Investing in any financial asset can be a tricky exercise, but this is especially true for the fast-paced cryptocurrency market, which comes with its own unique set of pitfalls and challenges.

A popular saying dictates that it takes 10,000 hours to master a skill and become an expert. In cryptoland time, this is measured in market cycles, which subject each trader to a few trips on the roller coaster of volatility as a crash course on navigating the market.

Here are five important lessons every trader should learn when it comes to investing in cryptocurrency bull markets.

Rule #1: No one ever went broke taking profits

Since the early days of crypto, the community has been proud of its “hodl” nature, with the volatility in the price of Bitcoin (BTC) and other tokens haven shaken coins out of paper hands and into those of the true believers who comprise today’s crypto aristocracy.

Few like to bring up the “not your keys, not your crypto” movement anymore, partially due to the fact that liquidity and money velocity are important factors in a healthy functioning market, but also because simply hodling as the market rises and then falls has resulted in fortunes achieved on paper simply fading away with the onset of a bear market.

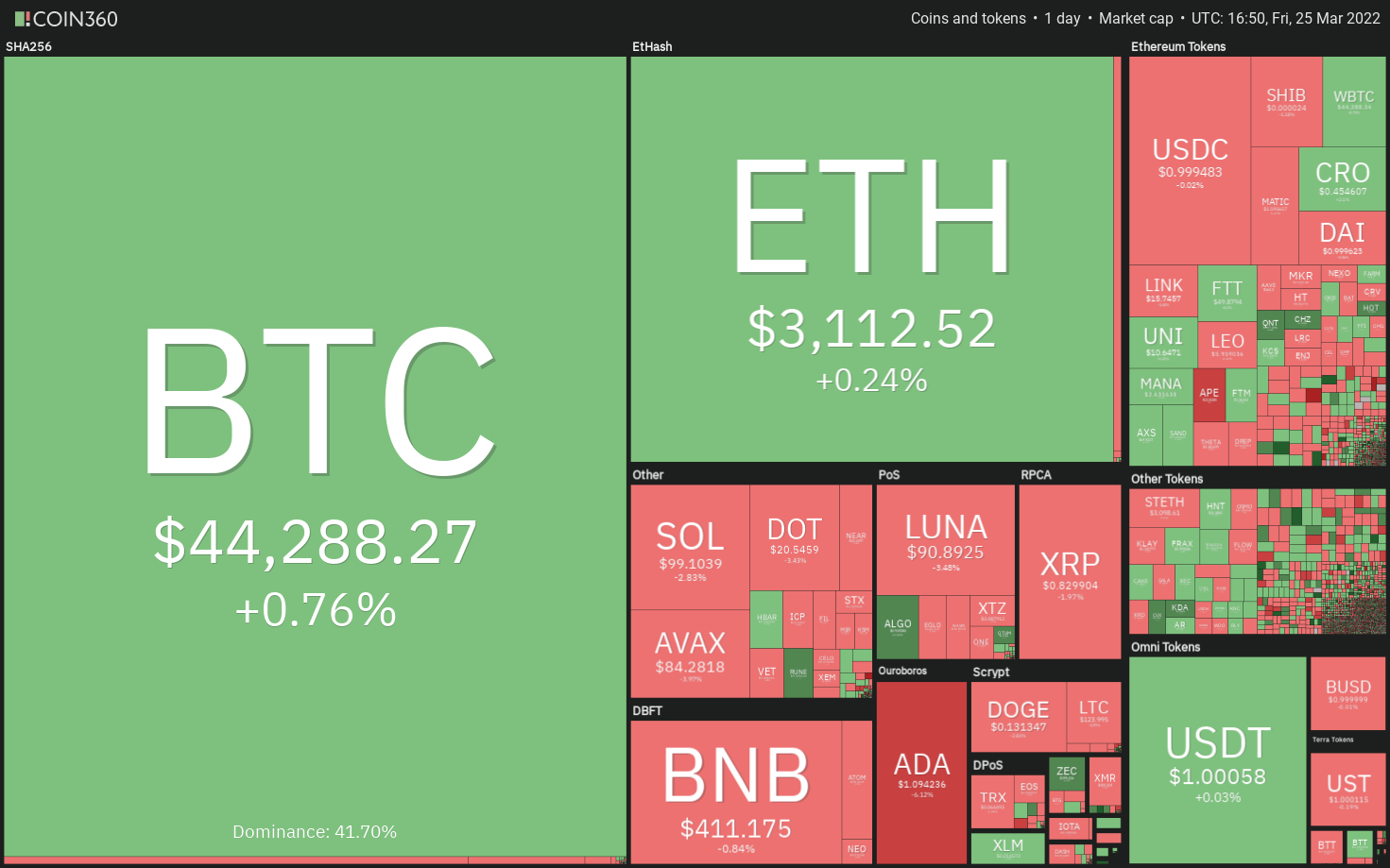

When a cryptocurrency has made significant gains, especially if the price went parabolic in a near-vertical line on its trading chart, the best move is to take profits and allocate those funds either to stablecoins or different assets whose trading cycles are not exhausted.

The fact of the matter is that nothing keeps going up forever, and in the cryptocurrency market, the fall can often be as fast and as hard as the rise.

If selling a token is difficult due to personal attachments and a bullish long-term outlook, it helps to consider that after a parabolic move and consolidation phase, it’s possible to acquire even more of the tokens with the cashed-out funds once the dust settles.

Rule #2: Don’t FOMO — there’s always another coin

One experience that just about every crypto investor has gone through is having the urge to buy a particular coin and resisting, only to see it take off like a rocket the following day and go on a two-week-long moonshot that sees its price increase tenfold.

At this point, FOMO — the fear of missing out — kicks in and becomes so strong that a large market order is placed and filled at the top of the market. The result of this is usually some unexpected pullback where the newly opened position loses half its value in just a few short hours as early holders follow Rule #1 and take profits.

Don’t FOMO!

Once a coin has started going parabolic, just watch from the sidelines. Mentally congratulate those who caught the rally, and repeat the following: “There is always another token.”

A quick survey of past bull markets will show boatloads of token pumps and token dumps in bull and bear markets, proving that there is no shortage of opportunities to get in early on high-flying projects and book solid gains amid the fast-paced hype cycles that the cryptocurrency market is known for.

Rule #3: It isn’t going to be like last time

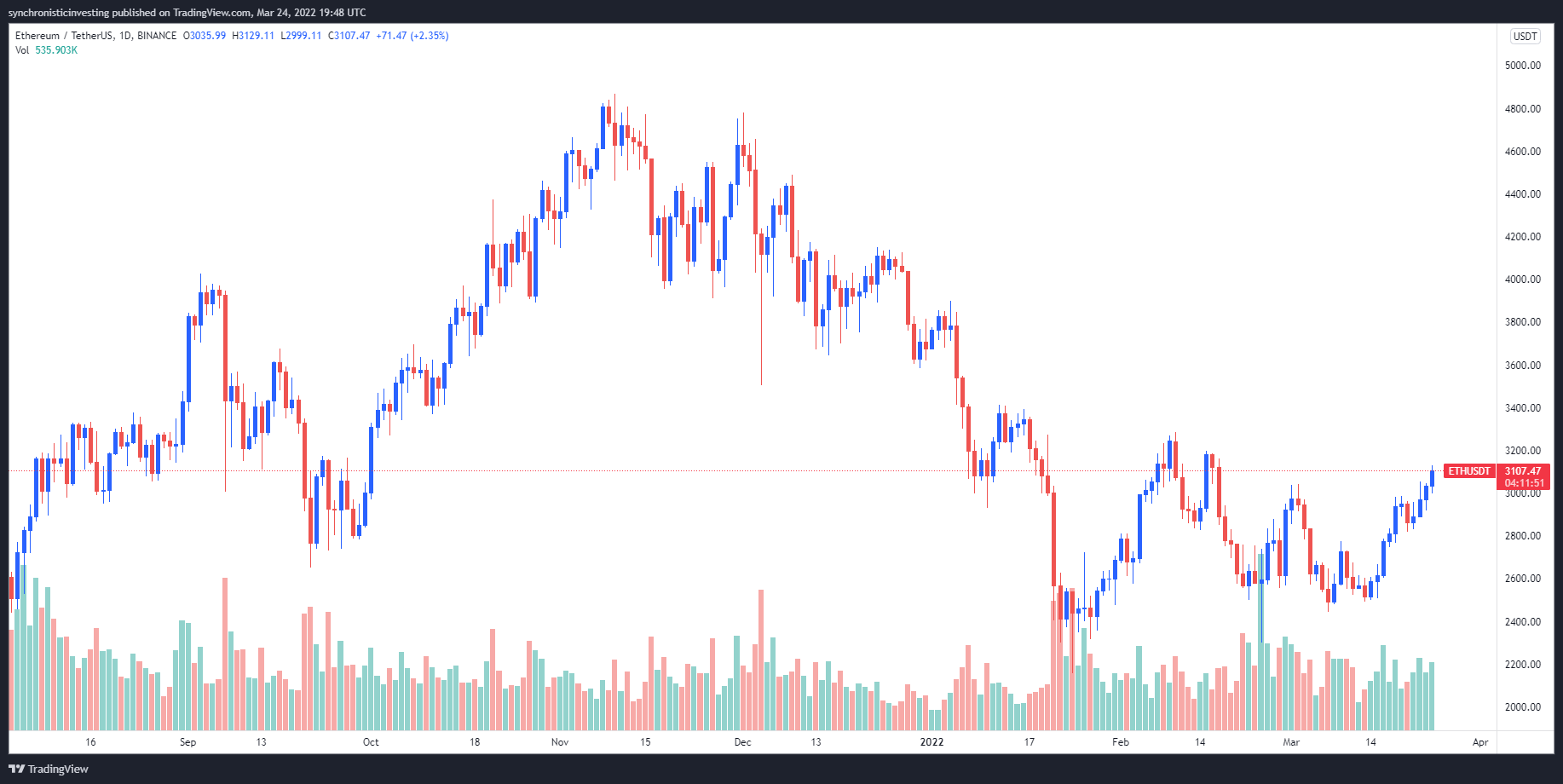

Technical analysts often like to assert that crypto follows a series of predictable cycles, which they use to validate certain pieces of their craft. Holding this perspective allows them to apply past market cycles to the current price chart as a way to predict what comes next.

In 2021, this belief led to yearlong proclamations that Bitcoin was going to $100,000 and beyond, only it topped out under $69,000 and limped into the close of the year without any sign of the highly anticipated blow-off top.

Over the course of the year, the market was compared to the 2017 bull rally, then the 2013 rally and finally a combination of the two rallies as chartists struggled to explain in which part of the cycle the market was and where it would go next.

In the end, the 2021 rally saw a unique double-top unlike any previous market cycle and could possibly extend into 2022 in alignment with the prediction by some that the four-year cycle is lengthening.

The main takeaway is not to expect the market to perform as it has previously and focus on trading the market you have. Follow the trends in price, and make sure to keep Rule #1 and Rule #2 in mind.

Related: US senators Lummis, Gillibrand reveal working on bipartisan crypto legislation

Rule #4: Play trend cycles carefully

In every crypto bull cycle, there is one sector that comes out of nowhere to dominate headlines and produce 100x gains.

2021 saw the rise of memecoins, the arrival of nonfungible tokens (NFTs) and the advent of play-to-earn gaming, much to the chagrin of Bitcoin maximalists and those who “are in it for the tech.”

When new trends like these begin to emerge in the cryptocurrency market, it’s wise to keep in mind the power of the cryptocurrency hype cycle and, if possible, get a little exposure to some of the tokens in that sector that have yet to start moving.

This is strictly a mostly short-term play and is most often a case where Rule #1 is applied in full, as the vast majority of new arrivals to the altcoin market flare out within the first year.

Rule #5: Don’t spend all your time focusing on the crypto market

This final rule is meant to help maintain a healthy life balance and peace of mind. There is far more to life than investing in cryptocurrencies, or any other market.

Just as all investment portfolios should be well-diversified, so too should your everyday experiences in the wider world.

A vast majority of the big moves in crypto happen in a matter of days or weeks, and the rest of the year is full of sideways markets and rangebound trading.

Conduct a decent amount of research, make your picks, follow Rule #1, and then use some of those profits in other parts of life to have more fun and diversify your experience to better enjoy the most precious commodity of all: time.

Want more information about trading and investing in crypto markets?

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.