- Bitcoin Dogs (0DOG) drops 49% from debut, but strong trading volume shows investor interest.

- Integration with Bitcoin blockchain and gaming features supports long-term growth.

- Controlled token release and upcoming developments may drive future price recovery.

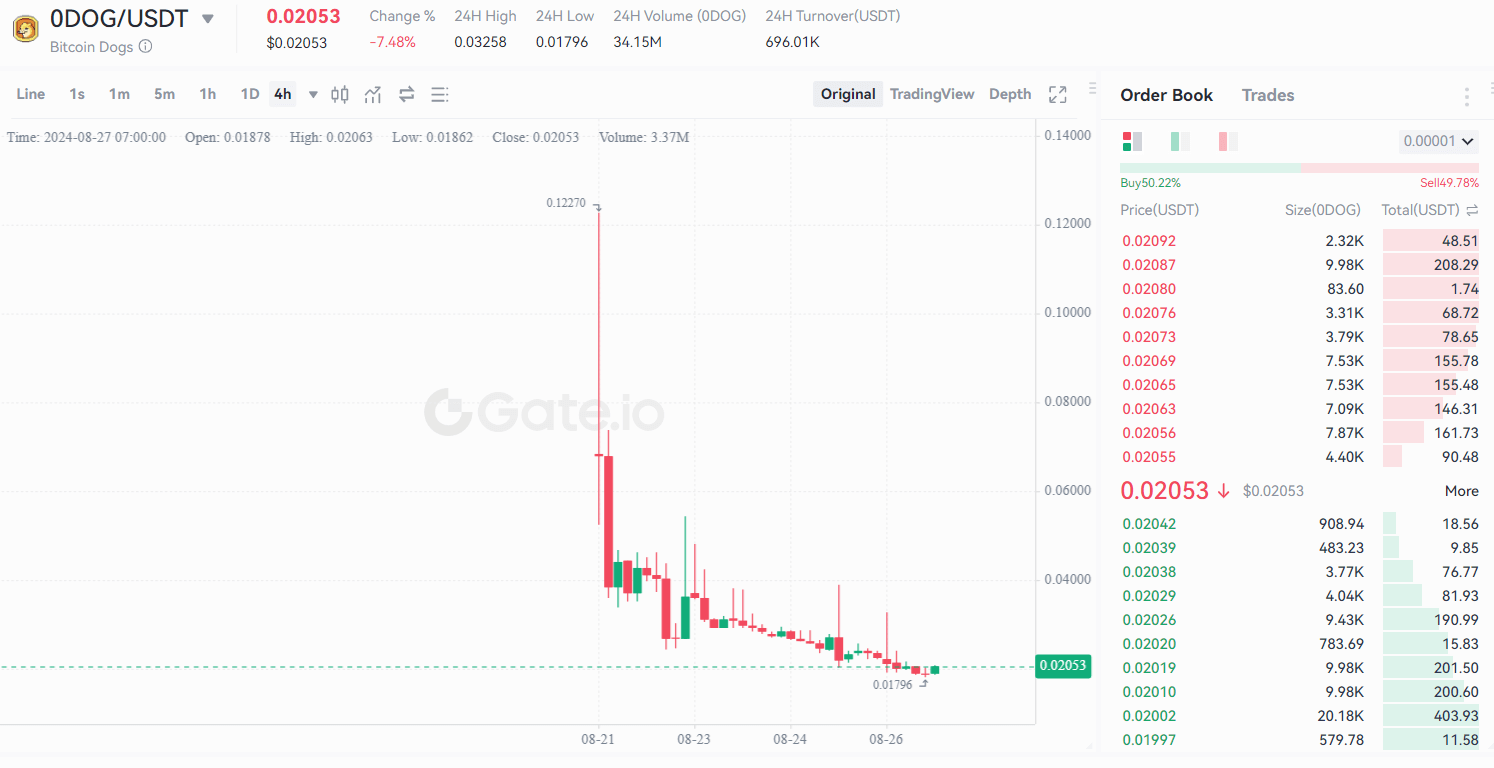

As the broader cryptocurrency market experiences a downturn, Bitcoin Dogs (0DOG) is not immune to the pullback. Despite an initial surge in price following its debut, 0DOG has seen its value drop by nearly 50%.

However, beneath the surface of this decline lies a narrative of resilience and potential, driven by strong trading volumes and a series of upcoming developments that could reignite investor interest.

Market pullback and 0DOG price drop

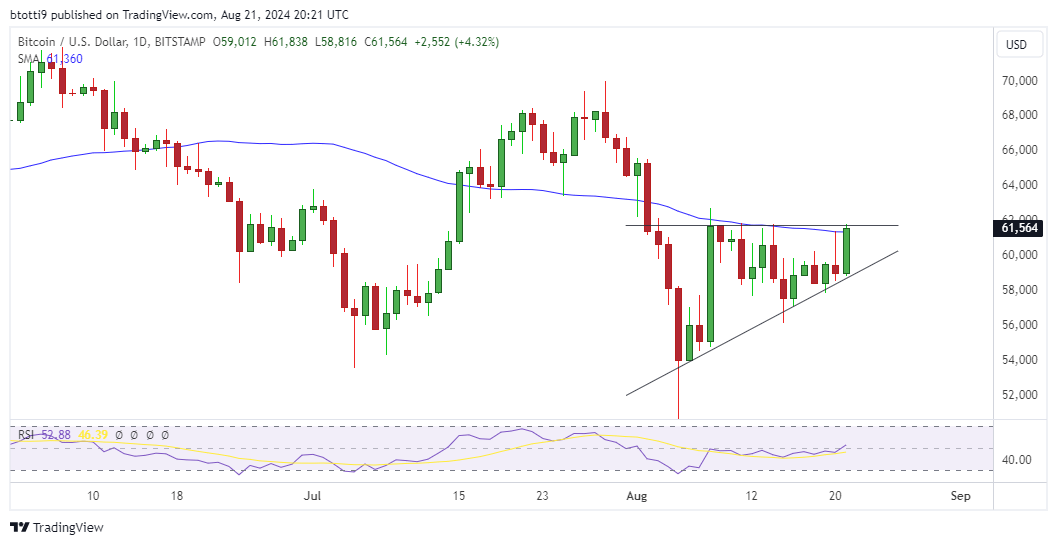

The global cryptocurrency market has recently witnessed a decrease in overall value, with the total market cap now standing at $2.21 trillion, marking a 1.27% decrease over the last day.

Major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB) have all seen their prices drop, reflecting a broader bearish sentiment. In this context, Bitcoin Dogs (0DOG) has also experienced a significant pullback, with its price dropping by approximately 49.24% from its listing price of $0.0404 to around $0.02053.

Despite this decline, 0DOG has shown some signs of strength. The token’s trading volume remains relatively high, standing at around $3.37 million, indicating that investor interest has not waned entirely. This level of trading activity suggests that there is still a strong base of holders who believe in the token’s long-term potential.

The initial surge in 0DOG’s price, where it climbed almost 3x to reach $0.12270, demonstrated the robust demand and technical support backing the token. While the price has cooled off, the resilience in trading volume points to a potential for recovery, especially as the broader market stabilizes.

The catch: upcoming developments and future prospects

While the current price drop might deter some investors, those looking at the bigger picture will find reasons for optimism. Bitcoin Dogs (0DOG) is not just another meme coin; it’s part of a broader crypto-gaming and social ecosystem that integrates with Bitcoin’s blockchain.

The token’s initial success can be attributed to its strong presale, which raised $13.5 million, and its listing on major exchanges like MEXC, Gate, and UniSat.

The tokenomics of 0DOG, with a supply of 900 million tokens, has been designed to benefit long-term holders, particularly with the planned developments on the horizon.

The upcoming months are crucial for 0DOG’s trajectory. The token is expected to benefit from anticipated bullish trends in Bitcoin’s price action, particularly in Q4 2024, when Bitcoin’s price is predicted to surge.

Additionally, the integration of Bitcoin Dogs into the Telegram gaming sector, coupled with unique features like Tamagotchi-style gameplay, PvP battles, staking opportunities, and NFT collections, is set to attract a significant user base.

These developments are likely to drive additional interest and investment in 0DOG, potentially pushing its price beyond its recent highs.

Moreover, the token claim process, which began on August 21, 2024, is set to run for ten months, with 10% of the total claimable tokens available each month. This gradual release of tokens is expected to create a controlled supply, potentially limiting excessive sell pressure and supporting the price.

If intrigued by Bitcoin Dogs (0DOG), you can visit the official Bitcoin Dogs website to learn more about the cryptocurrency. 0DOG is currently tradable on MEXC, Gate, and UniSat for those looking for where to trade the token.