- Bitcoin (BTC) has rebounded above $85,000, with a predicted rise to $137,000 by Q3 2025.

- US Treasury’s $500B liquidity boost and ETF inflows drive the bullish Bitcoin price prediction.

- However, risks like US debt ceiling talks and failure of the coin to break $85,000 resistance could push the BTC price lower.

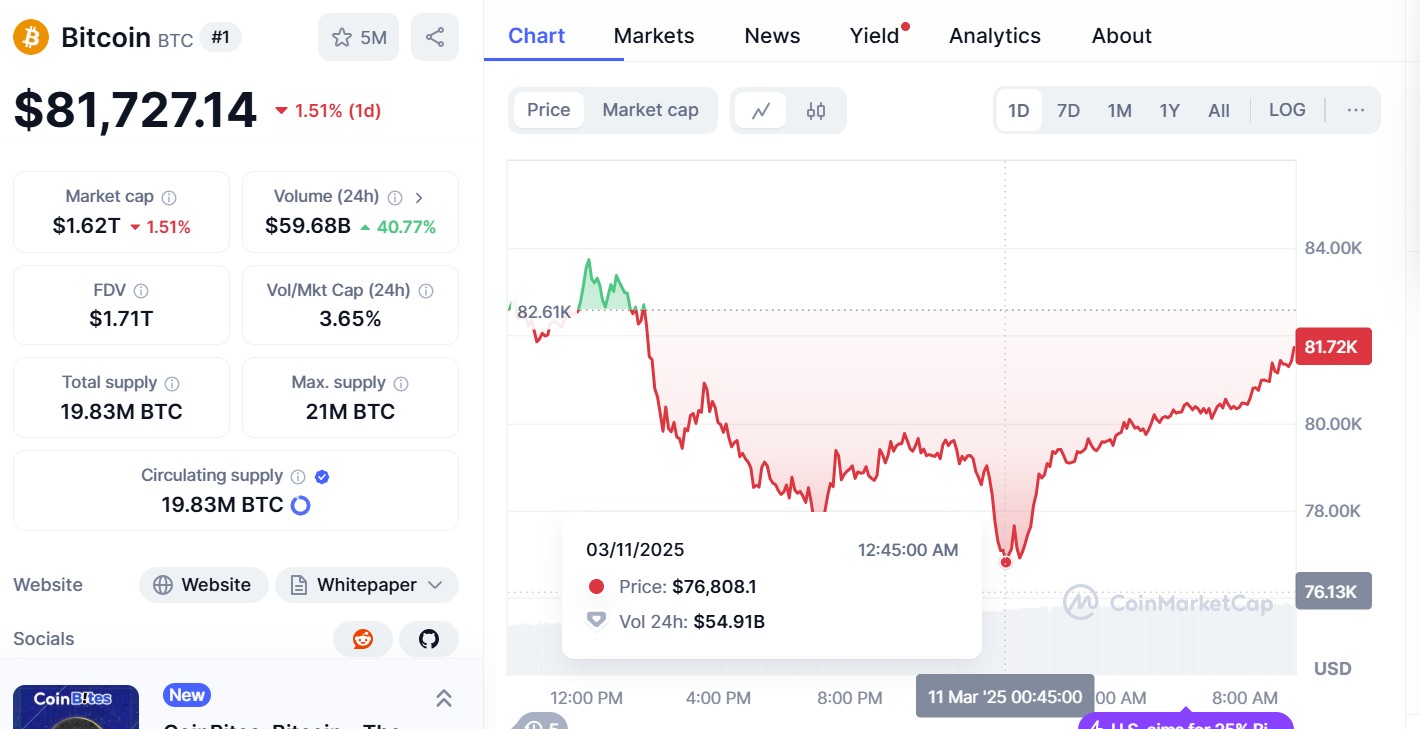

Bitcoin’s price trajectory over the past few days has captured the crypto community’s attention as it stabilizes above $85,000 after a recent dip below $80,000 following US President Donald Trump’s Liberation Day tariffs.

Analyst Titan of Crypto has forecasted that Bitcoin (BTC) could soar to $137,000 by the third quarter of 2025, igniting excitement among cryptocurrency enthusiasts.

#Bitcoin $137,000 in the Cards? 🚀#BTC has formed a bull pennant on the daily chart.

If it plays out, a new ATH could be reached — right against current market sentiment.Let’s see if price can break to the upside in the coming week! pic.twitter.com/Irr01KLvSE

— Titan of Crypto (@Washigorira) April 13, 2025

This ambitious prediction hinges on a blend of technical indicators and macroeconomic trends currently shaping the market.

Why Bitcoin (BTC) price could hit $137,000

One of the factors behind Titan’s Bitcoin price prediction is the massive US Treasury liquidity injections.

The US Treasury has injected $500 billion into the markets since February 2025, reducing its Treasury General Account from $842 billion to $342 billion, significantly boosting liquidity in the markets.

This move elevated the net Federal Reserve liquidity to $6.3 trillion, with forecasts suggesting it could climb to $6.6 trillion by August if debt ceiling negotiations persist.

📈 Fed liquidity is rising

Net Federal Reserve Liquidity has increased by around $500bn since February.

It’s not really having any positive impact on risk asset prices with everything else going on.

But it is happening.

Here’s what is occurring and what to expect next…… https://t.co/VZJgGnDySS pic.twitter.com/IIsDJBuABq

— Tomas (@TomasOnMarkets) April 13, 2025

According to historical trends, BTC has exhibited an 83% correlation with global liquidity over the past year, often outperforming traditional assets like stocks and gold.

For example, past liquidity surges in 2022 and 2023 preceded notable Bitcoin rallies, hinting that the current environment could pave the way for another upward surge.

On the technical front, Titan of Crypto points to a bullish pennant pattern on Bitcoin’s daily chart, suggesting a potential 60% rally to $137,000 if it breaks the 200-day EMA near $90,000.

Bitcoin has struggled to overcome this resistance around $85,000 since late February, but a decisive close above it could shift momentum firmly in favour of the bulls.

Adding to the optimism, Bernstein analysts had predicted that over $70 billion in Bitcoin ETF inflows in 2025 could push prices as high as $200,000, reflecting growing institutional adoption.

The April 2024 halving, which slashed mining rewards to 3.125 BTC, further supports this narrative, as previous halvings have triggered bull runs exceeding 600% gains.

Beyond technicals, macroeconomic factors like recent tariff exemptions have lowered US Treasury yields, easing pressure on risk assets and creating a fertile ground for Bitcoin’s growth.

Market sentiment also leans bullish, with buy-side liquidity on exchanges like Binance outpacing sell-side by a factor of 10, while large investors shift BTC to cold storage, signaling long-term confidence.

The risks to Bitcoin’s climb

However, risks loom on the horizon, as an early US debt ceiling resolution could cap liquidity at $6.3 trillion, potentially stunting Bitcoin’s ascent.

Renewed trade war fears or geopolitical tensions could also drive investors toward gold, leaving Bitcoin vulnerable to a shift in safe-haven preferences.

Technically, failure to breach the 200-day EMA could trap Bitcoin below $85,000, risking a drop to supports at $78,000 or $74,500.

Despite these challenges, the broader 2025 outlook remains bright, with price targets ranging from $137,000 to $250,000, fueled by ETF inflows, corporate uptake, and post-halving dynamics.

Companies like Semler Scientific, planning to raise $500 million to buy more BTC, exemplify the rising corporate embrace of Bitcoin as a treasury asset.

Meanwhile, potential US-China trade talks could further enhance risk-on sentiment, benefiting speculative assets like Bitcoin if tensions ease.

In the mining sector, increased selling by miners due to lower profitability, evidenced by 15,000 BTC outflows on April 7 when prices hit $74,000 according to the weekly CryptoQuant’s report, presents a short-term hurdle.

Bitcoin miner CleanSpark on Tuesday announced it has secured a $200 million Bitcoin-backed credit facility from Coinbase Prime, shifting away from its previous 100% Bitcoin HODL strategy.

The company will now begin selling part of its monthly BTC production to support growth and fund operations.

However, the robust demand from institutional and retail investors appears poised to absorb this supply, maintaining upward pressure on prices.

Ultimately, Titan of Crypto’s $137,000 Bitcoin price prediction by Q3 2025 rests on a compelling mix of liquidity trends, technical potential, and institutional momentum, offering a plausible glimpse into Bitcoin’s near-term future.