Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

Cointelegraph compiled data this week for crypto donations sent to the Ukrainian government, military and charities amid the country’s ongoing conflict with Russia. By Monday, total crypto donations to the Ukrainian government and charities linked to it had reached $37 million.

The “Reserve fund of Ukraine” backed by local crypto exchange Kuna appeared to be the largest recipient, garnering roughly $13 million worth of BTC, ETH, USDT and other assets. Next in line was charity organization Come Back Alive, which pulled in $7.2 million. The group says it’s aiding the Ukrainian Armed Forces’ resistance efforts.

Notably, UkraineDAO also sold a tokenized Ukrainian flag for 2,174 ETH ($5.95 million) to support local civilian organizations.

The South Korean Ministry of Science and ICT put some serious weight behind the metaverse this week, allocating $186.7 million to create a virtual ecosystem to foster digital content and corporate growth within the country.

The metaverse ecosystem is called the “Expanded Virtual World,” and the funding will be used to expand the virtual industrial growth of cities, education and media. The ministry also said that it will host community-oriented creative activities to drive interest, such as a metaverse developer contest and a hackathon.

“It is important to create a world-class metaverse ecosystem as the starting point to intensively foster a new hyper-connected industry,” stated Park Yungyu, head of communication and policy at the ministry in the announcement.

On Tuesday, U.S.-based payment solutions provider Shift4 announced the acquisition of The Giving Block in a cash and stock deal worth $54 million. The deal includes provisions that could generate a total earnout of up to $246 million.

The Giving Block platform enables more than 1,300 nonprofit organizations and charities to accept crypto donations. According to the group’s annual report, it processed $69.64 million in crypto donations in 2021, with roughly $12.3 million coming from NFT projects.

“Shift4 will invest further in The Giving Block’s successful strategy while also pursuing a $45+ billion embedded cross-sell opportunity by bundling crypto donation capabilities with traditional card acceptance,” said Shift4 in a statement. “This represents just a small portion of the $470+ billion nonprofit addressable markets that Shift4 will uniquely be able to pursue as a result of this acquisition.”

Jamie Iannone, CEO of eBay, stated during a recent interview that the e-commerce giant could soon be looking to integrate crypto payments into its marketplace. The CEO also pointed to the growing popularity of NFT buying and selling on the platform, but did not divulge any specific plans to ramp up support for NFT technology.

Iannone said that eBay has been considering the idea for a long time as the company continues to explore new payment methods. He went on to hint that there could be a crypto-related announcement during eBay’s upcoming investor day on March 10.

If eBay were to support crypto, it would be a second attempt from the firm, as it initially tried integrating BTC payments back in 2014.

Top NFT marketplace OpenSea reportedly started barring Iranian users from its platform this week. The firm justified its decision by alluding to policy that prohibits people in U.S.-sanctioned territories from using its platform.

Iranian OpenSea users started posting on Twitter on Thursday that their accounts were being deactivated or deleted with no prior warning. An Iranian NFT artist who goes by “Bornosor” stated on Twitter: “NOT A gm AT ALL. Woke up to my @opensea trading account being deactivated/deleted without notice or any explanation.”

An OpenSea spokesperson spoke with Cointelegraph and noted that:

“We have a zero-tolerance policy for the use of our services by sanctioned individuals or entities and people located in sanctioned countries. If we find individuals to be in violation of our sanctions policy, we take swift action to ban the associated accounts.”

Winners and Losers

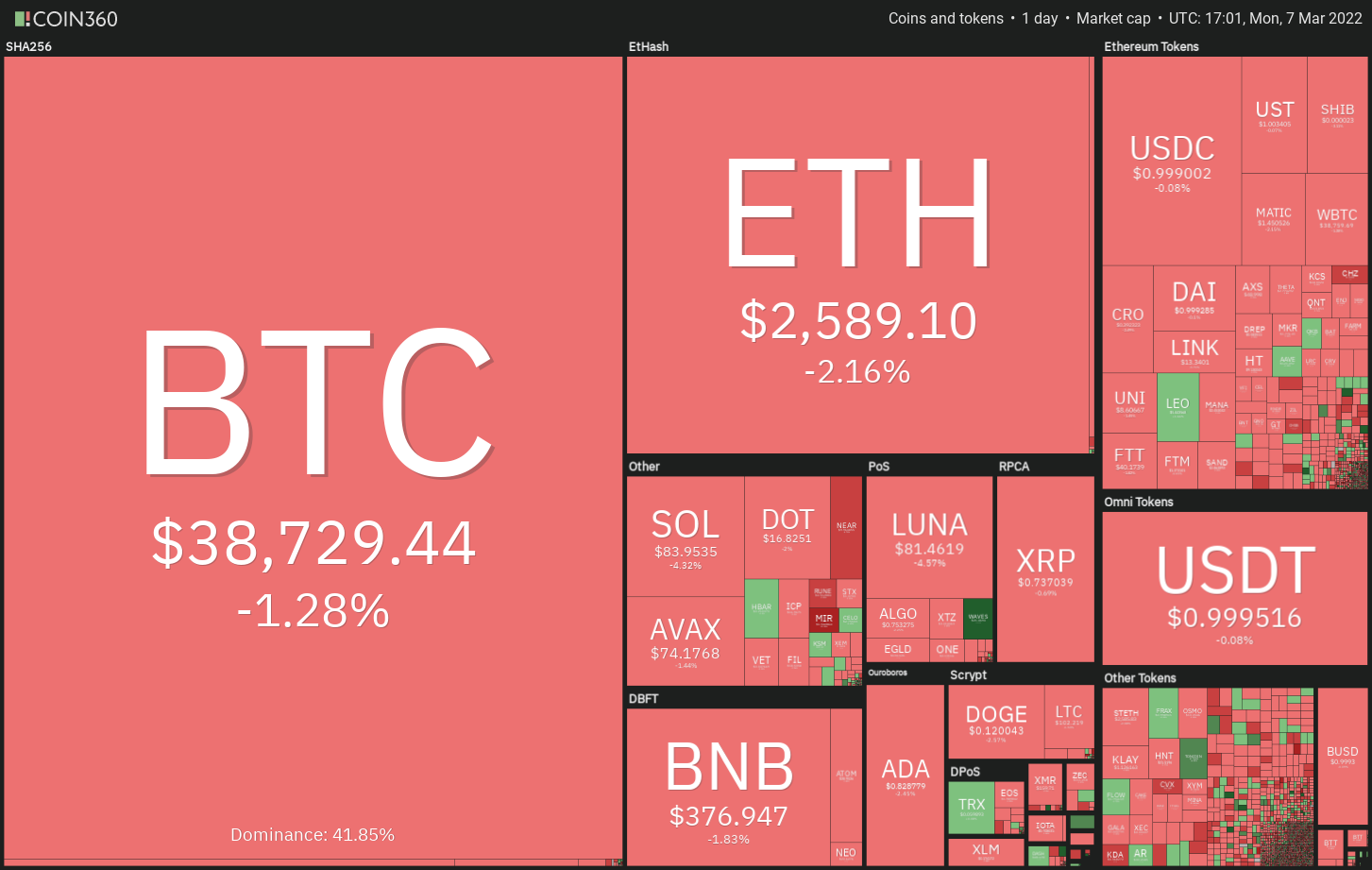

At the end of the week, Bitcoin (BTC) is at $40,617, Ether (ETH) at $2,667 and XRP at $0.73. The total market cap is at $1.79 trillion, according to CoinMarketCap.

At the end of the week, Bitcoin (BTC) is at $40,617, Ether (ETH) at $2,667 and XRP at $0.73. The total market cap is at $1.79 trillion, according to CoinMarketCap.

Among the largest 100 cryptocurrencies, the top three altcoin gainers of the week are UMA (UMA) at 104.80%, Waves (WAVES) at 98.29% and THORChain (RUNE) at 64.14%.

The top three altcoin losers of the week are Convex Finance (CVX) at -14.72%, Secret (SCRT) at -9.37% and Amp (AMP) at -8.46%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“The demand for Bitcoin is so large in Senegal that it doesn’t matter how many exchanges you make.”

Nourou, founder of Bitcoin Senegal

“Eventually, the bot concludes the best move is to buy as soon as possible and never sell!”

Tiago Vasconcelos, founder of Aceita Bitcoin, regarding the AI Bitcoin trading bot he coded

“Now is a pivotal point in #Bitcoin’s evolution — we’re on the verge of mass adoption, and I think that I can make it happen faster.”

Samson Mow, CEO of Pixelmatic and former chief strategy officer of Blockstream

“Investors are speculating that crypto will become increasingly important as apolitical and trustless money in a time of escalating geopolitical uncertainty, conflict, and capital controls.”

Arcane Research

“Crypto has been one of the great stories in finance over the course of the last 15 years. And I’ll be clear, I’ve been in the naysayer camp over that period of time. But the crypto market today has a market capitalization of about $2 trillion in round numbers, which tells you that I haven’t been right on this call.”

Ken Griffin, founder of Citadel

“Everyone with a heartbeat and a telephone should be able to transact value all over the world.”

Didi Taihuttu, father of the Bitcoin Family

“Worldwide NFT search volume fell off a cliff. Reminds me A LOT of the crypto 2017 bull market and subsequent 2018 bear market. How long will the disinterest last until it starts to pick back up? Or will it?”

Andrew Steinwold, managing partner of Sfermion

“Ideally, there should be a threshold where people who earn below a certain level require zero compliance/verification, because really, if, for example, that threshold was at R5,000 / month [$330], what possible harm can a person do with that amount?”

Hermann Vivier, founder of Bitcoin Ekasi

Prediction of the Week

Bitcoin once again showed no shortage of price movement this week. The asset bounced from around $38,000 on Sunday up to almost $45,500 on Wednesday before falling back below $41,000 on Friday, according to Cointelegraph’s BTC price index.

Crypto Ed, a pseudonymous trader on Twitter, concisely summed up the scene for BTC: “Bullish above 42, bearish below 40k.” Prior to his bullish/bearish conclusion, Crypto Ed explained his rationale via Bitcoin charts and technical analysis.

Bitcoin’s price appears to be mirroring global macro uncertainty as investors continue to assess monetary policy and the conflict in Ukraine.

FUD of the Week

The U.S. Securities and Exchange Commission (SEC), led by crypto-skeptic Gary Gensler, is reportedly investigating NFT creators and marketplaces for apparent securities violations.

According to anonymous sources who spoke to Bloomberg, the SEC is working to ascertain whether certain NFTs are being “utilized to raise money like traditional securities,” with the agency believed to have sent subpoenas demanding information on specific NFTs and other token offerings.

With billions of dollars flowing into NFTs over the past 18 months, it was only a matter of time before the SEC began taking a deeper dive into the sector’s compliance standards.

A group claiming to represent 35 former ConsenSys AG (CAG) employees requested an audit on Tuesday, under the Swiss Code of Obligations, to investigate “serious irregularities” they allege occurred at CAG during mid-2020.

The group alleged that “fundamental intellectual property and subsidiaries were illegally transferred” from CAG (also known as Mesh) to an entity called ConsenSys Software Incorporated. They also asserted that the deal was conducted unbeknownst to minority shareholders and was specifically made to benefit founder Joseph Lubin.

The company responded by issuing a statement suggesting that the complaint emanated from just one former employee:

“Mesh refutes the allegations underlying the legal action as well as those contained in the factually inaccurate press release that was self-authored by one of the former employees. […] Mesh looks forward to formally refuting the allegations and accusations in Swiss courts.”

The United Kingdom’s Financial Conduct Authority announced on Thursday that it is investigating 50 unauthorized crypto companies. The FCA also stated that it has pursued more than 300 cases on unregistered crypto firms in the last six months.

The move is part of a push to crack down on potentially dubious firms involved in scamming activities. According to the FCA, U.K. residents sent in 16,400 inquiries between April and September 2021, which included crypto-related scams.

The regulatory body outlined that it would be implementing tools, including “more assertive supervision and enforcement action,” to deter bad actors in the local crypto sector.

Best Cointelegraph Features

Decentralization of Web3 infrastructure is critical to its success as it gives us back the freedom that we are currently paying for using Web2.

Consolidation of law enforcement activity sends a clear message to the industry: It is time to comply.

What is a DAO, how do they work and are they the future or just a passing fad?

At the end of the week, Bitcoin (

At the end of the week, Bitcoin (