any project can get listed can get to trending section can scam and can be on top . and no one gonna question because do your own research with no responsibility of the source .

there are 100″s of people who can get u listed but who suffers the normal investor but who should take note binance and coin market cap