With the cryptocurrency market eyeing a stellar 2025 amid a new wave of optimism, new crypto project Remittix (RTX) is trending.

The altcoin looks to have stolen the shine off XRP (XRP) early on as its presale hits $4 million. But what’s driving the interest in this project? Could the new era for crypto under President Donald Trump be the catalyst that pushes RTX to the top of the payments finance, or PayFi world?

What is Remittix (RTX)?

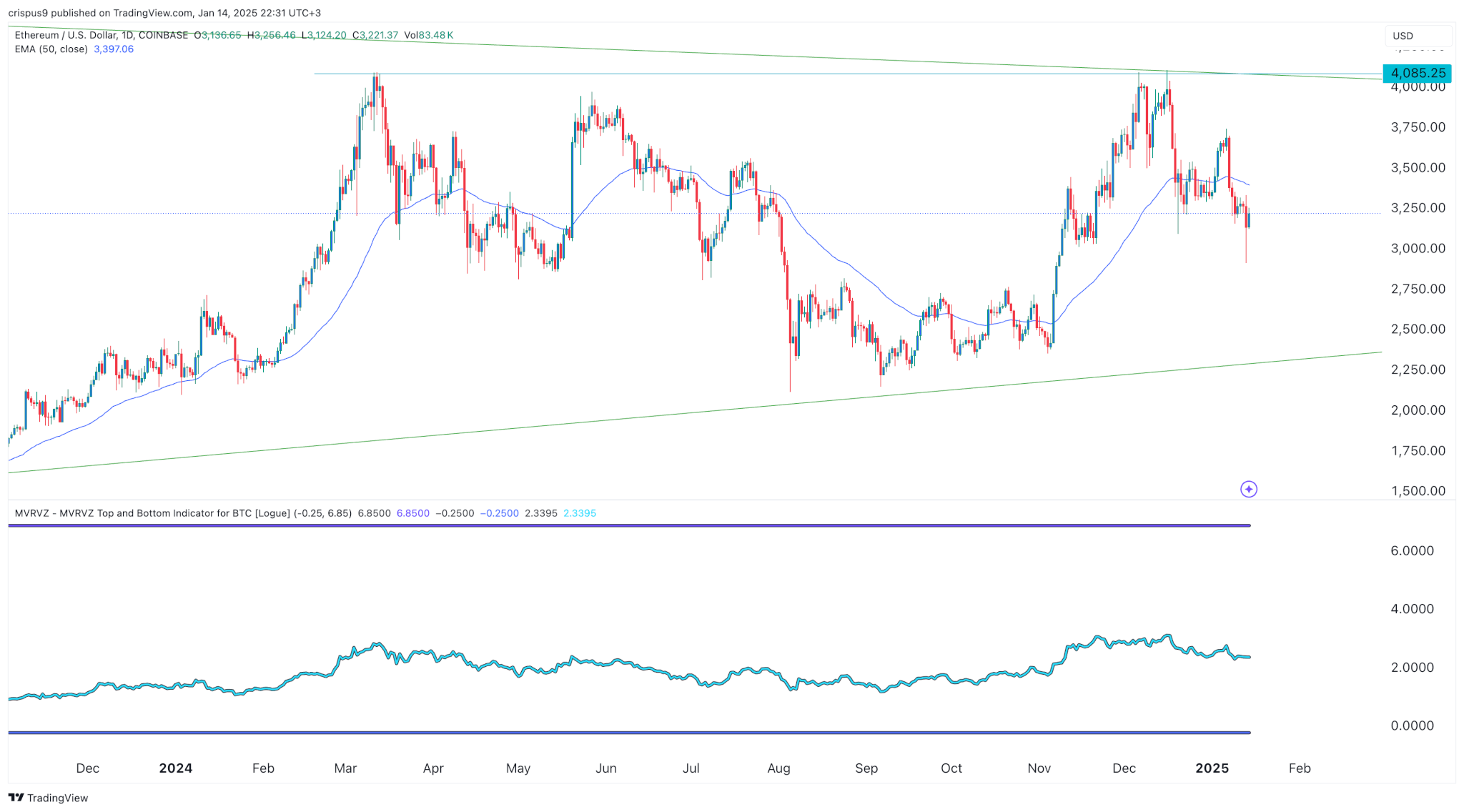

XRP and Stellar (XLM) have stood out as crypto solutions aim to revolutionize the remittances and cross-border payments space. XRP’s massive traction in the space means its recent bounce in the market may continue as traditional players adopt crypto.

Remittix (RTX) is entering this ecosystem with a new Ethereum-based payments network targeted for individuals and businesses.

The project aims at allowing anyone to benefit from the growing adoption of cryptocurrencies with a novel crypto-to-fiat payments solution. With Remittix, users can send crypto and see their recipients get fiat in their bank account.

The project taps into the blockchain technology’s features of faster, cheaper and transparent transactions to let users send money across borders. Unlike traditional banking apps and solutions, Remittix provides a multi-currency wallet that lets users easily send over 50 cryptocurrency pairs. It supports more than 30 fiat currencies.

Native token RTX attracts $4 million in presale

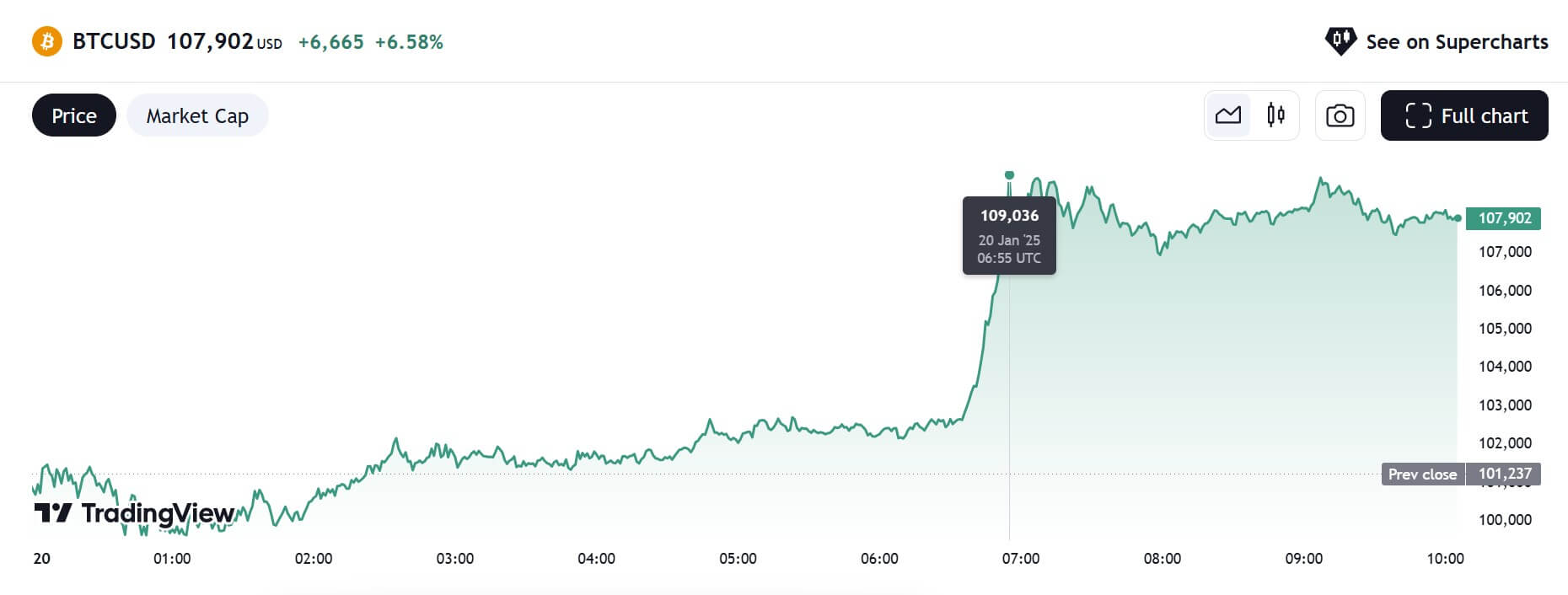

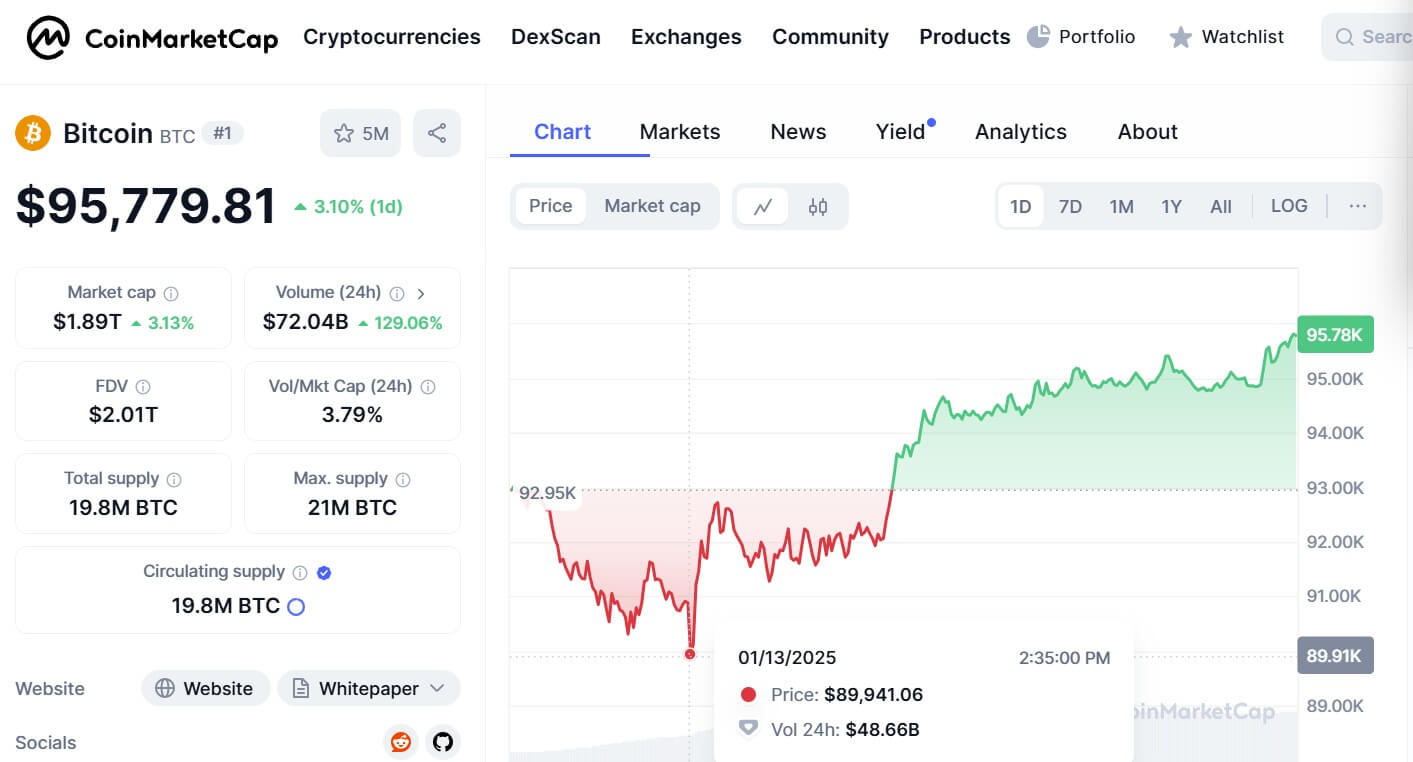

Interest in Remittix has picked momentum as the crypto market celebrates the inauguration of Donald Trump as the 47th President of the United States. Notably, the presale for the native RTX token raced to over $4 million in under 30 days.

RTX will power Remittix’s payments ecosystem, providing for governance, staking and rewards. Of the limited supply of 1.5 billion RTX, 50% of it (750 million) has been allocated to the community via a presale. The presale soft cap is $18 million and hard cap is $36 million

Remittix is celebrating Trump’s inauguration with a 30% bonus that runs to Jan. 28. Presale participants can use the promocode TRUMP30 to unlock the bonus.

With crypto poised for a bullish reset in 2025 and beyond, the presale offers Remittix buyers a chance to get in early. An environment that supports innovation and regulatory clarity means Remittix could be on the cusp of completely redefining cross-border payments.

Remittix (RTX) presale price

So far, savvy crypto investors have scooped nearly 230 million RTX, raising more than $4.1 million as the RTX price jumps to $0.0228.

The next price increase will push Remittix presale value to $0.0239. RTX presale is 70% sold out in the current stage, which means interested early adopters have a chance to get it at a bargain before price rises.

Find out more about Remittix and what makes the project stand out by visiting the official website.