Crypto majors including Bitcoin remain under pressure amid a neutral market sentiment. However, revolutionary projects within the sector are thriving as savvy investors look for cheaper alternatives with great growth potential.

Bitcoin Pepe, the first meme ICO on the Bitcoin network has captured the attention of crypto enthusiasts, surpassing $1 million within the first 6 hours of its presale. Its early adopters acknowledge that its unique approach of merging the meme culture with Solana’s speed and Bitcoin’s security will yield hefty returns ahead of its launch in Q2’25.

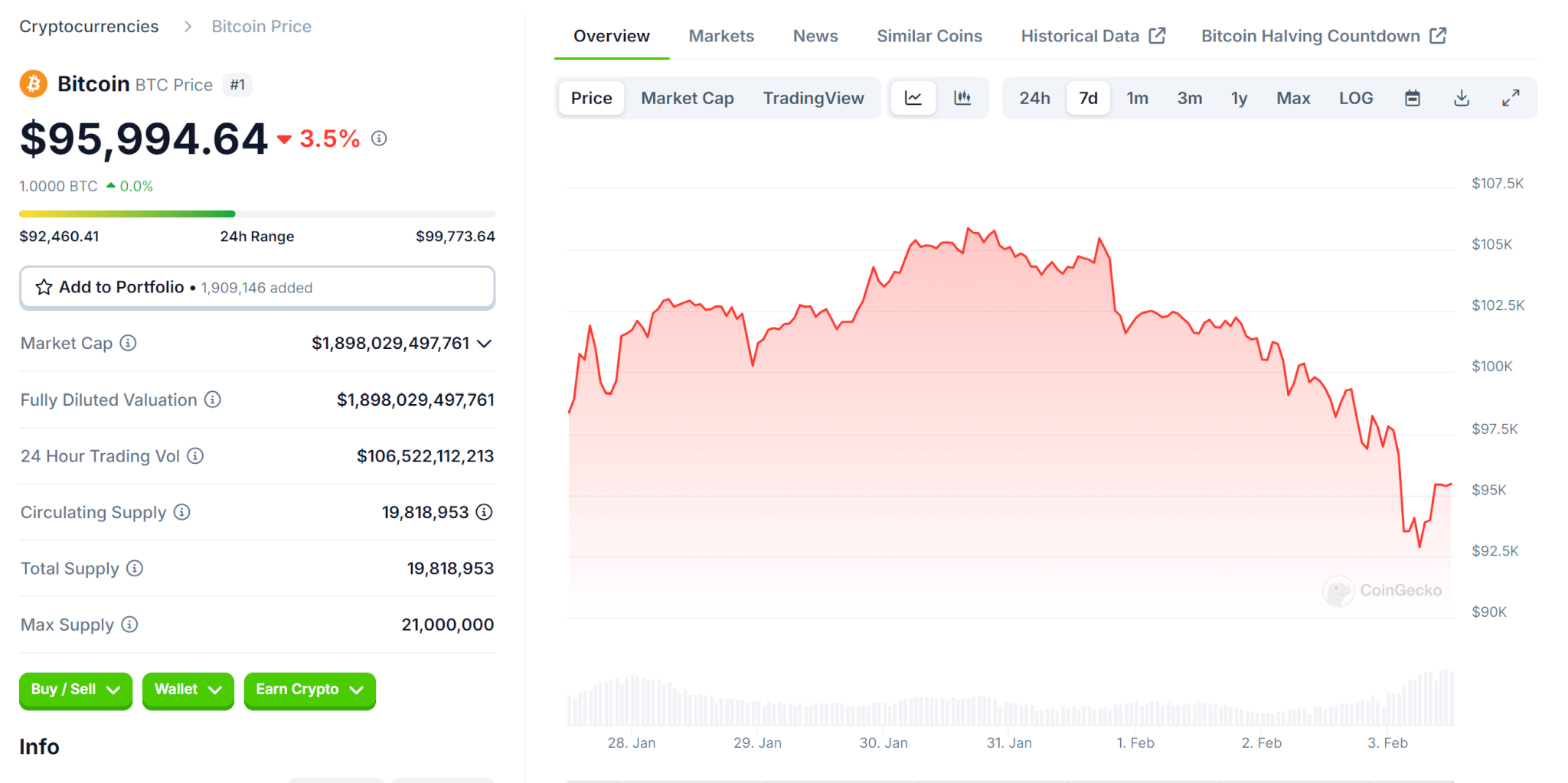

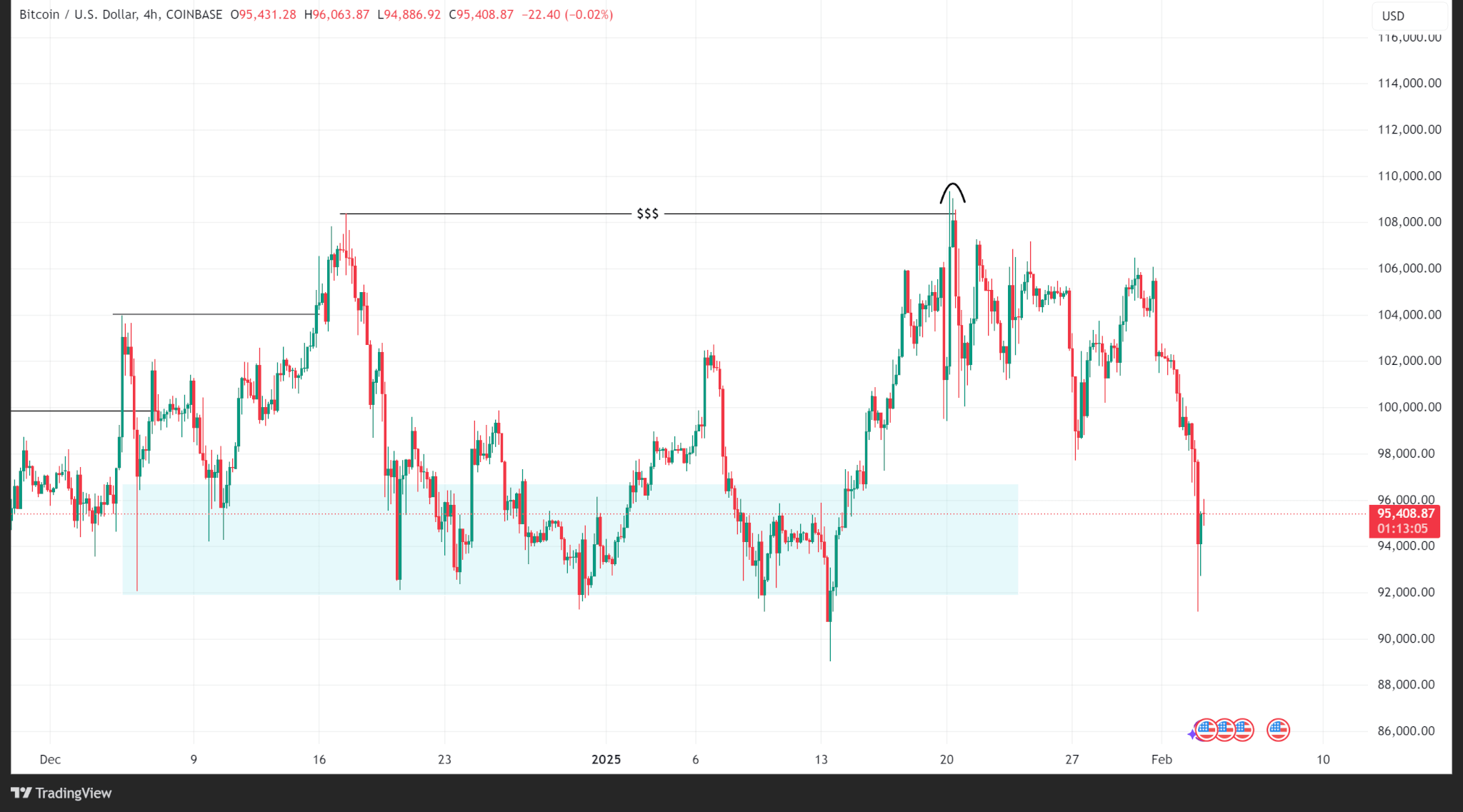

Bitcoin price to remain range-bound amid a neutral market sentiment

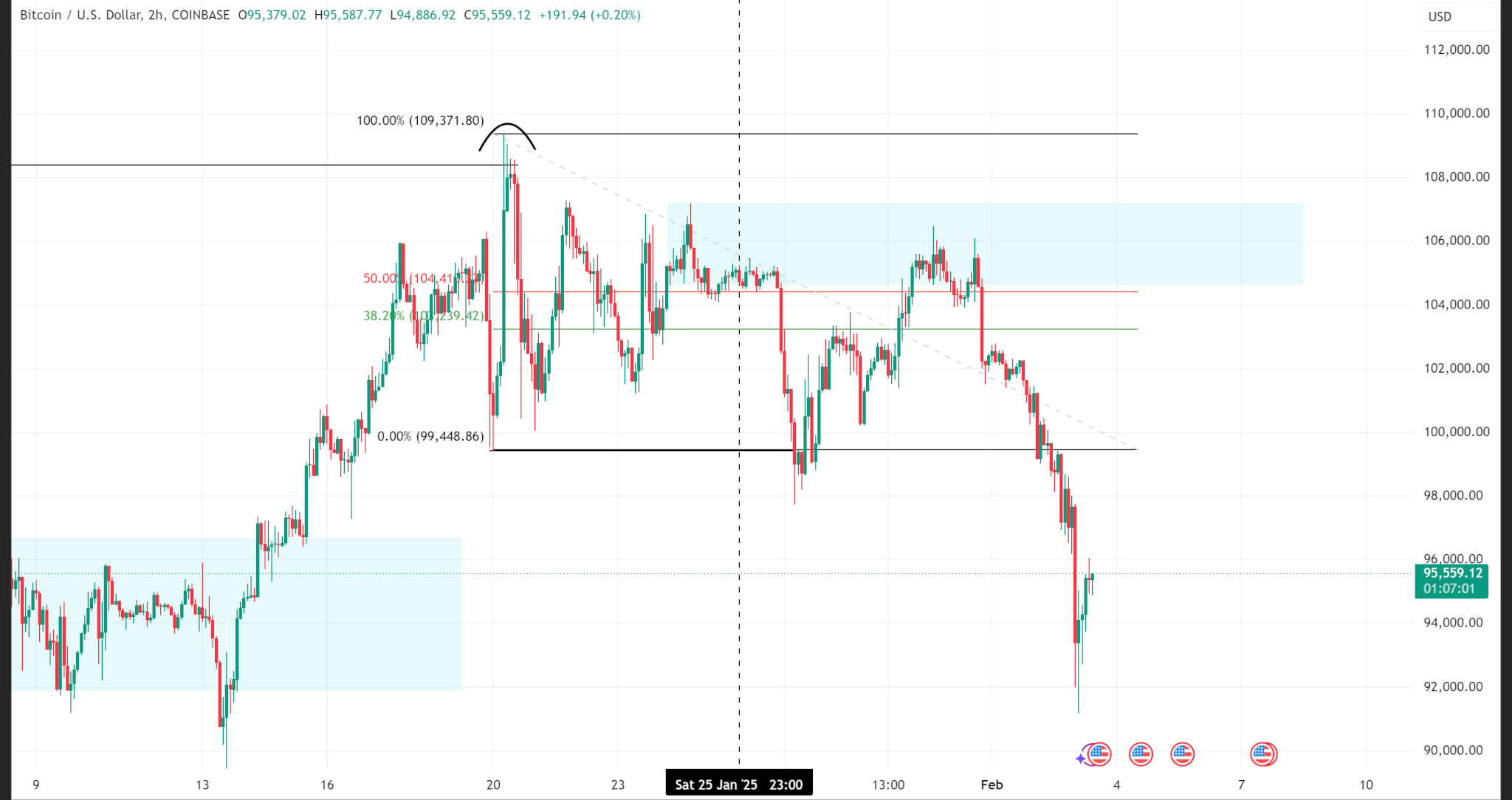

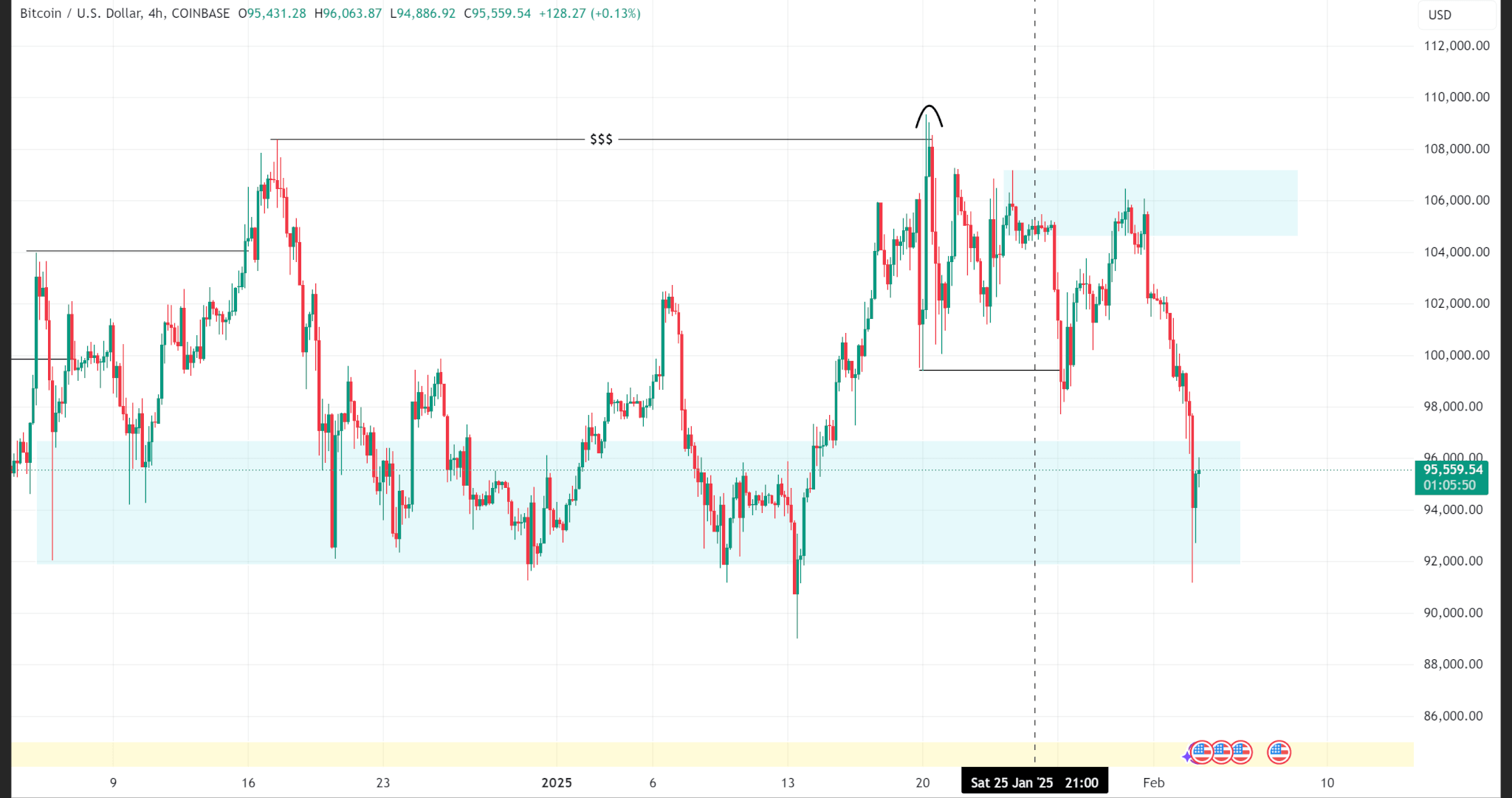

Bitcoin price has remained in consolidation; trading in the red for the third consecutive week. At a fear & greed index of 47, which points to a neutral market sentiment, the crypto major may remain range-bound in the absence of a key near-term catalyst.

In the short term, the range between the support level of $93,500 and the resistance zone of $100,898.95 remains worth watching. Indeed, below this range, this thesis will be invalid. If successful at breaking the current resistance, bitcoin bulls will have their eyes on the next target at $102,954.12.

Bitcoin Pepe’s unique trifactor positions it for fastest-growing ICO of 2025

Bitcoin Pepe, the first meme ICO on the Bitcoin network, has already raised over $1.7 million within the first 48 hours of its presale. Indeed, this is the playing field that meme coin enthusiasts have hungered for.

On the one hand, Bitcoin is highly valued as the main alternative to fiat currency. Besides, it is considered as a safe haven and hedge against inflation.

While its Proof-of-Work (PoW) system assures Bitcoin’s unmatched security, it results in slower transaction speed of up to 60 minutes. In comparison, it takes about 0.5 seconds for a transaction to be completed on Solana with up to 65,000 transactions processed in a second.

Bitcoin Pepe has merged the two while propelling the meme culture; a trifactor that has captured the attention of crypto enthusiasts. The project leverages on Bitcoin’s security and Solana’s super speed while integrating the ultra-popular meme culture.

It is this ideal setup that has sparked immense interest among crypto enthusiasts. Amid the heightened FOMO, savvy investors understand that the current price of $0.0232 may be the lowest for the BPEP token moving forward.

It is currently at stage 3 of the total 30 stages on its 2025 roadmap, which also includes launching a decentralized exchange (DEX) and L2 Bridge. As it achieves these developments, its value is set to skyrocket. As such, this is the best opportunity for cryptocurrency enthusiasts to amass some BPEP tokens. Buy the Bitcoin Pepe here.

Solana price will need steady rebounding to ratify trend reversal

Solana price is set for its fourth week of losses despite the recent rebounding that cut across crypto majors. While the selling pressure may remain a headwind in the near term, improvement of the market sentiment may flip its plight as it leverages on its super speed and low transaction fees.

In the meantime, the bulls are keen on defending the support at $186.21. On the upside, additional momentum may have it break the resistance at $206.48. However, a rebound past $215.70 to rubberstamp a trend reversal.