iDEGEN has hit the crypto market running, riding a major bullish mood engulfing the entire market.

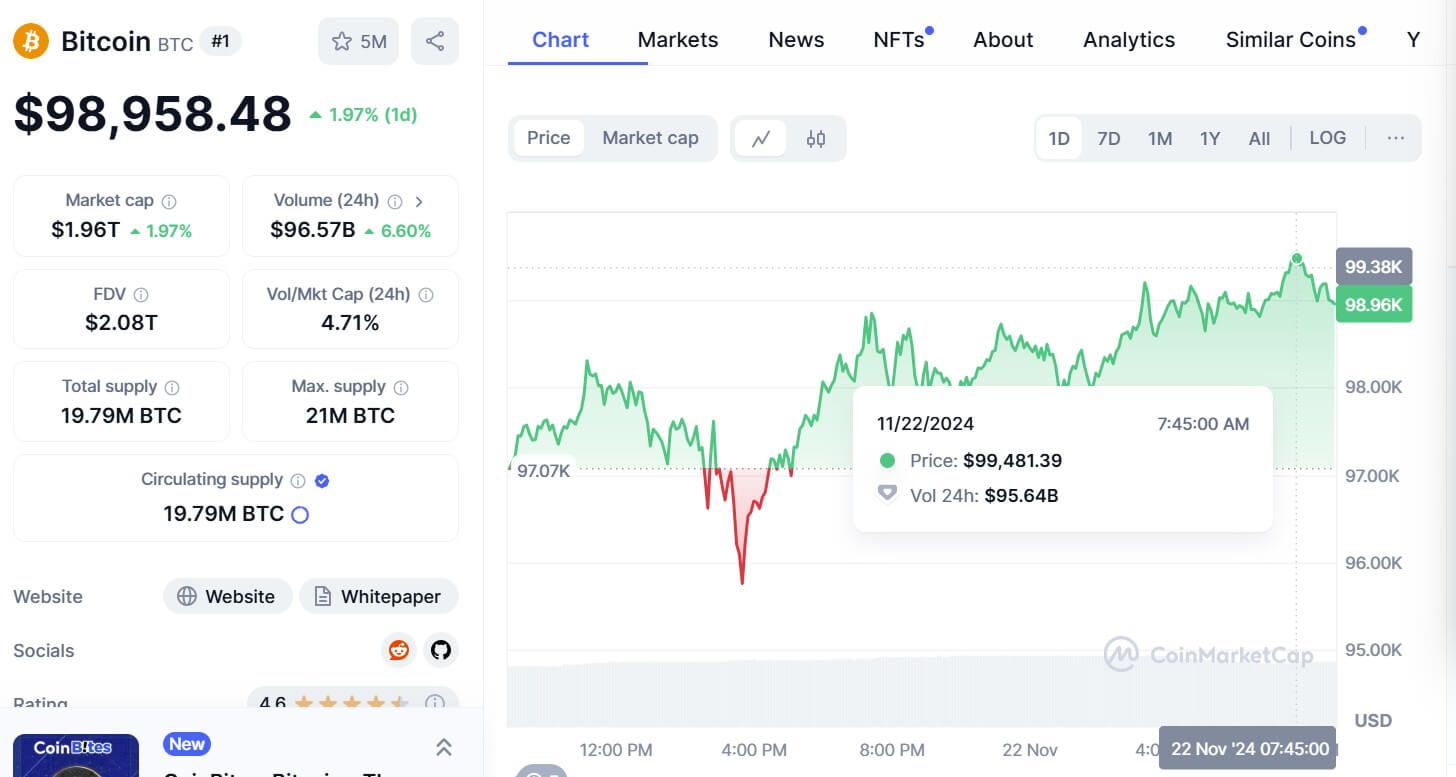

This comes as traders cheer Bitcoin’s massive and record monthly green candle. As the benchmark crypto looks to break the sell wall at the $100k level, several altcoins are toying with levels that have traders excited.

Amid the market-wide buzz is an aggressive positioning across the artificial intelligence related space. Some of the best performing tokens in the last few months have been AI tokens, which has analysts pointing to the real upside as one ahead.

Does this make iDEGEN the biggest opportunity among AI tokens as the bull run shapes up? Here’s more.

Altcoins eye rally

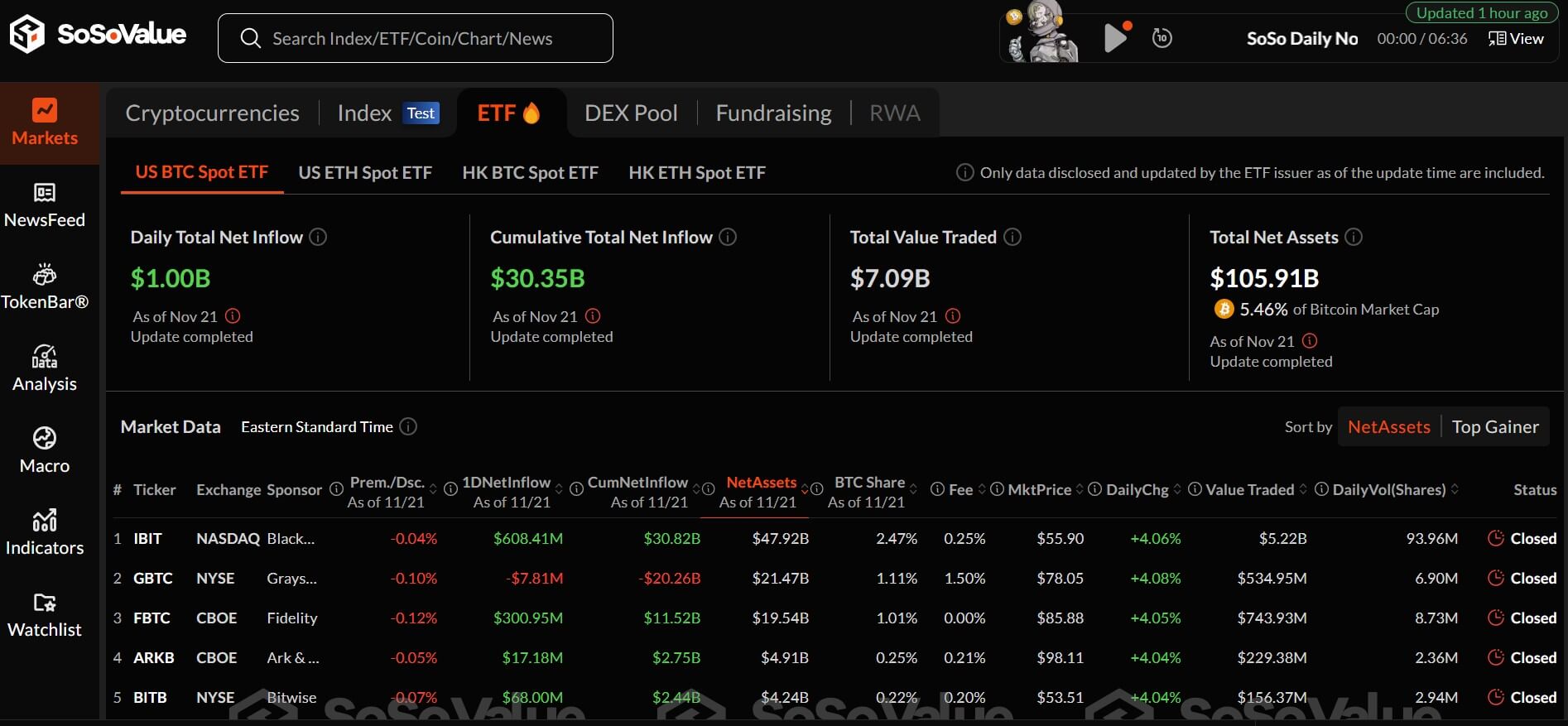

While Bitcoin has struggled with the sell wall at $100k, bulls remain upbeat amid a rising supply shock. Demand for the flagship cryptocurrency has seen multiple publicly-listed companies announce major moves to buy BTC.

The bullish predictions for Bitcoin have also extended to top coins Ethereum, XRP, Solana and Cardano.

However, analysts are most bullish about small caps and gems in emerging crypto market segments. In 2025, the most profitable tokens are likely in AI. Notably, it’s AI agents that have the market in alert mode. This subsector of the AI and crypto merge has received massive traction after platforms like Terminal of Truth made Goateus Maximus a bull market sensation.

According to crypto analyst Miles Deutscher, the industry has yet to hit even 0.01% of what these projects can offer.

“From Adobe to Expedia, many top corporations have built & integrated AI Agents in the past 1-2 years. This trend is only going to increase,” Deutscher said.

iDEGEN races to $1.6 million presale raise

iDEGEN’s freelance operation with its launch based on zero knowledge is purely dependent on the real time interactions with users on X. Currently in its presale phase, the iDEGEN token has raced to over $1.6 million.

This comes as tokens sold in the past week surges to over 385 million, adding to IDGN token’s viral spike after raising over $1 million in just over 72 hours.

IDGN is “sentient” and “degenerate”.

Ideally, iDEGEN is an AI project that engages the crypto community through X, tweeting every sixty minutes as its learning evolves. The design starts with a blank AI, but degens have the opportunity to teach it and help it take over crypto twitter.

As an AI powered “born and raised” agent, iDEGEN has the potential to grow into what the crypto degen community wants. The native token IDGN could evolve similarly, following this trend to surpass GOAT and others.

iDEGEN will launch in January, and investors have a chance to buy early into a sector at the cusp of a major breakout. Top industry players are making moves that mean the whole sector is only getting started.

At $0.0201, IDGN is still a relative bargain for a token that could go 100x or more in the next bull cycle.

Do you want to learn more about iDEGEN or how to buy IDGN? Visit the official presale page.