- BARR pattern breakout signals a potential 40% rise to $9.50 for Toncoin (TON).

- Binance listing and Injective integration boost Toncoin’s price and liquidity.

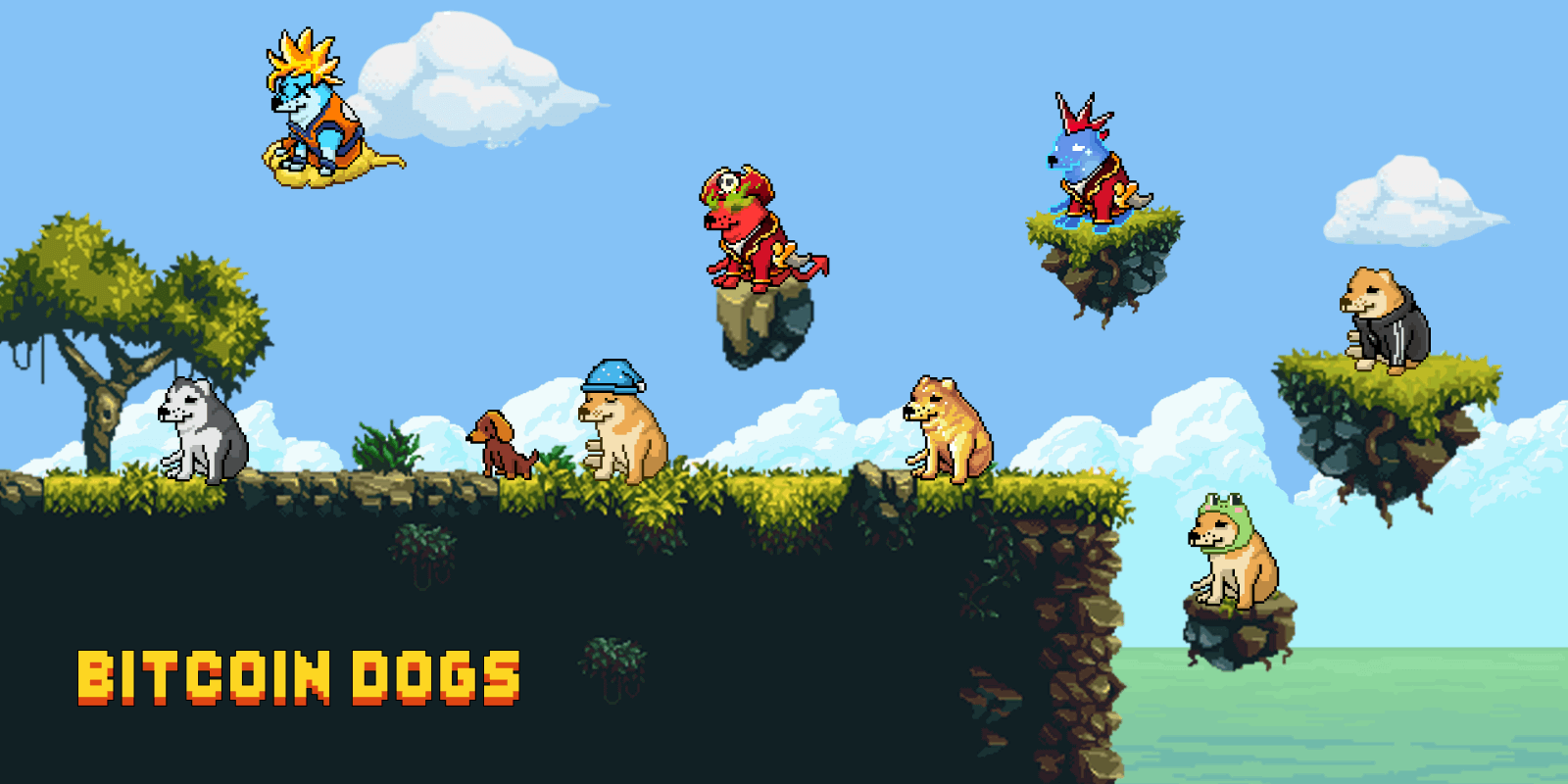

- Bitcoin Dogs’ 0DOG token will debut on Gate.io, MEXC Official, and Unisat Wallet.

As August progresses, Toncoin (TON) and Bitcoin Dogs, two prominent players in the cryptocurrency space are capturing the spotlight. Toncoin is showcasing impressive bullish momentum, while Bitcoin Dogs is preparing for a significant market debut.

With the crypto market witnessing fluctuating trends, these developments offer intriguing insights into the evolving landscape of digital assets. This article delves into the bullish signals for Toncoin and the highly anticipated launch of Bitcoin Dogs on major exchanges.

Toncoin bullish momentum and technical analysis

Toncoin (TON) has exhibited strong bullish signals, positioning itself as one of the top-performing cryptocurrencies.

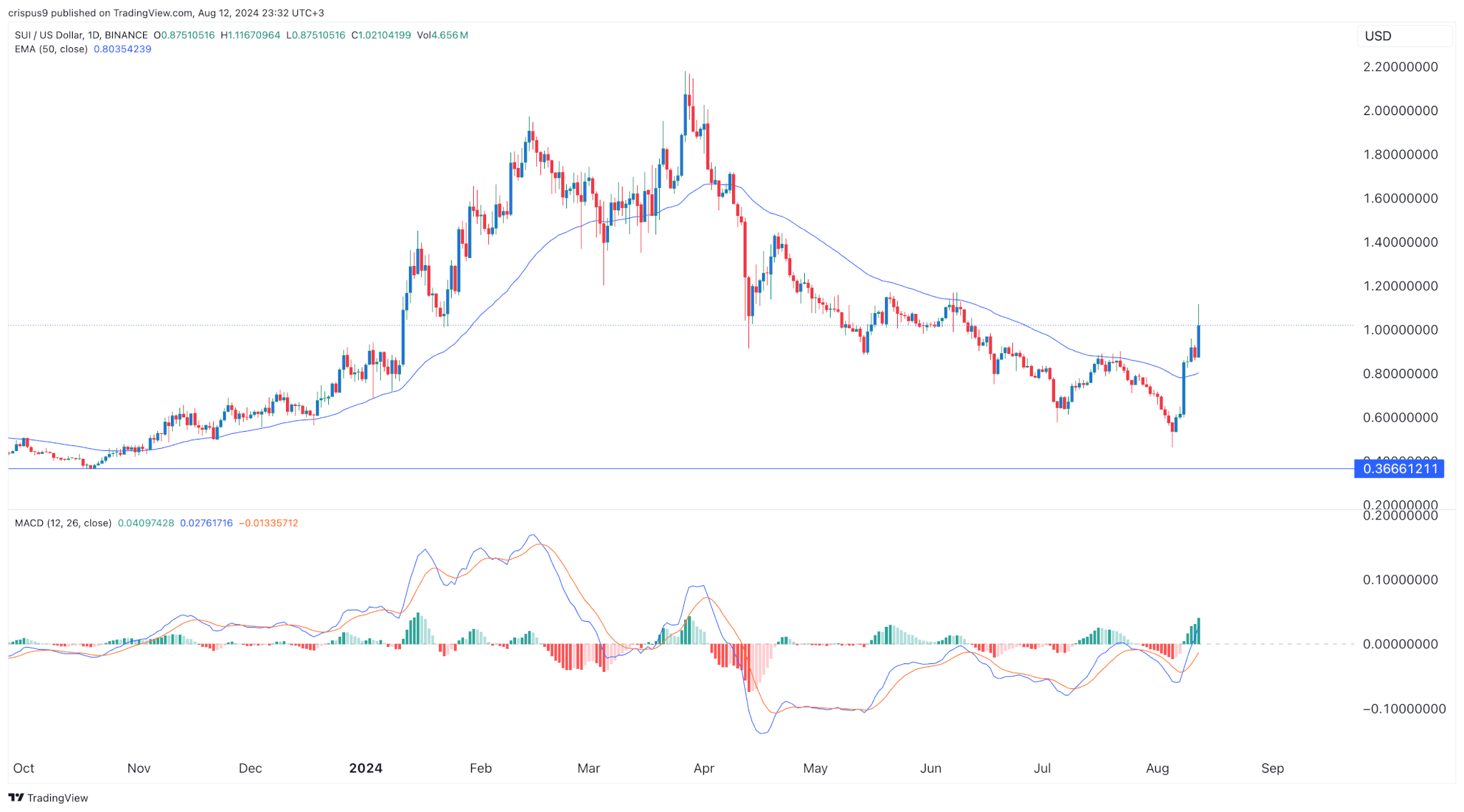

As of August 19, 2024, Toncoin is trading at $6.82, reflecting a notable rise of 8.36% over the past week, despite a broader market decline. This surge is attributed to several key factors, including technical patterns, fundamental developments, and on-chain data.

One of the most compelling technical indicators for Toncoin is its breakout from a Bump-and-Run Reversal (BARR) pattern. This pattern, often a precursor to significant upward movement, suggests a potential price increase of around 40%, targeting the $9.50 mark.

The BARR setup begins with a lead-in phase, followed by a sharp downturn (bump), and culminates in a recovery and eventual breakout (run). Recent price behaviour aligns with this setup, reinforcing the bullish outlook.

The breakout, which occurred around August 18, 2024, was marked by a sustained rise above the previous declining trendline, coupled with increased trading volume. This technical shift is further supported by Toncoin trading above its 50-day and 200-day exponential moving averages (EMAs), both of which are showing upward slopes.

Additionally, the Relative Strength Index (RSI) remains above the neutral 50 level, indicating continued buying pressure despite short-term overbought conditions.

Fundamental factors have also played a crucial role in Toncoin’s recent price surge. Notably, the listing of Toncoin on Binance on August 15, 2024, has significantly improved its liquidity and market accessibility.

Furthermore, the integration of Toncoin with the decentralized finance protocol Injective on August 14, 2024, has enabled TON-based assets to be utilized within Injective’s ecosystem, enhancing its utility and adoption.

On-chain data further supports the bullish sentiment surrounding Toncoin. Analysis shows a redistribution of tokens from large holders (whales) to smaller investors. As of August 19, 2024, the percentage of Toncoin held by addresses with 100,000 to 1,000,000 coins has declined, while the share held by addresses with 10,000 to 100,000 coins has increased.

This shift indicates growing buying interest among mid-sized investors, often a precursor to bullish price action.

Bitcoin Dogs’ major market debut on August 21

In a parallel development, Bitcoin Dogs is set to make a significant market debut on August 21, 2024. The project, which raised over $13.496 million in its presale, will list its 0DOG token on three major exchanges: Gate.io, MEXC Official, and Unisat Wallet.

This milestone marks the transition from its presale phase to active trading and is expected to generate substantial interest and trading activity.

Bitcoin Dogs is notable for being the first-ever ICO on the Bitcoin blockchain, combining blockchain technology with canine-themed digital assets. The project features a metaverse called the Dogaverse, where users can engage in various activities, including gameplay and NFT trading centred around a canine theme.

The presale of Bitcoin Dogs was a resounding success, and the upcoming exchange listings represent a pivotal moment for the project. The strategic choice of exchanges reflects Bitcoin Dogs’ commitment to expanding its market reach and providing ample liquidity for its tokens.

The token claim process will also commence on August 21, allowing presale participants to access their tokens.

Looking ahead, Bitcoin Dogs has outlined an ambitious roadmap, including a game beta, token staking, and multi-chain support. The project’s innovative blend of blockchain technology and canine culture positions it as a unique player in the crypto space, with further developments planned for late 2024 and early 2025.

Conclusion

As Toncoin signals bullish momentum with promising technical and fundamental indicators, and Bitcoin Dogs (0DOG) gears up for its major exchange debut, these developments underscore the dynamic nature of the cryptocurrency market.

Investors and enthusiasts alike are keenly watching these developments, which could shape the future trajectory of these digital assets.