- Bitcoin price fell to lows of $82,131, dipping to levels seen in November 2024.

- The BTC sell-off happens after Trump’s latest tariffs announcement, including a 25% tarriffs on the EU.

- Equities also dumped, with the S&P 500 seeing $500 billion wiped off.

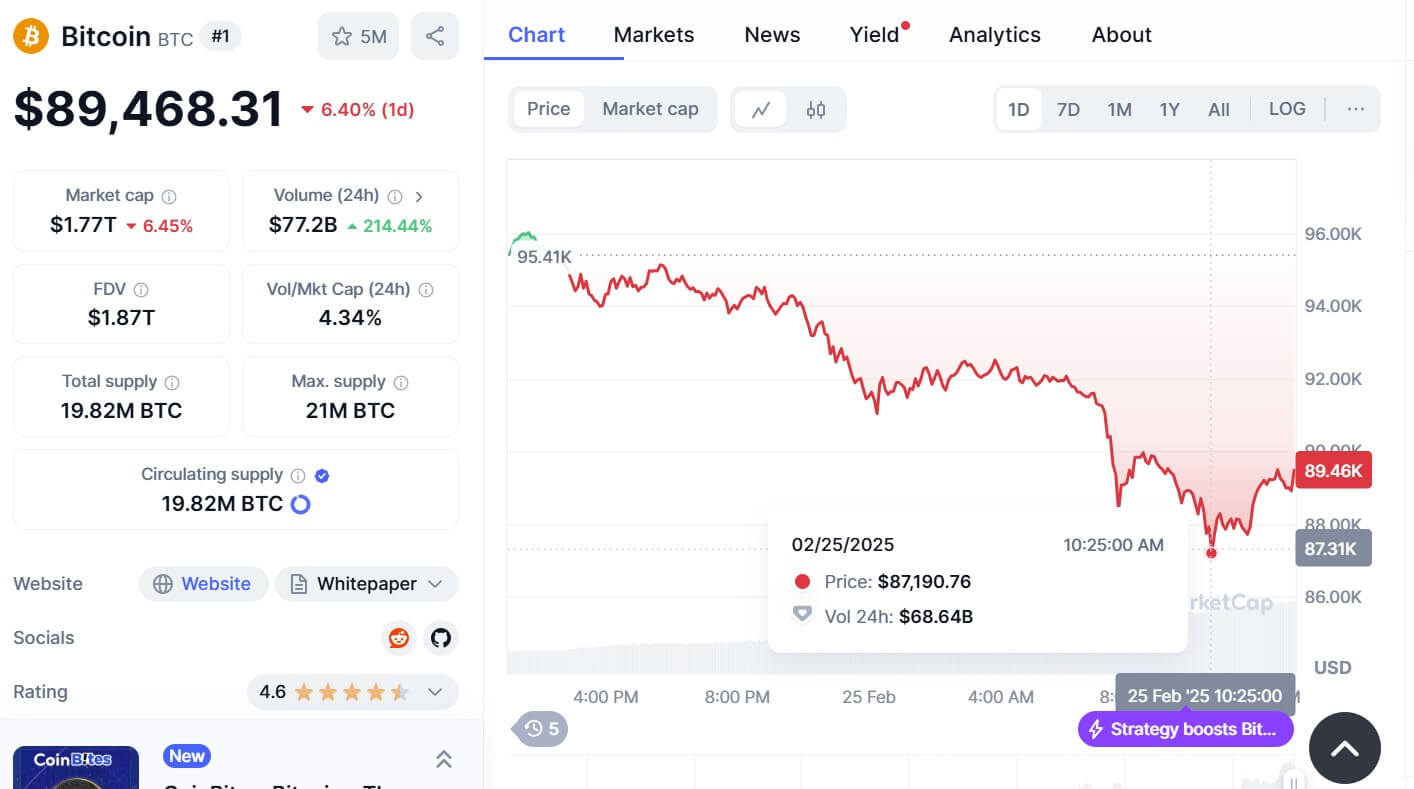

The price of Bitcoin dropped more than 6% in 24 hours to break below $84,000 on Wednesday.

Notably, Bitcoin price has touched its lowest levels since November 2024, when it rose amid election momentum. According to crypto and stocks trader IncomeSharks, the market is bearish.

BTC sold-off as the crypto market reacted to trade war sentiment, with this coming on the heels of the latest tariffs announcement by President Donald Trump.

Having announced that the 25% tariffs on Canada and Mexico and 10% on China will go into effect in April, Trump said he would slap 25% tariffs on the European Union. The news saw the S&P 500 fall, with over $500 billion in market cap wiped off.

Bitcoin dips amid ETFs outflows

As equities reacted to the potential trade war, Bitcoin crashed below $84,000. Per data from CoinMarketCap, the price of BTC hit lows of $82,131.

BTC price also dumped amid massive selling pressure from ETFs. Major issuers Fidelity, Ark and Grayscale all sold. BlackRock, which sent millions of dollars worth of BTC and ETH to an exchange on Tuesday, also offloaded $150 million of the flagship coin.

FIDELITY SOLD

ARK SOLD

GRAYSCALE SOLDBUT BLACKROCK… ALSO SOLD $150M $BTC pic.twitter.com/Zfn4W2iIhk

— Arkham (@arkham) February 26, 2025

While bulls had rebounded to above $84k at the time of writing, sentiment remains weak and a retest of $80k is possible. Crypto analyst Rekt Capital shared the chart below.

Bitcoin is getting closer and closer to filling its CME Gap formed back in November 2024

The CME Gap is located between $78,000 and ~$80,700$BTC #Crypto #Bitcoin https://t.co/ucDt6FVDN6 pic.twitter.com/l2MmnPimn0

— Rekt Capital (@rektcapital) February 26, 2025

According to analysts, the markets are pricing in a possible “rebound in inflation” with investors factoring in likely spikes in the prices of goods.

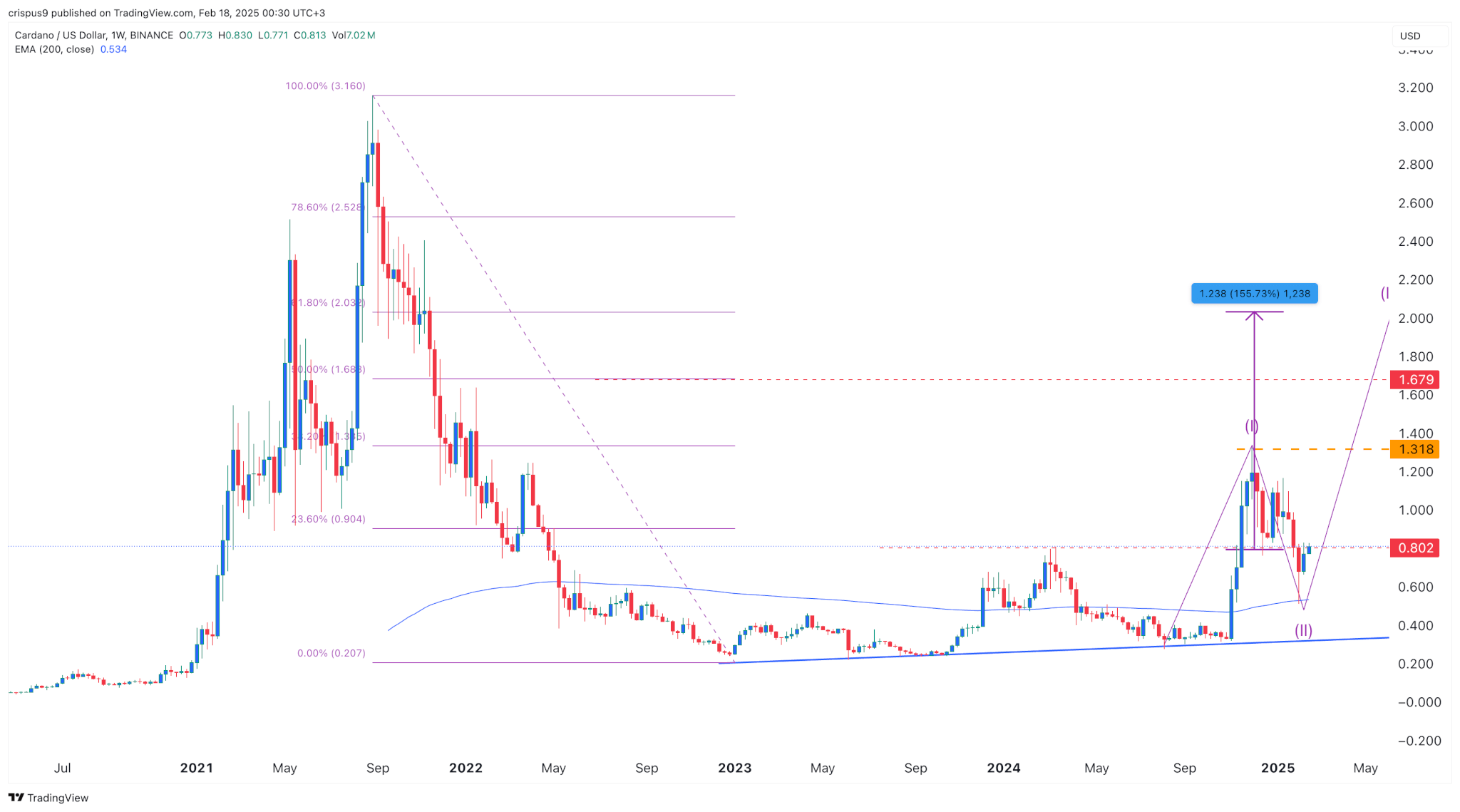

“What’s interesting is the SHARP divergence between Gold and Bitcoin since the trade war began. While Gold is up +10%, Bitcoin is down -10%, even though Bitcoin is historically viewed as a “hedge” against uncertainty,” the Kobeissi Letter said.